AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

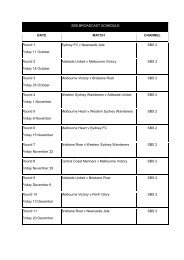

16(b) Average annual reportable remuneration paid to substantive senior executives during the reporting<br />

period (cont.)<br />

Notes:<br />

1 This table (on the previous page) reports substantive senior executives who received remuneration during the reporting period, and<br />

is reported on a cash basis. Each row is an averaged figure based on headcount for individuals in the band.<br />

2 ‘Reportable salary’ includes the following: a) gross payments (less any bonuses paid, which are separated out and disclosed in the<br />

‘bonus paid’ column); b) reportable fringe benefits (at the net amount prior to ‘grossing up’ to account for tax benefits); and c) exempt<br />

foreign employment income.<br />

3 The ‘contributed superannuation’ amount is the average actual superannuation contributions paid to senior executives in that<br />

reportable remuneration band during the reporting period, including any salary sacrificed amounts, as per the individuals’ payslips.<br />

4 ‘Reportable allowances’ are the average actual allowances paid as per the ‘total allowances’ line on individuals’ payment summaries.<br />

5 ‘Bonus paid’ represents average actual bonuses paid during the reporting period in that reportable remuneration band. The ‘bonus<br />

paid’ within a particular band may vary between financial years due to various factors such as individuals commencing with or leaving<br />

the entity during the financial year.<br />

6 Various salary sacrifice arrangements were available to senior executives including superannuation, motor vehicle and expense<br />

payment fringe benefits. Salary sacrifice benefits are reported in the ‘reportable salary’ column, excluding salary sacrificed<br />

superannuation, which is reported in the ‘contributed superannuation’ column.<br />

16(c) Other employees whose salary (including performance bonus) was more than $150,000<br />

<strong>2012</strong><br />

COnSOlIDAteD<br />

AVeRAGe ANNUAL<br />

RePoRtABLe<br />

ReMUNeRAtIoN 1<br />

total remuneration<br />

(incl. part-time<br />

arrangements)<br />

stAFF<br />

NUMBeR<br />

RePoRtABLe<br />

sALARY 2<br />

$<br />

CoNtRIBUteD<br />

sUPeR-<br />

ANNUAtIoN 3<br />

$<br />

RePoRtABLe<br />

ALLoWANCes 4<br />

$<br />

BoNUs PAID 5<br />

$<br />

totAL<br />

$<br />

$150,000 – $179,999 31 132,906 25,306 53 5,085 163,350<br />

$180,000 – $209,999 19 166,643 20,139 82 9,280 196,144<br />

$210,000 – $239,999 6 173,737 36,593 4 17,849 228,183<br />

$240,000 – $269,999 6 201,662 29,829 – 25,840 257,331<br />

$270,000 – $299,999 1 219,832 19,785 – 34,500 274,117<br />

$300,000 – $329,999 3 232,711 46,991 – 40,015 319,717<br />

$390,000 – $419,999 1 344,451 71,670 – – 416,121<br />

total 67<br />

The above table includes three employees from the Corporation’s controlled entity, STV Ltd.<br />

114 SBS