Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

86<br />

Shareholders’ information continued<br />

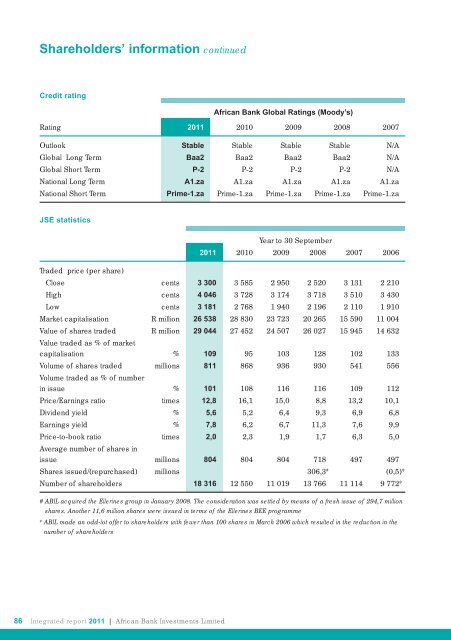

Credit rating<br />

<strong>African</strong> <strong>Bank</strong> Global Ratings (Moody’s)<br />

Rating 2011 2010 2009 2008 2007<br />

Outlook Stable Stable Stable Stable N/A<br />

Global Long Term Baa2 Baa2 Baa2 Baa2 N/A<br />

Global Short Term P-2 P-2 P-2 P-2 N/A<br />

National Long Term A1.za A1.za A1.za A1.za A1.za<br />

National Short Term Prime-1.za Prime-1.za Prime-1.za Prime-1.za Prime-1.za<br />

JSE statistics<br />

Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited<br />

Year to 30 September<br />

2011 2010 2009 2008 2007 2006<br />

Traded price (per share)<br />

Close cents 3 300 3 585 2 950 2 520 3 131 2 210<br />

High cents 4 046 3 728 3 174 3 718 3 510 3 430<br />

Low cents 3 181 2 768 1 940 2 196 2 110 1 910<br />

Market capitalisation R million 26 538 28 830 23 723 20 265 15 590 11 004<br />

Value of shares traded<br />

Value traded as % of market<br />

R million 29 044 27 452 24 507 26 027 15 945 14 632<br />

capitalisation % 109 95 103 128 102 133<br />

Volume of shares traded<br />

Volume traded as % of number<br />

millions 811 868 936 930 541 556<br />

in issue % 101 108 116 116 109 112<br />

Price/Earnings ratio times 12,8 16,1 15,0 8,8 13,2 10,1<br />

Dividend yield % 5,6 5,2 6,4 9,3 6,9 6,8<br />

Earnings yield % 7,8 6,2 6,7 11,3 7,6 9,9<br />

Price-to-book ratio<br />

Average number of shares in<br />

times 2,0 2,3 1,9 1,7 6,3 5,0<br />

issue millions 804 804 804 718 497 497<br />

Shares issued/(repurchased) millions 306,3 # (0,5)*<br />

Number of shareholders 18 316 12 550 11 019 13 766 11 114 9 772*<br />

# ABIL acquired the Ellerines group in January 2008. The consideration was settled by means of a fresh issue of 294,7 million<br />

shares. Another 11,6 million shares were issued in terms of the Ellerines BEE programme<br />

* ABIL made an odd-lot offer to shareholders with fewer than 100 shares in March 2006 which resulted in the reduction in the<br />

number of shareholders