2 - Cash Registers

2 - Cash Registers

2 - Cash Registers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

50<br />

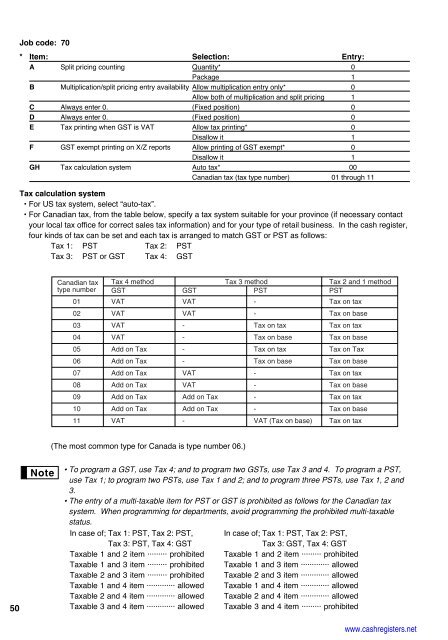

Job code: 70<br />

* Item: Selection: Entry:<br />

A Split pricing counting Quantity* 0<br />

Package 1<br />

B Multiplication/split pricing entry availability Allow multiplication entry only* 0<br />

Allow both of multiplication and split pricing 1<br />

C Always enter 0. (Fixed position) 0<br />

D Always enter 0. (Fixed position) 0<br />

E Tax printing when GST is VAT Allow tax printing* 0<br />

Disallow it 1<br />

F GST exempt printing on X/Z reports Allow printing of GST exempt* 0<br />

Disallow it 1<br />

GH Tax calculation system Auto tax* 00<br />

Canadian tax (tax type number) 01 through 11<br />

Tax calculation system<br />

• For US tax system, select “auto-tax”.<br />

• For Canadian tax, from the table below, specify a tax system suitable for your province (if necessary contact<br />

your local tax office for correct sales tax information) and for your type of retail business. In the cash register,<br />

four kinds of tax can be set and each tax is arranged to match GST or PST as follows:<br />

Tax 1: PST Tax 2: PST<br />

Tax 3: PST or GST Tax 4: GST<br />

Canadian tax Tax 4 method Tax 3 method Tax 2 and 1 method<br />

type number GST GST PST PST<br />

01 VAT VAT - Tax on tax<br />

02 VAT VAT - Tax on base<br />

03 VAT - Tax on tax Tax on tax<br />

04 VAT - Tax on base Tax on base<br />

05 Add on Tax - Tax on tax Tax on Tax<br />

06 Add on Tax - Tax on base Tax on base<br />

07 Add on Tax VAT - Tax on tax<br />

08 Add on Tax VAT - Tax on base<br />

09 Add on Tax Add on Tax - Tax on tax<br />

10 Add on Tax Add on Tax - Tax on base<br />

11 VAT - VAT (Tax on base) Tax on tax<br />

(The most common type for Canada is type number 06.)<br />

• To program a GST, use Tax 4; and to program two GSTs, use Tax 3 and 4. To program a PST,<br />

use Tax 1; to program two PSTs, use Tax 1 and 2; and to program three PSTs, use Tax 1, 2 and<br />

3.<br />

• The entry of a multi-taxable item for PST or GST is prohibited as follows for the Canadian tax<br />

system. When programming for departments, avoid programming the prohibited multi-taxable<br />

status.<br />

In case of; Tax 1: PST, Tax 2: PST,<br />

Tax 3: PST, Tax 4: GST<br />

Taxable 1 and 2 item ········· prohibited<br />

Taxable 1 and 3 item ········· prohibited<br />

Taxable 2 and 3 item ········· prohibited<br />

Taxable 1 and 4 item ············· allowed<br />

Taxable 2 and 4 item ············· allowed<br />

Taxable 3 and 4 item ············· allowed<br />

In case of; Tax 1: PST, Tax 2: PST,<br />

Tax 3: GST, Tax 4: GST<br />

Taxable 1 and 2 item ········· prohibited<br />

Taxable 1 and 3 item ············· allowed<br />

Taxable 2 and 3 item ············· allowed<br />

Taxable 1 and 4 item ············· allowed<br />

Taxable 2 and 4 item ············· allowed<br />

Taxable 3 and 4 item ········· prohibited<br />

www.cashregisters.net