Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ABIL manages its regulatory environment in a proactive and anticipatory<br />

manner. It actively participates in forums to debate proposed and<br />

required changes in regulatory requirements and ensures that it adapts<br />

its business model to new requirements well in advance of anticipated<br />

changes. The group is committed to conducting its business practices<br />

in a way that is fully compliant with both the intent and the letter of the full<br />

spectrum of laws and regulations that apply to us.<br />

Please refer to the regulatory risk section on our web-based risk <strong>report</strong><br />

at http://africanbank.investo<strong>report</strong>s.com/africanbank_ar_2011/risk/<br />

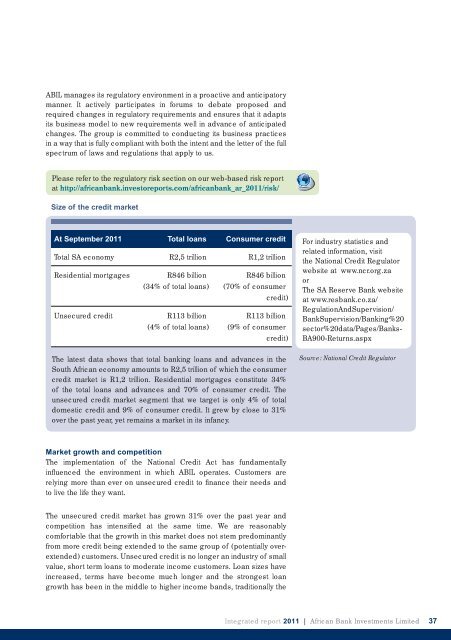

Size of the credit market<br />

At September 2011 Total loans Consumer credit<br />

Total SA economy R2,5 trillion R1,2 trillion<br />

Residential mortgages R846 billion<br />

(34% of total loans)<br />

Unsecured credit R113 billion<br />

(4% of total loans)<br />

R846 billion<br />

(70% of consumer<br />

credit)<br />

R113 billion<br />

(9% of consumer<br />

credit)<br />

The latest data shows that total banking loans and advances in the<br />

South <strong>African</strong> economy amounts to R2,5 trillion of which the consumer<br />

credit market is R1,2 trillion. Residential mortgages constitute 34%<br />

of the total loans and advances and 70% of consumer credit. The<br />

unsecured credit market segment that we target is only 4% of total<br />

domestic credit and 9% of consumer credit. It grew by close to 31%<br />

over the past year, yet remains a market in its infancy.<br />

Market growth and competition<br />

The implementation of the National Credit Act has fundamentally<br />

infl uenced the environment in which ABIL operates. Customers are<br />

relying more than ever on unsecured credit to fi nance their needs and<br />

to live the life they want.<br />

The unsecured credit market has grown 31% over the past year and<br />

competition has intensifi ed at the same time. We are reasonably<br />

comfortable that the growth in this market does not stem predominantly<br />

from more credit being extended to the same group of (potentially over-<br />

extended) customers. Unsecured credit is no longer an industry of small<br />

value, short term loans to moderate income customers. Loan sizes have<br />

increased, terms have become much longer and the strongest loan<br />

growth has been in the middle to higher income bands, traditionally the<br />

For industry statistics and<br />

related information, visit<br />

the National Credit Regulator<br />

website at www.ncr.org.za<br />

or<br />

The SA Reserve <strong>Bank</strong> website<br />

at www.resbank.co.za/<br />

RegulationAndSupervision/<br />

<strong>Bank</strong>Supervision/<strong>Bank</strong>ing%20<br />

sector%20data/Pages/<strong>Bank</strong>s-<br />

BA900-Returns.aspx<br />

Source: National Credit Regulator<br />

Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited 37