AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

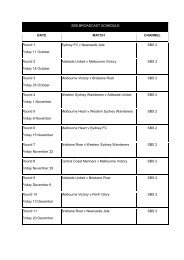

18(e) Credit risk (cont.)<br />

The following consolidated table for the economic entity illustrates the economic entity’s exposure to credit risk. There<br />

is no significant difference between the Corporation’s and the economic entity’s exposure to credit risk. Receivables<br />

(for goods and services) for the Corporation’s subsidiary STV Ltd relate to Pay TV subscription fees ($2.523m in <strong>2012</strong>).<br />

CoNsoLIDAteD Notes<br />

nOt pASt Due nOR<br />

IMpAIReD<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

pASt Due OR<br />

IMpAIReD<br />

<strong>2012</strong><br />

$’000<br />

<strong>2011</strong><br />

$’000<br />

Receivables for goods and services (net) 7(b) 15,614 14,326 1,314 1,376<br />

Ageing of financial assets that are past due but not impaired are provided in note 7(b). An impairment allowance for<br />

doubtful debts is made for receivables assessed individually as impaired.<br />

18(f) Market risk<br />

Market risks of the Corporation comprise mainly of interest and foreign currency risk.<br />

The Corporation’s foreign currency risk is limited to some major sports events where contracts are entered into in foreign<br />

currencies. The majority of contracts, however, including overseas program purchases, are entered into in Australian dollars.<br />

Under current Government regulations, the Corporation cannot enter into any specific foreign exchange hedge contracts.<br />

Interest rate risks are managed by maintaining an appropriate mix between fixed and floating rates for both the<br />

economic entity’s investments and loans from Government. The two loans from Government are fixed, the first at the<br />

prevailing 10 year Government bond rate (6.02%) at the time of raising the loan in 2002, and the second (a loan of<br />

$15.000m received in 2009 – see Note 10) is fixed at 4.29%. The first loan was fully repaid by 30 June <strong>2012</strong>.<br />

The economic entity’s consolidated exposure to interest rates on financial assets and financial liabilities are detailed<br />

in the liquidity risk management section of this note (see note 18(g)).<br />

Interest rate and foreign currency sensitivity analysis is provided in the following table:<br />

seNsItIVItY ANALYsIs<br />

As At 30 JUNe <strong>2012</strong> Notes<br />

Consolidated<br />

Interest rate risk – analogue extensions<br />

investments (i)<br />

RIsk<br />

VARIABLe<br />

CHANGe<br />

IN<br />

VARIABLe<br />

%<br />

PRoFIt<br />

AND Loss<br />

$’000<br />

eFFeCt On<br />

eQUItY<br />

$’000<br />

Increase Interest +1.40% 192 –<br />

Decrease Interest – 1.40% (192) –<br />

Interest rate risk – operational investments<br />

Increase Interest +1.40% 346 –<br />

Decrease<br />

Currency risk (mainly in Swiss CHF and<br />

Interest – 1.40% (346) –<br />

American USD) (ii)<br />

Increase<br />

Decrease<br />

(i) and (ii) – see next page.<br />

Exposed<br />

Currency +15% 10,476 –<br />

Exposed<br />

Currency – 15% (10,476) –<br />

<strong>AnnuAl</strong> RepoRt <strong>2011</strong> – <strong>2012</strong> 119