Annual Report 2010 - AdP

Annual Report 2010 - AdP

Annual Report 2010 - AdP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.7 Tangible fixed assets<br />

Tangible fixed assets are valued at cost, less all impairment losses, and depreciated in accordance with estimated useful life. Expenses<br />

directly attributable to acquisition of the goods and their preparation for operation are considered at their balance sheet value.<br />

A significant part of the tangible fixed assets of <strong>AdP</strong> Group (EPAL) acquired at 31 December 2008 are recorded at acquisition cost<br />

or deemed cost, which includes the effects of revaluations conducted in accordance with legal provisions, as well as the effects of<br />

free revaluations, on the basis of valuations conducted by an independent and specialized entity with reference to the transition<br />

date (1 January 2009).<br />

Subsequent costs are included in the book value of the asset or recognized as separate assets, whatever the case may be, only when<br />

it is probable that economic benefits will ensue for the Company and the cost can be reliably measured. Depreciation of the assets<br />

shall be conducted over the course of the remaining useful life of the asset or until their next repair, whichever occurs first. The<br />

replaced component of the asset is identified and recorded under income/loss.<br />

All other expenses related to repairs and maintenance are recorded as cost for the period in which they are incurred.<br />

Depreciation of operational fixed assets is based on the estimated useful life as of the time they are ready to become operational.<br />

The depreciable value is obtained by deducting the expected residual value at the end of the estimated useful life.<br />

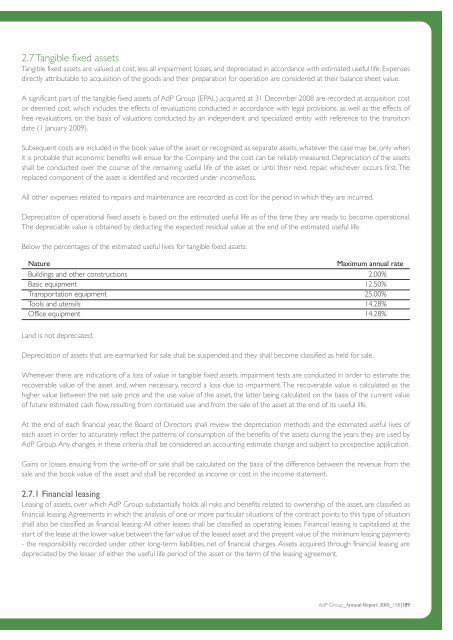

Below the percentages of the estimated useful lives for tangible fixed assets:<br />

Nature Maximum annual rate<br />

Buildings and other constructions 2.00%<br />

Basic equipment 12.50%<br />

Transportation equipment 25.00%<br />

Tools and utensils 14.28%<br />

Office equipment 14.28%<br />

Land is not depreciated.<br />

Depreciation of assets that are earmarked for sale shall be suspended and they shall become classified as held for sale.<br />

Whenever there are indications of a loss of value in tangible fixed assets, impairment tests are conducted in order to estimate the<br />

recoverable value of the asset and, when necessary, record a loss due to impairment. The recoverable value is calculated as the<br />

higher value between the net sale price and the use value of the asset, the latter being calculated on the basis of the current value<br />

of future estimated cash flow, resulting from continued use and from the sale of the asset at the end of its useful life.<br />

At the end of each financial year, the Board of Directors shall review the depreciation methods and the estimated useful lives of<br />

each asset in order to accurately reflect the patterns of consumption of the benefits of the assets during the years they are used by<br />

<strong>AdP</strong> Group. Any changes in these criteria shall be considered an accounting estimate change and subject to prospective application.<br />

Gains or losses ensuing from the write-off or sale shall be calculated on the basis of the difference between the revenue from the<br />

sale and the book value of the asset and shall be recorded as income or cost in the income statement.<br />

2.7.1 Financial leasing<br />

Leasing of assets, over which <strong>AdP</strong> Group substantially holds all risks and benefits related to ownership of the asset, are classified as<br />

financial leasing. Agreements in which the analysis of one or more particular situations of the contract points to this type of situation<br />

shall also be classified as financial leasing. All other leases shall be classified as operating leases. Financial leasing is capitalized at the<br />

start of the lease at the lower value between the fair value of the leased asset and the present value of the minimum leasing payments<br />

- the responsibility recorded under other long-term liabilities, net of financial charges. Assets acquired through financial leasing are<br />

depreciated by the lesser of either the useful life period of the asset or the term of the leasing agreement.<br />

<strong>AdP</strong> Group_<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>_188|189