Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Connecting the nation. and Beyond. - ChartNexus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 FINANCIAL RISK MANAGEMENT (cont’d)<br />

(i) Interest rate risk (cont’d)<br />

The Group manages this risk through <strong>the</strong> use of fixed <strong>and</strong> floating rate debt.<br />

The Group’s outst<strong>and</strong>ing borrowings as at year end at variable rates on which hedges have not been entered into,<br />

are denominated in RM. If <strong>the</strong> RM annual interest rates increase/decrease by 1% respectively (2010: 1%) with all<br />

o<strong>the</strong>r variables including tax rate being held constant, <strong>the</strong> result after tax will be lower/higher by 4% (2010: 5%) as<br />

a result of higher/lower interest expense on <strong>the</strong>se borrowings.<br />

(ii) Liquidity <strong>and</strong> cash flow risk<br />

The Group manages its liquidity risk by maintaining sufficient levels of cash or cash convertible investments <strong>and</strong><br />

available credit facilities to meet its working capital requirements.<br />

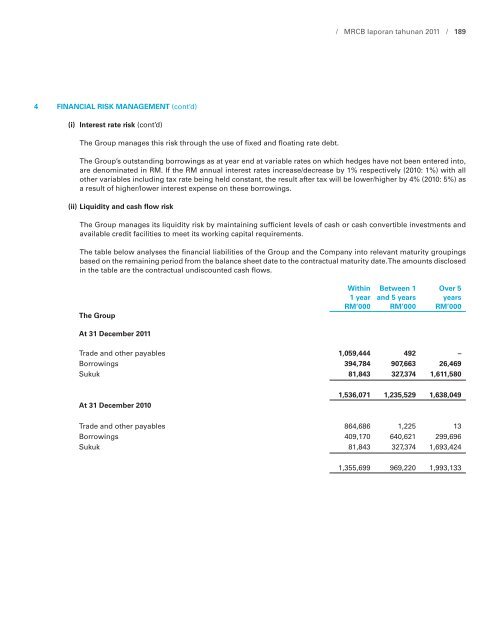

The table below analyses <strong>the</strong> financial liabilities of <strong>the</strong> Group <strong>and</strong> <strong>the</strong> Company into relevant maturity groupings<br />

based on <strong>the</strong> remaining period from <strong>the</strong> balance sheet date to <strong>the</strong> contractual maturity date. The amounts disclosed<br />

in <strong>the</strong> table are <strong>the</strong> contractual undiscounted cash flows.<br />

The Group<br />

At 31 December 2011<br />

Within Between 1 Over 5<br />

1 year <strong>and</strong> 5 years years<br />

RM’000 RM’000 RM’000<br />

Trade <strong>and</strong> o<strong>the</strong>r payables 1,059,444 492 –<br />

Borrowings 394,784 907,663 26,469<br />

Sukuk 81,843 327,374 1,611,580<br />

At 31 December 2010<br />

/ MRCB laporan tahunan 2011 / 189<br />

1,536,071 1,235,529 1,638,049<br />

Trade <strong>and</strong> o<strong>the</strong>r payables 864,686 1,225 13<br />

Borrowings 409,170 640,621 299,696<br />

Sukuk 81,843 327,374 1,693,424<br />

1,355,699 969,220 1,993,133