Environmental Management Accounting Procedures and Principles

Environmental Management Accounting Procedures and Principles

Environmental Management Accounting Procedures and Principles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Environmental</strong> <strong>Management</strong> <strong>Accounting</strong><br />

<strong>Procedures</strong> <strong>and</strong> <strong>Principles</strong><br />

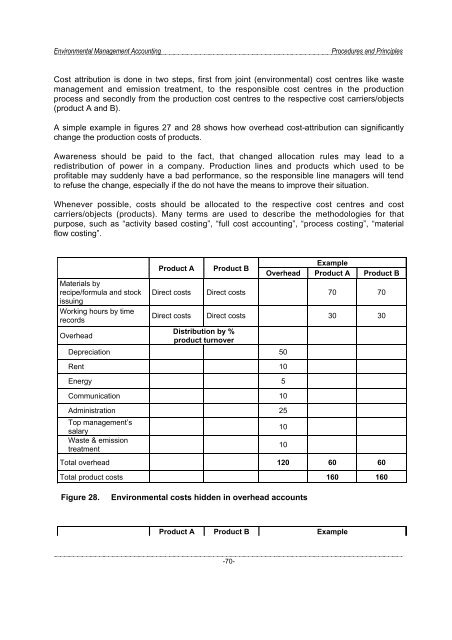

Cost attribution is done in two steps, first from joint (environmental) cost centres like waste<br />

management <strong>and</strong> emission treatment, to the responsible cost centres in the production<br />

process <strong>and</strong> secondly from the production cost centres to the respective cost carriers/objects<br />

(product A <strong>and</strong> B).<br />

A simple example in figures 27 <strong>and</strong> 28 shows how overhead cost-attribution can significantly<br />

change the production costs of products.<br />

Awareness should be paid to the fact, that changed allocation rules may lead to a<br />

redistribution of power in a company. Production lines <strong>and</strong> products which used to be<br />

profitable may suddenly have a bad performance, so the responsible line managers will tend<br />

to refuse the change, especially if the do not have the means to improve their situation.<br />

Whenever possible, costs should be allocated to the respective cost centres <strong>and</strong> cost<br />

carriers/objects (products). Many terms are used to describe the methodologies for that<br />

purpose, such as “activity based costing”, “full cost accounting”, “process costing”, “material<br />

flow costing”.<br />

Materials by<br />

recipe/formula <strong>and</strong> stock<br />

issuing<br />

Working hours by time<br />

records<br />

Product A<br />

Product B<br />

Example<br />

Overhead Product A Product B<br />

Direct costs Direct costs 70 70<br />

Direct costs Direct costs 30 30<br />

Distribution by %<br />

Overhead<br />

product turnover<br />

Depreciation 50<br />

Rent 10<br />

Energy 5<br />

Communication 10<br />

Administration 25<br />

Top management’s<br />

salary<br />

10<br />

Waste & emission<br />

treatment<br />

10<br />

Total overhead 120 60 60<br />

Total product costs 160 160<br />

Figure 28.<br />

<strong>Environmental</strong> costs hidden in overhead accounts<br />

Product A Product B Example<br />

-70-