AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

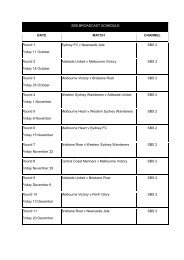

18(c) net income and expense from financial<br />

liabilities<br />

Notes<br />

COnSOlIDAteD CORpORAtIOn<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

Financial liabilities – at amortised cost<br />

Interest expense<br />

Payables<br />

3(d) (600) (959) (600) (903)<br />

Exchange gains/(loss) (14) 33 (15) 33<br />

Net gain/(loss) financial liabilities (614) (926) (615) (870)<br />

Net gain/(loss) from financial liabilities (not at<br />

fair value through profit and loss) (i) (614) (926) (615) (870)<br />

(i) There were no other gains or losses arising from financial liabilities other than interest paid and exchange rate<br />

gains or losses.<br />

18(d) Fair values of financial instruments<br />

Valuation method used for determining the fair value of financial instruments<br />

From 1 July 2009, amendments to AASB 7 “Financial Instruments: Disclosures” require fair value measurements to be<br />

in accordance with the following fair value measurement hierarchy (for recognition or disclosure of their fair value):<br />

• Level 1 – quoted prices (unadjusted) in active markets for identical assets or liabilities;<br />

• Level 2 – inputs (other than quoted prices included within level 1) that are observable for the asset or liability, either<br />

directly (as prices) or indirectly (derived from prices); and<br />

• Level 3 – inputs for the asset or liability that are not based on observable market data (unobservable inputs).<br />

As at 30 June <strong>2012</strong>, the Corporation held investments (held-to-maturity) and loans payable to the Commonwealth for<br />

which fair values have been calculated, and disclosed in this note (as level 2 financial instruments). The fair values of the<br />

held-to-maturity investments and the Commonwealth loans are calculated on the basis of discounted cash flows using<br />

current interest rates (at 30 June) for investments and liabilities with similar market and credit risk profiles. The fair values<br />

of cash, receivables for goods and services, and trade creditors approximate their carrying amounts.<br />

The Corporation has no level 3 financial instruments where a valuation technique is required to be based on significant<br />

unobservable inputs.<br />

No change in fair value disclosed in this note has been, nor is required to be, recognised in profit and loss. They are held<br />

to maturity, and are not held for sale. There are no unrecognised financial assets or liabilities.<br />

<strong>AnnuAl</strong> RepoRt <strong>2011</strong> – <strong>2012</strong> 117