- Page 1 and 2:

Connecting the nation. and Beyond.

- Page 3 and 4:

CONTENTS/KANDUNGAN 4 Vision & Missi

- Page 5 and 6:

MRCB laporan tahunan 2011 / 3

- Page 7 and 8:

CORPORATE INFORMATION MAKLUMAT KORP

- Page 9 and 10:

EDUCATING YOUTH / MRCB laporan tahu

- Page 11 and 12:

ENVIRONMENTAL INITIATIVES As a lead

- Page 13 and 14:

As the construction project is in t

- Page 15 and 16:

MRCB laporan tahunan 2011 / 13

- Page 17 and 18:

MRCB laporan tahunan 2011 / 15

- Page 19 and 20:

23 Mar MRCB receives BrandLaureate

- Page 21 and 22:

19-21 Jun MRCB Participates in Lang

- Page 23 and 24:

15 Sept MRCB Presents Key to SME Co

- Page 25 and 26:

6 Dec MRCB Holds EDL Briefi ng MRCB

- Page 27 and 28:

NOTICE OF DIVIDEND PAYMENT NOTICE I

- Page 29 and 30:

NOTIS PEMBAYARAN DIVIDEN DENGAN INI

- Page 31 and 32:

MRCB laporan tahunan 2011 / 29

- Page 33 and 34:

Left Dato’ Chong Pah Aung Indepen

- Page 35 and 36:

Datuk Mohamed Razeek Md Hussain Mar

- Page 37 and 38:

Dato’ Abdul Rahman Ahmad Independ

- Page 39 and 40:

Che King Tow Independent Director P

- Page 41 and 42:

Jamaludin Zakaria Independent Direc

- Page 43 and 44:

Member The Edge Billion Ringgit Clu

- Page 45 and 46:

ENGINEERING & CONSTRUCTION KEJURUTE

- Page 47 and 48:

Dear Valued Shareholders, Malaysian

- Page 49 and 50:

throughout the building. Buoyed by

- Page 51 and 52:

Our portfolio includes Stesen Sentr

- Page 53 and 54:

PENYATA PENGERUSI Para Pemegang Sah

- Page 55 and 56:

Pelbagai anugerah berjaya dicapai s

- Page 57 and 58:

Di Johor, Lebuhraya EDL dan Hospita

- Page 59 and 60:

Tujuan utama taklimat ini adalah un

- Page 61 and 62:

CHARTS Group Revenue (RM Million) 1

- Page 63 and 64:

Retail Peruncitan Chief Operating O

- Page 65 and 66:

Infrastructure, Concession & Enviro

- Page 67 and 68:

BUILDING GREEN / MRCB laporan tahun

- Page 69 and 70:

OPERATIONS REVIEW Property Developm

- Page 71 and 72:

award-winning architectural and pro

- Page 73 and 74:

Lot E: KL Sentral Park KL Sentral P

- Page 75 and 76:

Lot G: Offi ce (Perdana Sentral) An

- Page 77 and 78:

Completed Developments At Kuala Lum

- Page 79 and 80:

Plaza Sentral represents a sound in

- Page 81 and 82:

Selbourne Square, Shah Alam MRCB Se

- Page 83 and 84:

Plaza Alam Sentral With 91% occupan

- Page 85 and 86:

OPERATIONS REVIEW Engineering & Con

- Page 87 and 88:

The Brickfi elds and Kuala Lumpur S

- Page 89 and 90:

OPERATIONS REVIEW Infrastructure, C

- Page 91 and 92:

MRCB’s capability in the rehabili

- Page 93 and 94:

OPERATIONS REVIEW Building Services

- Page 95 and 96:

NEW GREEN TECHNOLOGY VENTURES Among

- Page 97 and 98:

of the planned six million sq. ft.

- Page 99 and 100:

OPERATIONS REVIEW Group Support Ser

- Page 101 and 102:

MRCB laporan tahunan 2011 / 99

- Page 103 and 104:

The Terms of Reference of each Comm

- Page 105 and 106:

Table 3: Details of attendance of m

- Page 107 and 108:

Table 6: Details of Aggregate Direc

- Page 109 and 110:

f Keeping tabs with the company’s

- Page 111 and 112:

d annual general meeting (“agm”

- Page 113 and 114:

penYata taDBIr UrUs Korporat Lembag

- Page 115 and 116:

Jadual 2: Butiran kehadiran ahli di

- Page 117 and 118:

Jadual 4: Butiran kehadiran ahli di

- Page 119 and 120:

4. tatacara LemBaga pengaraH Lembag

- Page 121 and 122:

c pencegahan penipuan Lembaga Penga

- Page 123 and 124:

MRCB juga terus diwakili sebagai ah

- Page 125 and 126:

• the going concern assumption; a

- Page 127 and 128:

viii) Deliberated and approved the

- Page 129 and 130:

• sebarang perubahan dasar dan am

- Page 131 and 132:

v) Mengkaji penemuan audit dan audi

- Page 133 and 134:

penYata KaWaLan DaLaman Lembaga Pen

- Page 135 and 136:

Laporan pengUrUsan rIsIKo Salah sat

- Page 137 and 138:

v) sanctions and/or penalties Impos

- Page 139 and 140:

v) sekatan dan/atau Denda yang Dike

- Page 141 and 142:

KontraK-KontraK pentIng mrcB (JanUa

- Page 143 and 144:

anaLIsa pegangan saHam PADA 31 JANU

- Page 145 and 146:

MRCB laporan tahunan 2011 / 143 nam

- Page 147 and 148:

MRCB laporan tahunan 2011 / 145 nam

- Page 149 and 150:

MRCB laporan tahunan 2011 / 147 Des

- Page 151 and 152:

FINANCIAL REPORT 2011 150 Directors

- Page 153 and 154:

DIRECTORS (cont’d) In accordance

- Page 155 and 156:

STATUTORY INFORMATION ON THE FINANC

- Page 157 and 158:

INDEPENDENT AUDITORS’ REPORT TO T

- Page 159 and 160:

STATEMENTS OF COMPREHENSIVE INCOME

- Page 161 and 162:

STATEMENTS OF FINANCIAL POSITION AS

- Page 163 and 164:

CONSOLIDATED STATEMENTS OF CHANGES

- Page 165 and 166:

COMPANY STATEMENTS OF CHANGES IN EQ

- Page 167 and 168:

STATEMENTS OF CASH FLOWS FOR THE FI

- Page 169 and 170:

OPERATING ACTIVITIES (cont’d) / M

- Page 171 and 172:

FINANCING ACTIVITIES / MRCB laporan

- Page 173 and 174:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 175 and 176:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 177 and 178:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 179 and 180:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 181 and 182:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 183 and 184:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 185 and 186:

2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 187 and 188: 2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 189 and 190: 2 SUMMARY OF SIGNIFICANT ACCOUNTING

- Page 191 and 192: 4 FINANCIAL RISK MANAGEMENT (cont

- Page 193 and 194: 4 FINANCIAL RISK MANAGEMENT (cont

- Page 195 and 196: 5 ACQUISITION OF SUBSIDIARIES (cont

- Page 197 and 198: 7 INTANGIBLE ASSETS The carrying am

- Page 199 and 200: 10 OTHER INCOME Group Company 2011

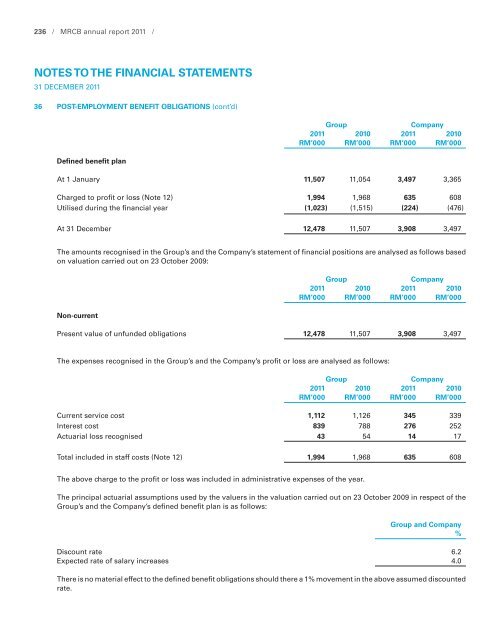

- Page 201 and 202: 12 STAFF COSTS Group Company 2011 2

- Page 203 and 204: 15 INCOME TAX EXPENSE (a) Tax charg

- Page 205 and 206: 16 EARNINGS PER SHARE (a) Basic ear

- Page 207 and 208: 17 PROPERTY, PLANT AND EQUIPMENT (c

- Page 209 and 210: 17 PROPERTY, PLANT AND EQUIPMENT (c

- Page 211 and 212: 17 PROPERTY, PLANT AND EQUIPMENT (c

- Page 213 and 214: 17 PROPERTY, PLANT AND EQUIPMENT (c

- Page 215 and 216: 18 INVESTMENT PROPERTIES (cont’d)

- Page 217 and 218: 19 PROPERTY DEVELOPMENT ACTIVITIES

- Page 219 and 220: 19 PROPERTY DEVELOPMENT ACTIVITIES

- Page 221 and 222: 21 SUBSIDIARIES / MRCB laporan tahu

- Page 223 and 224: 23 JOINTLY CONTROLLED ENTITIES Grou

- Page 225 and 226: 25 DEFERRED TAX Deferred tax assets

- Page 227 and 228: 27 TRADE AND OTHER RECEIVABLES Grou

- Page 229 and 230: 27 TRADE AND OTHER RECEIVABLES (con

- Page 231 and 232: 30 DEPOSITS, CASH AND BANK BALANCES

- Page 233 and 234: 31 SHARE CAPITAL (cont’d) Employe

- Page 235 and 236: 33 LOAN STOCKS AT COST The loan sto

- Page 237: 35 SENIOR AND JUNIOR SUKUK (cont’

- Page 241 and 242: 39 TRADE AND OTHER PAYABLES Group C

- Page 243 and 244: 41 SHORT TERM BORROWINGS Secured: G

- Page 245 and 246: 43 RELATED PARTY DISCLOSURES (cont

- Page 247 and 248: 46 SUBSIDIARIES, JOINTLY CONTROLLED

- Page 249 and 250: 46 SUBSIDIARIES, JOINTLY CONTROLLED

- Page 251 and 252: 46 SUBSIDIARIES, JOINTLY CONTROLLED

- Page 253 and 254: 47 SEGMENT REPORTING Management has

- Page 255 and 256: 47 SEGMENT REPORTING (cont’d) Yea

- Page 257 and 258: 48 SIGNIFICANT EVENTS DURING THE FI

- Page 259 and 260: 50 COMPARATIVES Comparative figures

- Page 261 and 262: PROXY FORM (Please see the notes be

- Page 263 and 264: BORANG PROKSI (Sila Lihat Nota-Nota

- Page 265: MaLaYSIan reSourCeS CorporaTIon Ber