Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)<br />

2.2 ECONOMIC ENTITIES IN THE GROUP (cont’d)<br />

(d) Jointly controlled entities (cont’d)<br />

Equity accounting involves recognising <strong>the</strong> venturer’s share of <strong>the</strong> post acquisition results of jointly controlled entities<br />

in <strong>the</strong> profit or loss <strong>and</strong> its share of post acquisition movements within reserves in reserves. The cumulative post<br />

acquisition movements are adjusted against <strong>the</strong> cost of <strong>the</strong> investment <strong>and</strong> include goodwill on acquisition (net of<br />

accumulated impairment losses).<br />

The Group recognises <strong>the</strong> portion of gains or losses on <strong>the</strong> sale of assets by <strong>the</strong> Group to <strong>the</strong> joint venture that is<br />

attributable to <strong>the</strong> o<strong>the</strong>r venturers. The Group does not recognise its share of profits or losses from <strong>the</strong> joint venture<br />

that result from <strong>the</strong> purchase of assets by <strong>the</strong> Group from <strong>the</strong> joint venture until it resells <strong>the</strong> assets to an independent<br />

party. However, a loss on <strong>the</strong> transaction is recognised immediately if <strong>the</strong> loss provides evidence of a reduction in <strong>the</strong><br />

net realisable value of current assets or an impairment loss.<br />

Where necessary, adjustments have been made to <strong>the</strong> financial statements of jointly controlled entities to ensure<br />

consistency of accounting policies with those of <strong>the</strong> Group.<br />

2.3 FOREIGN CURRENCIES<br />

(a) Functional <strong>and</strong> presentation currency<br />

Items included in <strong>the</strong> financial statements of each of <strong>the</strong> Group’s entities are measured using <strong>the</strong> currency of <strong>the</strong><br />

primary economic environment in which <strong>the</strong> entity operates (<strong>the</strong> functional currency). The financial statements are<br />

presented in Ringgit Malaysia, which is <strong>the</strong> Company’s functional currency.<br />

(b) Transactions <strong>and</strong> balances<br />

Foreign currency transactions are translated into <strong>the</strong> functional currency using <strong>the</strong> exchange rates prevailing at <strong>the</strong><br />

dates of <strong>the</strong> transactions. Foreign exchange gains <strong>and</strong> losses resulting from <strong>the</strong> settlement of such transactions <strong>and</strong><br />

from <strong>the</strong> translation at year-end exchange rates of monetary assets <strong>and</strong> liabilities denominated in foreign currencies<br />

are recognised in <strong>the</strong> profit or loss.<br />

All foreign exchange gains <strong>and</strong> losses are presented in <strong>the</strong> statements of comprehensive income within o<strong>the</strong>r expenses.<br />

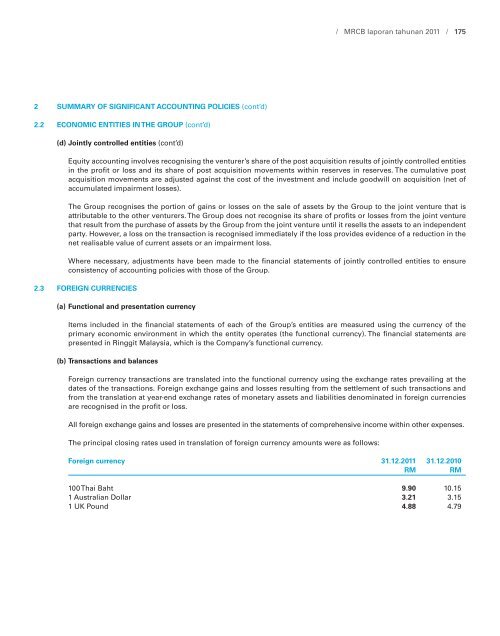

The principal closing rates used in translation of foreign currency amounts were as follows:<br />

/ MRCB laporan tahunan 2011 / 175<br />

Foreign currency 31.12.2011 31.12.2010<br />

RM RM<br />

100 Thai Baht 9.90 10.15<br />

1 Australian Dollar 3.21 3.15<br />

1 UK Pound 4.88 4.79