Ardagh Glass Finance plc - Irish Stock Exchange

Ardagh Glass Finance plc - Irish Stock Exchange

Ardagh Glass Finance plc - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

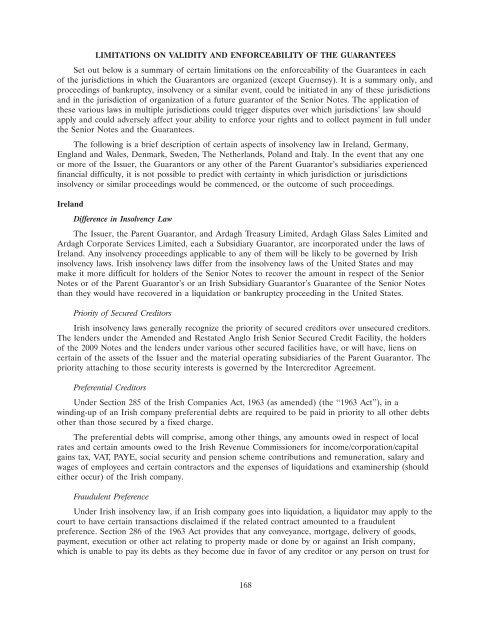

LIMITATIONS ON VALIDITY AND ENFORCEABILITY OF THE GUARANTEES<br />

Set out below is a summary of certain limitations on the enforceability of the Guarantees in each<br />

of the jurisdictions in which the Guarantors are organized (except Guernsey). It is a summary only, and<br />

proceedings of bankruptcy, insolvency or a similar event, could be initiated in any of these jurisdictions<br />

and in the jurisdiction of organization of a future guarantor of the Senior Notes. The application of<br />

these various laws in multiple jurisdictions could trigger disputes over which jurisdictions’ law should<br />

apply and could adversely affect your ability to enforce your rights and to collect payment in full under<br />

the Senior Notes and the Guarantees.<br />

The following is a brief description of certain aspects of insolvency law in Ireland, Germany,<br />

England and Wales, Denmark, Sweden, The Netherlands, Poland and Italy. In the event that any one<br />

or more of the Issuer, the Guarantors or any other of the Parent Guarantor’s subsidiaries experienced<br />

financial difficulty, it is not possible to predict with certainty in which jurisdiction or jurisdictions<br />

insolvency or similar proceedings would be commenced, or the outcome of such proceedings.<br />

Ireland<br />

Difference in Insolvency Law<br />

The Issuer, the Parent Guarantor, and <strong>Ardagh</strong> Treasury Limited, <strong>Ardagh</strong> <strong>Glass</strong> Sales Limited and<br />

<strong>Ardagh</strong> Corporate Services Limited, each a Subsidiary Guarantor, are incorporated under the laws of<br />

Ireland. Any insolvency proceedings applicable to any of them will be likely to be governed by <strong>Irish</strong><br />

insolvency laws. <strong>Irish</strong> insolvency laws differ from the insolvency laws of the United States and may<br />

make it more difficult for holders of the Senior Notes to recover the amount in respect of the Senior<br />

Notes or of the Parent Guarantor’s or an <strong>Irish</strong> Subsidiary Guarantor’s Guarantee of the Senior Notes<br />

than they would have recovered in a liquidation or bankruptcy proceeding in the United States.<br />

Priority of Secured Creditors<br />

<strong>Irish</strong> insolvency laws generally recognize the priority of secured creditors over unsecured creditors.<br />

The lenders under the Amended and Restated Anglo <strong>Irish</strong> Senior Secured Credit Facility, the holders<br />

of the 2009 Notes and the lenders under various other secured facilities have, or will have, liens on<br />

certain of the assets of the Issuer and the material operating subsidiaries of the Parent Guarantor. The<br />

priority attaching to those security interests is governed by the Intercreditor Agreement.<br />

Preferential Creditors<br />

Under Section 285 of the <strong>Irish</strong> Companies Act, 1963 (as amended) (the ‘‘1963 Act’’), in a<br />

winding-up of an <strong>Irish</strong> company preferential debts are required to be paid in priority to all other debts<br />

other than those secured by a fixed charge.<br />

The preferential debts will comprise, among other things, any amounts owed in respect of local<br />

rates and certain amounts owed to the <strong>Irish</strong> Revenue Commissioners for income/corporation/capital<br />

gains tax, VAT, PAYE, social security and pension scheme contributions and remuneration, salary and<br />

wages of employees and certain contractors and the expenses of liquidations and examinership (should<br />

either occur) of the <strong>Irish</strong> company.<br />

Fraudulent Preference<br />

Under <strong>Irish</strong> insolvency law, if an <strong>Irish</strong> company goes into liquidation, a liquidator may apply to the<br />

court to have certain transactions disclaimed if the related contract amounted to a fraudulent<br />

preference. Section 286 of the 1963 Act provides that any conveyance, mortgage, delivery of goods,<br />

payment, execution or other act relating to property made or done by or against an <strong>Irish</strong> company,<br />

which is unable to pay its debts as they become due in favor of any creditor or any person on trust for<br />

168