Annual Report 2010 - AdP

Annual Report 2010 - AdP

Annual Report 2010 - AdP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

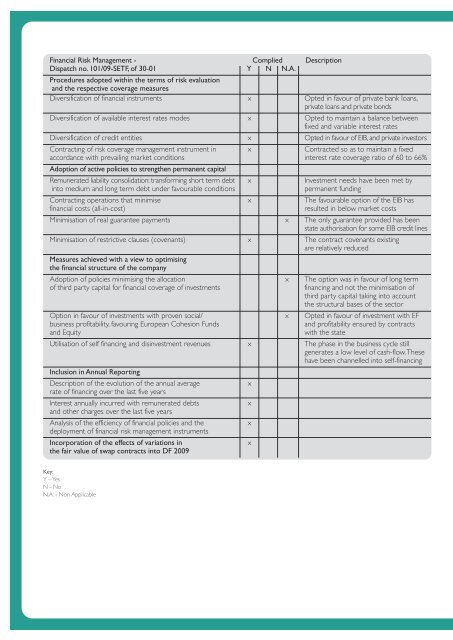

Financial Risk Management - Complied Description<br />

Dispatch no. 101/09-SETF, of 30-01<br />

Procedures adopted within the terms of risk evaluation<br />

and the respective coverage measures<br />

Y N N.A.<br />

Diversification of financial instruments x Opted in favour of private bank loans,<br />

private loans and private bonds<br />

Diversification of available interest rates modes x Opted to maintain a balance between<br />

fixed and variable interest rates<br />

Diversification of credit entities x Opted in favour of EIB, and private investors<br />

Contracting of risk coverage management instrument in x Contracted so as to maintain a fixed<br />

accordance with prevailing market conditions<br />

Adoption of active policies to strengthen permanent capital<br />

interest rate coverage ratio of 60 to 66%<br />

Remunerated liability consolidation: transforming short term debt x Investment needs have been met by<br />

into medium and long term debt under favourable conditions permanent funding<br />

Contracting operations that minimise x The favourable option of the EIB has<br />

financial costs (all-in-cost) resulted in below market costs<br />

Minimisation of real guarantee payments x The only guarantee provided has been<br />

state authorisation for some EIB credit lines<br />

Minimisation of restrictive clauses (covenants)<br />

Measures achieved with a view to optimising<br />

the financial structure of the company<br />

x The contract covenants existing<br />

are relatively reduced<br />

Adoption of policies minimising the allocation x The option was in favour of long term<br />

of third party capital for financial coverage of investments financing and not the minimisation of<br />

third party capital taking into account<br />

the structural bases of the sector<br />

Option in favour of investments with proven social/ x Opted in favour of investment with EF<br />

business profitability, favouring European Cohesion Funds and profitability ensured by contracts<br />

and Equity with the state<br />

Utilisation of self financing and disinvestment revenues<br />

Inclusion in <strong>Annual</strong> <strong>Report</strong>ing<br />

x The phase in the business cycle still<br />

generates a low level of cash-flow. These<br />

have been channelled into self-financing<br />

Description of the evolution of the annual average<br />

rate of financing over the last five years<br />

x<br />

Interest annually incurred with remunerated debts<br />

and other charges over the last five years<br />

x<br />

Analysis of the efficiency of financial policies and the<br />

deployment of financial risk management instruments<br />

x<br />

Incorporation of the effects of variations in<br />

the fair value of swap contracts into DF 2009<br />

x<br />

Key:<br />

Y – Yes<br />

N - No<br />

N.A. - Non Applicable