AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

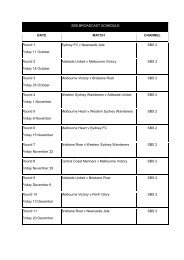

6. Income tax<br />

Notes<br />

6(a) Income tax expense (i)<br />

COnSOlIDAteD CORpORAtIOn<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

Numerical reconciliation between tax expense<br />

and pre-tax net profit<br />

Prima facie income tax expense calculated at<br />

30% of profit (16) 511 – –<br />

Increase in income tax expense due to nondeductible<br />

expenses 13 18 – –<br />

Net adjustments to tax base on tax consolidation – (241) – –<br />

Under/(over) provision of income tax in prior year 4 32 – –<br />

Deferred tax liability charged to Asset Revaluation<br />

Reserves (3) – – –<br />

total income tax expense (ii) (2) 320 – –<br />

(i) Income tax expenses relate only to the Corporation’s controlled entities, STV Ltd and PAN TV Ltd, which are both<br />

subject to income tax – see note 1(y).<br />

(ii) Income tax expense recognised in the statement of comprehensive income.<br />

Notes<br />

COnSOlIDAteD CORpORAtIOn<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

Current tax expense:<br />

Current year – 195 – –<br />

Under/(over) provision in prior year (57) 32 – –<br />

Deferred tax expense/(income): (57) 227 – –<br />

Under/(over) provision of deferred tax in prior year 61 – –<br />

Origination and reversal of temporary differences 376 93 – –<br />

Current year tax loss<br />

Deferred tax liability charged to asset revaluation<br />

(378) – – –<br />

reserve (iii) (4) – – –<br />

total deferred tax expense/(income) 55 93 – –<br />

total tax expense in the statement of<br />

comprehensive income (2) 320 – –<br />

(iii) Tax recognised in other comprehensive income – see next page.<br />

<strong>AnnuAl</strong> RepoRt <strong>2011</strong> – <strong>2012</strong> 93