Environmental Management Accounting Procedures and Principles

Environmental Management Accounting Procedures and Principles

Environmental Management Accounting Procedures and Principles

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Environmental</strong> <strong>Management</strong> <strong>Accounting</strong><br />

<strong>Procedures</strong> <strong>and</strong> <strong>Principles</strong><br />

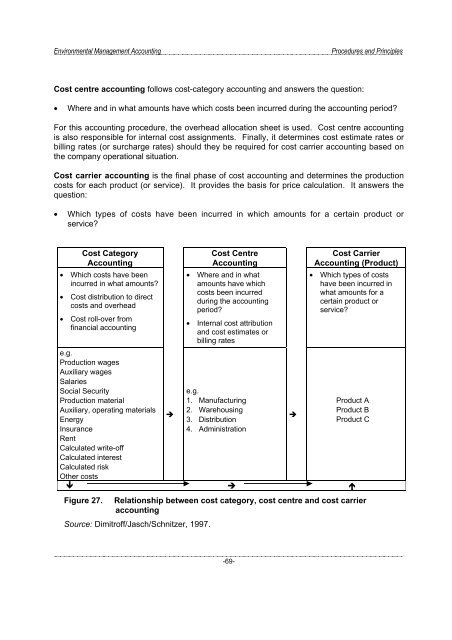

Cost centre accounting follows cost-category accounting <strong>and</strong> answers the question:<br />

• Where <strong>and</strong> in what amounts have which costs been incurred during the accounting period?<br />

For this accounting procedure, the overhead allocation sheet is used. Cost centre accounting<br />

is also responsible for internal cost assignments. Finally, it determines cost estimate rates or<br />

billing rates (or surcharge rates) should they be required for cost carrier accounting based on<br />

the company operational situation.<br />

Cost carrier accounting is the final phase of cost accounting <strong>and</strong> determines the production<br />

costs for each product (or service). It provides the basis for price calculation. It answers the<br />

question:<br />

• Which types of costs have been incurred in which amounts for a certain product or<br />

service?<br />

Cost Category<br />

<strong>Accounting</strong><br />

• Which costs have been<br />

incurred in what amounts?<br />

• Cost distribution to direct<br />

costs <strong>and</strong> overhead<br />

• Cost roll-over from<br />

financial accounting<br />

e.g.<br />

Production wages<br />

Auxiliary wages<br />

Salaries<br />

Social Security<br />

Production material<br />

Auxiliary, operating materials<br />

Energy<br />

Insurance<br />

Rent<br />

Calculated write-off<br />

Calculated interest<br />

Calculated risk<br />

Other costs<br />

<br />

Cost Centre<br />

<strong>Accounting</strong><br />

• Where <strong>and</strong> in what<br />

amounts have which<br />

costs been incurred<br />

during the accounting<br />

period?<br />

• Internal cost attribution<br />

<strong>and</strong> cost estimates or<br />

billing rates<br />

e.g.<br />

1. Manufacturing<br />

2. Warehousing<br />

3. Distribution<br />

4. Administration<br />

<br />

Cost Carrier<br />

<strong>Accounting</strong> (Product)<br />

• Which types of costs<br />

have been incurred in<br />

what amounts for a<br />

certain product or<br />

service?<br />

Product A<br />

Product B<br />

Product C<br />

<br />

Figure 27. Relationship between cost category, cost centre <strong>and</strong> cost carrier<br />

accounting<br />

Source: Dimitroff/Jasch/Schnitzer, 1997.<br />

-69-