Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

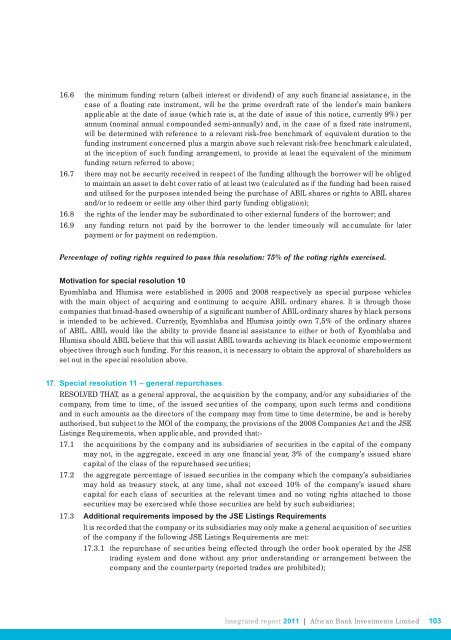

16.6 the minimum funding return (albeit interest or dividend) of any such fi nancial assistance, in the<br />

case of a fl oating rate instrument, will be the prime overdraft rate of the lender’s main bankers<br />

applicable at the date of issue (which rate is, at the date of issue of this notice, currently 9%) per<br />

annum (nominal <strong>annual</strong> compounded semi-<strong>annual</strong>ly) and, in the case of a fi xed rate instrument,<br />

will be determined with reference to a relevant risk-free benchmark of equivalent duration to the<br />

funding instrument concerned plus a margin above such relevant risk-free benchmark calculated,<br />

at the inception of such funding arrangement, to provide at least the equivalent of the minimum<br />

funding return referred to above;<br />

16.7 there may not be security received in respect of the funding although the borrower will be obliged<br />

to maintain an asset to debt cover ratio of at least two (calculated as if the funding had been raised<br />

and utilised for the purposes intended being the purchase of ABIL shares or rights to ABIL shares<br />

and/or to redeem or settle any other third party funding obligation);<br />

16.8 the rights of the lender may be subordinated to other external funders of the borrower; and<br />

16.9 any funding return not paid by the borrower to the lender timeously will accumulate for later<br />

payment or for payment on redemption.<br />

Percentage of voting rights required to pass this resolution: 75% of the voting rights exercised.<br />

Motivation for special resolution 10<br />

Eyomhlaba and Hlumisa were established in 2005 and 2008 respectively as special purpose vehicles<br />

with the main object of acquiring and continuing to acquire ABIL ordinary shares. It is through those<br />

companies that broad-based ownership of a signifi cant number of ABIL ordinary shares by black persons<br />

is intended to be achieved. Currently, Eyomhlaba and Hlumisa jointly own 7,5% of the ordinary shares<br />

of ABIL. ABIL would like the ability to provide fi nancial assistance to either or both of Eyomhlaba and<br />

Hlumisa should ABIL believe that this will assist ABIL towards achieving its black economic empowerment<br />

objectives through such funding. For this reason, it is necessary to obtain the approval of shareholders as<br />

set out in the special resolution above.<br />

17. Special resolution 11 – general repurchases<br />

RESOLVED THAT, as a general approval, the acquisition by the company, and/or any subsidiaries of the<br />

company, from time to time, of the issued securities of the company, upon such terms and conditions<br />

and in such amounts as the directors of the company may from time to time determine, be and is hereby<br />

authorised, but subject to the MOI of the company, the provisions of the 2008 Companies Act and the JSE<br />

Listings Requirements, when applicable, and provided that:-<br />

17.1 the acquisitions by the company and its subsidiaries of securities in the capital of the company<br />

may not, in the aggregate, exceed in any one fi nancial year, 3% of the company’s issued share<br />

capital of the class of the repurchased securities;<br />

17.2 the aggregate percentage of issued securities in the company which the company’s subsidiaries<br />

may hold as treasury stock, at any time, shall not exceed 10% of the company’s issued share<br />

capital for each class of securities at the relevant times and no voting rights attached to those<br />

securities may be exercised while those securities are held by such subsidiaries;<br />

17.3 Additional requirements imposed by the JSE Listings Requirements<br />

It is recorded that the company or its subsidiaries may only make a general acquisition of securities<br />

of the company if the following JSE Listings Requirements are met:<br />

17.3.1 the repurchase of securities being effected through the order book operated by the JSE<br />

trading system and done without any prior understanding or arrangement between the<br />

company and the counterparty (<strong>report</strong>ed trades are prohibited);<br />

Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited 103