Annual Report 2010 - AdP

Annual Report 2010 - AdP

Annual Report 2010 - AdP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The goal of capital risk management is to safeguard the continuity of group operations with adequate shareholder earnings and<br />

generating benefits for all interested third parties.<br />

<strong>AdP</strong> Group policy is to obtain loans from financial entities via parent company <strong>AdP</strong>, SGPS, S.A. (with the exception of EPAL and<br />

investment loans), which will then offer loans to its affiliates. This policy seeks to optimize the capital structure in view of greater tax<br />

efficiency and reduction of the average cost of capital.<br />

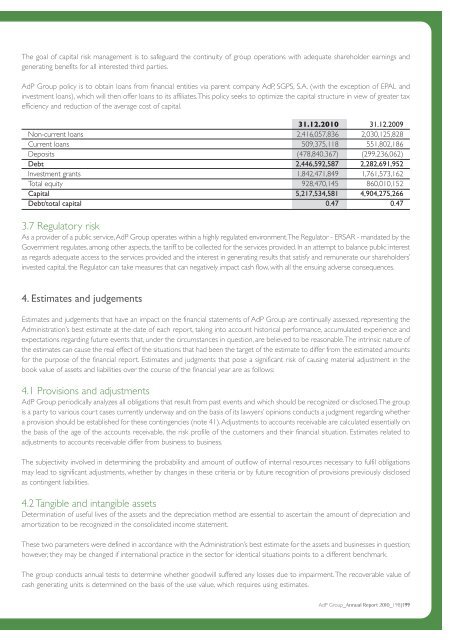

31.12.<strong>2010</strong> 31.12.2009<br />

Non-current loans 2,416,057,836 2,030,125,828<br />

Current loans 509,375,118 551,802,186<br />

Deposits (478,840,367) (299,236,062)<br />

Debt 2,446,592,587 2,282,691,952<br />

Investment grants 1,842,471,849 1,761,573,162<br />

Total equity 928,470,145 860,010,152<br />

Capital 5,217,534,581 4,904,275,266<br />

Debt/total capital 0.47 0.47<br />

3.7 Regulatory risk<br />

As a provider of a public service, <strong>AdP</strong> Group operates within a highly regulated environment. The Regulator - ERSAR - mandated by the<br />

Government regulates, among other aspects, the tariff to be collected for the services provided. In an attempt to balance public interest<br />

as regards adequate access to the services provided and the interest in generating results that satisfy and remunerate our shareholders’<br />

invested capital, the Regulator can take measures that can negatively impact cash flow, with all the ensuing adverse consequences.<br />

4. Estimates and judgements<br />

Estimates and judgements that have an impact on the financial statements of <strong>AdP</strong> Group are continually assessed, representing the<br />

Administration’s best estimate at the date of each report, taking into account historical performance, accumulated experience and<br />

expectations regarding future events that, under the circumstances in question, are believed to be reasonable. The intrinsic nature of<br />

the estimates can cause the real effect of the situations that had been the target of the estimate to differ from the estimated amounts<br />

for the purpose of the financial report. Estimates and judgments that pose a significant risk of causing material adjustment in the<br />

book value of assets and liabilities over the course of the financial year are as follows:<br />

4.1 Provisions and adjustments<br />

<strong>AdP</strong> Group periodically analyzes all obligations that result from past events and which should be recognized or disclosed. The group<br />

is a party to various court cases currently underway and on the basis of its lawyers’ opinions conducts a judgment regarding whether<br />

a provision should be established for these contingencies (note 41). Adjustments to accounts receivable are calculated essentially on<br />

the basis of the age of the accounts receivable, the risk profile of the customers and their financial situation. Estimates related to<br />

adjustments to accounts receivable differ from business to business.<br />

The subjectivity involved in determining the probability and amount of outflow of internal resources necessary to fulfil obligations<br />

may lead to significant adjustments, whether by changes in these criteria or by future recognition of provisions previously disclosed<br />

as contingent liabilities.<br />

4.2 Tangible and intangible assets<br />

Determination of useful lives of the assets and the depreciation method are essential to ascertain the amount of depreciation and<br />

amortization to be recognized in the consolidated income statement.<br />

These two parameters were defined in accordance with the Administration’s best estimate for the assets and businesses in question;<br />

however, they may be changed if international practice in the sector for identical situations points to a different benchmark.<br />

The group conducts annual tests to determine whether goodwill suffered any losses due to impairment. The recoverable value of<br />

cash generating units is determined on the basis of the use value, which requires using estimates.<br />

<strong>AdP</strong> Group_<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>_198|199