Santam Se perSoonlike poliS WerkSopDraG

Santam Se perSoonlike poliS WerkSopDraG

Santam Se perSoonlike poliS WerkSopDraG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

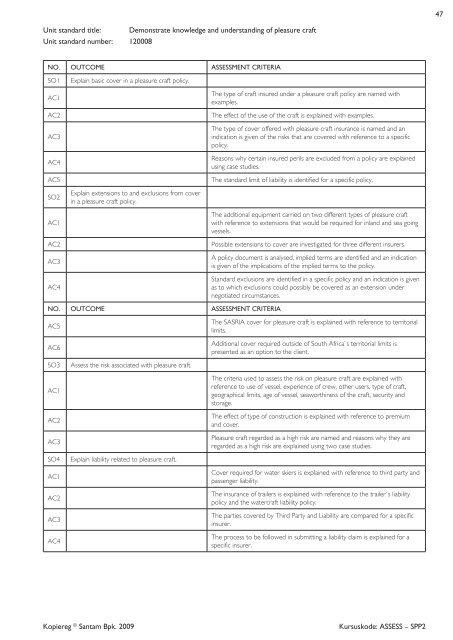

Unit standard title: Demonstrate knowledge and understanding of pleasure craft<br />

Unit standard number: 120008<br />

NO. OUTCOME ASSESSMENT CRITERIA<br />

So1 explain basic cover in a pleasure craft policy.<br />

aC1<br />

the type of craft insured under a pleasure craft policy are named with<br />

examples.<br />

aC2 the effect of the use of the craft is explained with examples.<br />

aC3<br />

aC4<br />

the type of cover offered with pleasure craft insurance is named and an<br />

indication is given of the risks that are covered with reference to a specific<br />

policy.<br />

reasons why certain insured perils are excluded from a policy are explained<br />

using case studies.<br />

aC5 the standard limit of liability is identified for a specific policy.<br />

So2<br />

aC1<br />

explain extensions to and exclusions from cover<br />

in a pleasure craft policy.<br />

the additional equipment carried on two different types of pleasure craft<br />

with reference to extensions that would be required for inland and sea going<br />

vessels.<br />

aC2 possible extensions to cover are investigated for three different insurers.<br />

aC3<br />

aC4<br />

NO. OUTCOME ASSESSMENT CRITERIA<br />

aC5<br />

aC6<br />

So3 assess the risk associated with pleasure craft.<br />

aC1<br />

aC2<br />

aC3<br />

So4 explain liability related to pleasure craft.<br />

aC1<br />

aC2<br />

aC3<br />

aC4<br />

a policy document is analysed, implied terms are identified and an indication<br />

is given of the implications of the implied terms to the policy.<br />

Standard exclusions are identified in a specific policy and an indication is given<br />

as to which exclusions could possibly be covered as an extension under<br />

negotiated circumstances.<br />

the SaSria cover for pleasure craft is explained with reference to territorial<br />

limits.<br />

additional cover required outside of South africa`s territorial limits is<br />

presented as an option to the client.<br />

the criteria used to assess the risk on pleasure craft are explained with<br />

reference to use of vessel, experience of crew, other users, type of craft,<br />

geographical limits, age of vessel, seaworthiness of the craft, security and<br />

storage.<br />

the effect of type of construction is explained with reference to premium<br />

and cover.<br />

pleasure craft regarded as a high risk are named and reasons why they are<br />

regarded as a high risk are explained using two case studies.<br />

Cover required for water skiers is explained with reference to third party and<br />

passenger liability.<br />

the insurance of trailers is explained with reference to the trailer`s liability<br />

policy and the watercraft liability policy.<br />

the parties covered by third party and liability are compared for a specific<br />

insurer.<br />

the process to be followed in submitting a liability claim is explained for a<br />

specific insurer.<br />

Kopiereg ©<strong>Santam</strong> Bpk. 2009 Kursuskode: ASSESS – SPP2<br />

47