Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Full integrated annual report - African Bank - Investoreports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>African</strong> <strong>Bank</strong> Investments Limited<br />

Capital management and dividends<br />

ABIL maintained its conservative approach to capital management during this period which continued to<br />

ensure stable credit ratings for the <strong>Bank</strong>, a steady fl ow of available funding and a further reduction in the cost<br />

of funding.<br />

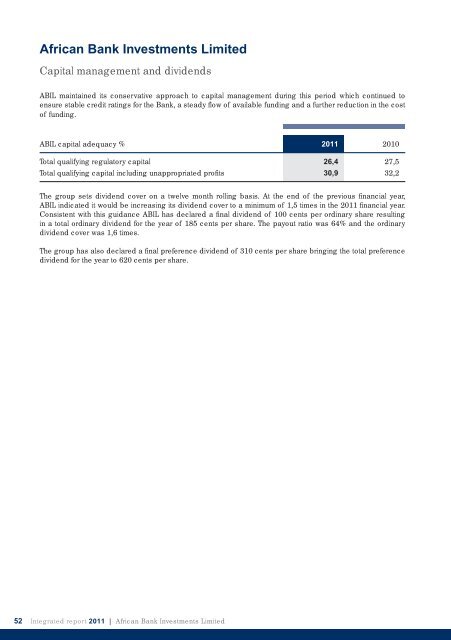

ABIL capital adequacy % 2011 2010<br />

Total qualifying regulatory capital 26,4 27,5<br />

Total qualifying capital including unappropriated profi ts 30,9 32,2<br />

The group sets dividend cover on a twelve month rolling basis. At the end of the previous fi nancial year,<br />

ABIL indicated it would be increasing its dividend cover to a minimum of 1,5 times in the 2011 fi nancial year.<br />

Consistent with this guidance ABIL has declared a fi nal dividend of 100 cents per ordinary share resulting<br />

in a total ordinary dividend for the year of 185 cents per share. The payout ratio was 64% and the ordinary<br />

dividend cover was 1,6 times.<br />

The group has also declared a fi nal preference dividend of 310 cents per share bringing the total preference<br />

dividend for the year to 620 cents per share.<br />

52 Integrated <strong>report</strong> 2011 | <strong>African</strong> <strong>Bank</strong> Investments Limited