Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

64<br />

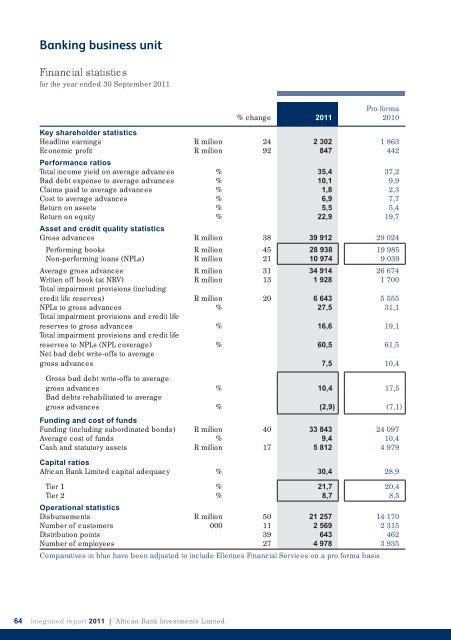

<strong>Bank</strong>ing business unit<br />

Financial statistics<br />

for the year ended 30 September 2011<br />

% change 2011<br />

Pro forma<br />

2010<br />

Key shareholder statistics<br />

Headline earnings R million 24 2 302 1 863<br />

Economic profi t<br />

Performance ratios<br />

R million 92 847 442<br />

Total income yield on average advances % 35,4 37,2<br />

Bad debt expense to average advances % 10,1 9,9<br />

Claims paid to average advances % 1,8 2,3<br />

Cost to average advances % 6,9 7,7<br />

Return on assets % 5,5 5,4<br />

Return on equity<br />

Asset and credit quality statistics<br />

% 22,9 19,7<br />

Gross advances R million 38 39 912 29 024<br />

Performing books R million 45 28 938 19 985<br />

Non-performing loans (NPLs) R million 21 10 974 9 039<br />

Average gross advances R million 31 34 914 26 674<br />

Written off book (at NRV) R million 13 1 928 1 700<br />

Total impairment provisions (including<br />

credit life reserves) R million 20 6 643 5 555<br />

NPLs to gross advances % 27,5 31,1<br />

Total impairment provisions and credit life<br />

reserves to gross advances % 16,6 19,1<br />

Total impairment provisions and credit life<br />

reserves to NPLs (NPL coverage) % 60,5 61,5<br />

Net bad debt write-offs to average<br />

gross advances 7,5 10,4<br />

Gross bad debt write-offs to average<br />

gross advances<br />

Bad debts rehabilitated to average<br />

% 10,4 17,5<br />

gross advances<br />

Funding and cost of funds<br />

% (2,9) (7,1)<br />

Funding (including subordinated bonds) R million 40 33 843 24 097<br />

Average cost of funds % 9,4 10,4<br />

Cash and statutory assets<br />

Capital ratios<br />

R million 17 5 812 4 979<br />

<strong>African</strong> <strong>Bank</strong> Limited capital adequacy % 30,4 28,9<br />

Tier 1 % 21,7 20,4<br />

Tier 2<br />

Operational statistics<br />

% 8,7 8,5<br />

Disbursements R million 50 21 257 14 170<br />

Number of customers 000 11 2 569 2 315<br />

Distribution points 39 643 462<br />

Number of employees 27 4 978 3 935<br />

Comparatives in blue have been adjusted to include Ellerines Financial Services on a pro forma basis<br />

Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited