Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

212 / MRCB annual report 2011 /<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2011<br />

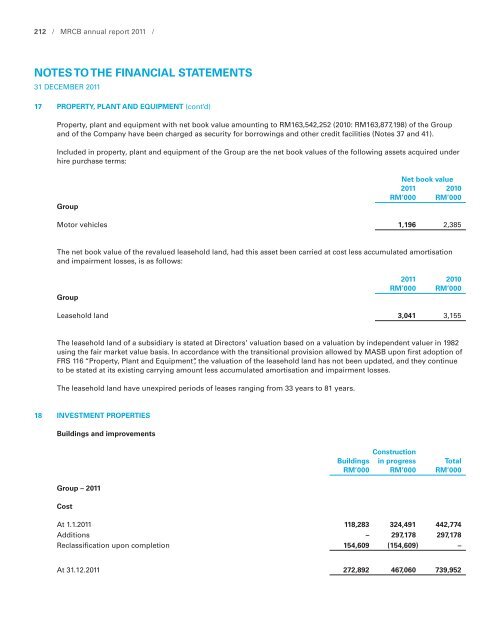

17 PROPERTY, PLANT AND EQUIPMENT (cont’d)<br />

Property, plant <strong>and</strong> equipment with net book value amounting to RM163,542,252 (2010: RM163,877,198) of <strong>the</strong> Group<br />

<strong>and</strong> of <strong>the</strong> Company have been charged as security for borrowings <strong>and</strong> o<strong>the</strong>r credit facilities (Notes 37 <strong>and</strong> 41).<br />

Included in property, plant <strong>and</strong> equipment of <strong>the</strong> Group are <strong>the</strong> net book values of <strong>the</strong> following assets acquired under<br />

hire purchase terms:<br />

Group<br />

Net book value<br />

2011 2010<br />

RM’000 RM’000<br />

Motor vehicles 1,196 2,385<br />

The net book value of <strong>the</strong> revalued leasehold l<strong>and</strong>, had this asset been carried at cost less accumulated amortisation<br />

<strong>and</strong> impairment losses, is as follows:<br />

Group<br />

2011 2010<br />

RM’000 RM’000<br />

Leasehold l<strong>and</strong> 3,041 3,155<br />

The leasehold l<strong>and</strong> of a subsidiary is stated at Directors’ valuation based on a valuation by independent valuer in 1982<br />

using <strong>the</strong> fair market value basis. In accordance with <strong>the</strong> transitional provision allowed by MASB upon first adoption of<br />

FRS 116 “Property, Plant <strong>and</strong> Equipment”, <strong>the</strong> valuation of <strong>the</strong> leasehold l<strong>and</strong> has not been updated, <strong>and</strong> <strong>the</strong>y continue<br />

to be stated at its existing carrying amount less accumulated amortisation <strong>and</strong> impairment losses.<br />

The leasehold l<strong>and</strong> have unexpired periods of leases ranging from 33 years to 81 years.<br />

18 INVESTMENT PROPERTIES<br />

Buildings <strong>and</strong> improvements<br />

Group – 2011<br />

Cost<br />

Construction<br />

Buildings in progress Total<br />

RM’000 RM’000 RM’000<br />

At 1.1.2011 118,283 324,491 442,774<br />

Additions – 297,178 297,178<br />

Reclassification upon completion 154,609 (154,609) –<br />

At 31.12.2011 272,892 467,060 739,952