Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial review continued<br />

Economic profi t<br />

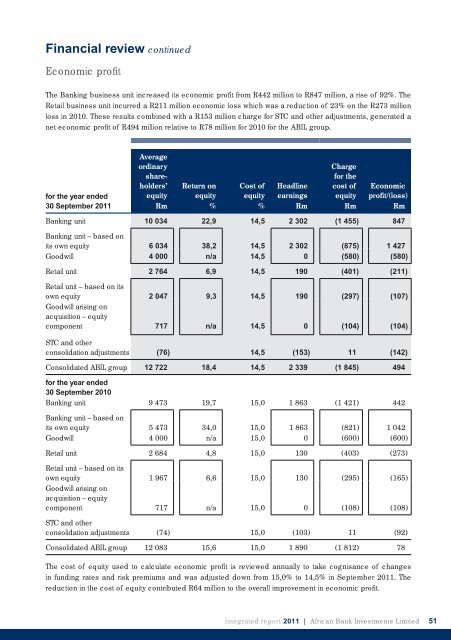

The <strong>Bank</strong>ing business unit increased its economic profi t from R442 million to R847 million, a rise of 92%. The<br />

Retail business unit incurred a R211 million economic loss which was a reduction of 23% on the R273 million<br />

loss in 2010. These results combined with a R153 million charge for STC and other adjustments, generated a<br />

net economic profi t of R494 million relative to R78 million for 2010 for the ABIL group.<br />

for the year ended<br />

30 September 2011<br />

Average<br />

ordinary<br />

Charge<br />

share-<br />

for the<br />

holders’ Return on Cost of Headline cost of Economic<br />

equity equity equity earnings equity profit/(loss)<br />

Rm % % Rm Rm Rm<br />

<strong>Bank</strong>ing unit<br />

<strong>Bank</strong>ing unit – based on<br />

10 034 22,9 14,5 2 302 (1 455) 847<br />

its own equity 6 034 38,2 14,5 2 302 (875) 1 427<br />

Goodwill 4 000 n/a 14,5 0 (580) (580)<br />

Retail unit<br />

Retail unit – based on its<br />

2 764 6,9 14,5 190 (401) (211)<br />

own equity<br />

Goodwill arising on<br />

acquisition – equity<br />

2 047 9,3 14,5 190 (297) (107)<br />

component 717 n/a 14,5 0 (104) (104)<br />

STC and other<br />

consolidation adjustments (76) 14,5 (153) 11 (142)<br />

Consolidated ABIL group<br />

for the year ended<br />

30 September 2010<br />

12 722 18,4 14,5 2 339 (1 845) 494<br />

<strong>Bank</strong>ing unit<br />

<strong>Bank</strong>ing unit – based on<br />

9 473 19,7 15,0 1 863 (1 421) 442<br />

its own equity 5 473 34,0 15,0 1 863 (821) 1 042<br />

Goodwill 4 000 n/a 15,0 0 (600) (600)<br />

Retail unit<br />

Retail unit – based on its<br />

2 684 4,8 15,0 130 (403) (273)<br />

own equity<br />

Goodwill arising on<br />

acquisition – equity<br />

1 967 6,6 15,0 130 (295) (165)<br />

component<br />

STC and other<br />

717 n/a 15,0 0 (108) (108)<br />

consolidation adjustments (74) 15,0 (103) 11 (92)<br />

Consolidated ABIL group 12 083 15,6 15,0 1 890 (1 812) 78<br />

The cost of equity used to calculate economic profi t is reviewed <strong>annual</strong>ly to take cognisance of changes<br />

in funding rates and risk premiums and was adjusted down from 15,0% to 14,5% in September 2011. The<br />

reduction in the cost of equity contributed R64 million to the overall improvement in economic profi t.<br />

Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited<br />

51