Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

226 / MRCB annual report 2011 /<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2011<br />

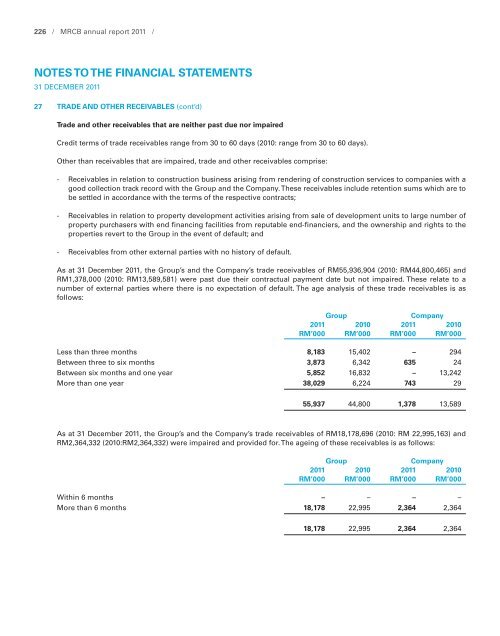

27 TRADE AND OTHER RECEIVABLES (cont’d)<br />

Trade <strong>and</strong> o<strong>the</strong>r receivables that are nei<strong>the</strong>r past due nor impaired<br />

Credit terms of trade receivables range from 30 to 60 days (2010: range from 30 to 60 days).<br />

O<strong>the</strong>r than receivables that are impaired, trade <strong>and</strong> o<strong>the</strong>r receivables comprise:<br />

- Receivables in relation to construction business arising from rendering of construction services to companies with a<br />

good collection track record with <strong>the</strong> Group <strong>and</strong> <strong>the</strong> Company. These receivables include retention sums which are to<br />

be settled in accordance with <strong>the</strong> terms of <strong>the</strong> respective contracts;<br />

- Receivables in relation to property development activities arising from sale of development units to large number of<br />

property purchasers with end financing facilities from reputable end-financiers, <strong>and</strong> <strong>the</strong> ownership <strong>and</strong> rights to <strong>the</strong><br />

properties revert to <strong>the</strong> Group in <strong>the</strong> event of default; <strong>and</strong><br />

- Receivables from o<strong>the</strong>r external parties with no history of default.<br />

As at 31 December 2011, <strong>the</strong> Group’s <strong>and</strong> <strong>the</strong> Company’s trade receivables of RM55,936,904 (2010: RM44,800,465) <strong>and</strong><br />

RM1,378,000 (2010: RM13,589,581) were past due <strong>the</strong>ir contractual payment date but not impaired. These relate to a<br />

number of external parties where <strong>the</strong>re is no expectation of default. The age analysis of <strong>the</strong>se trade receivables is as<br />

follows:<br />

Group Company<br />

2011 2010 2011 2010<br />

RM’000 RM’000 RM’000 RM’000<br />

Less than three months 8,183 15,402 – 294<br />

Between three to six months 3,873 6,342 635 24<br />

Between six months <strong>and</strong> one year 5,852 16,832 – 13,242<br />

More than one year 38,029 6,224 743 29<br />

55,937 44,800 1,378 13,589<br />

As at 31 December 2011, <strong>the</strong> Group’s <strong>and</strong> <strong>the</strong> Company’s trade receivables of RM18,178,696 (2010: RM 22,995,163) <strong>and</strong><br />

RM2,364,332 (2010:RM2,364,332) were impaired <strong>and</strong> provided for. The ageing of <strong>the</strong>se receivables is as follows:<br />

Group Company<br />

2011 2010 2011 2010<br />

RM’000 RM’000 RM’000 RM’000<br />

Within 6 months – – – –<br />

More than 6 months 18,178 22,995 2,364 2,364<br />

18,178 22,995 2,364 2,364