Santam Se perSoonlike poliS WerkSopDraG

Santam Se perSoonlike poliS WerkSopDraG

Santam Se perSoonlike poliS WerkSopDraG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

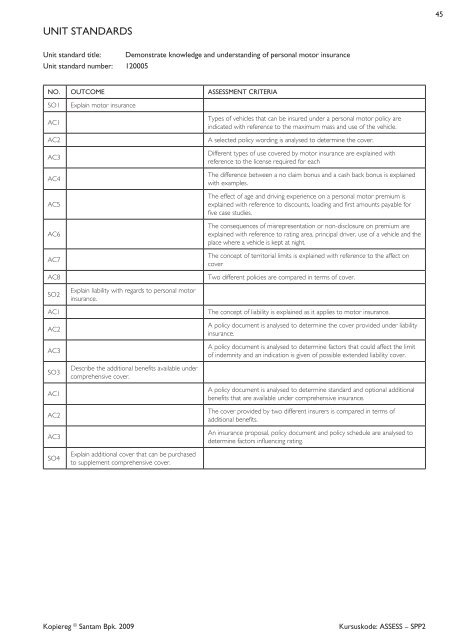

UNIT STANDARDS<br />

Unit standard title: Demonstrate knowledge and understanding of personal motor insurance<br />

Unit standard number: 120005<br />

NO. OUTCOME ASSESSMENT CRITERIA<br />

So1 explain motor insurance<br />

aC1<br />

types of vehicles that can be insured under a personal motor policy are<br />

indicated with reference to the maximum mass and use of the vehicle.<br />

aC2 a selected policy wording is analysed to determine the cover.<br />

aC3<br />

aC4<br />

aC5<br />

aC6<br />

aC7<br />

Different types of use covered by motor insurance are explained with<br />

reference to the license required for each<br />

the difference between a no claim bonus and a cash back bonus is explained<br />

with examples.<br />

the effect of age and driving experience on a personal motor premium is<br />

explained with reference to discounts, loading and first amounts payable for<br />

five case studies.<br />

the consequences of misrepresentation or non-disclosure on premium are<br />

explained with reference to rating area, principal driver, use of a vehicle and the<br />

place where a vehicle is kept at night.<br />

the concept of territorial limits is explained with reference to the affect on<br />

cover<br />

aC8 two different policies are compared in terms of cover.<br />

So2<br />

explain liability with regards to personal motor<br />

insurance.<br />

aC1 the concept of liability is explained as it applies to motor insurance.<br />

aC2<br />

aC3<br />

So3<br />

aC1<br />

aC2<br />

aC3<br />

So4<br />

Describe the additional benefits available under<br />

comprehensive cover.<br />

explain additional cover that can be purchased<br />

to supplement comprehensive cover.<br />

a policy document is analysed to determine the cover provided under liability<br />

insurance.<br />

a policy document is analysed to determine factors that could affect the limit<br />

of indemnity and an indication is given of possible extended liability cover.<br />

a policy document is analysed to determine standard and optional additional<br />

benefits that are available under comprehensive insurance.<br />

the cover provided by two different insurers is compared in terms of<br />

additional benefits.<br />

an insurance proposal, policy document and policy schedule are analysed to<br />

determine factors influencing rating.<br />

Kopiereg ©<strong>Santam</strong> Bpk. 2009 Kursuskode: ASSESS – SPP2<br />

45