- Page 1 and 2:

OFFERING MEMORANDUM—LISTING PARTI

- Page 3 and 4:

IMPORTANT INFORMATION This Offering

- Page 5 and 6:

NOTICE TO EEA INVESTORS This Offeri

- Page 7 and 8:

NOTES ON DEFINED TERMS USED IN THIS

- Page 9 and 10:

PRESENTATION OF FINANCIAL AND OTHER

- Page 11 and 12:

The 2007 Pro Forma Financial Inform

- Page 13 and 14:

EXCHANGE RATES Exchange Rate Betwee

- Page 15 and 16: Exchange Rate Between the Euro and

- Page 17 and 18: Exchange Rate Between the Euro and

- Page 19 and 20: Ardagh Glass Engineering Ardagh Gla

- Page 21 and 22: • Continue to Apply Advanced Tech

- Page 23 and 24: As at September 30, 2009, after giv

- Page 25 and 26: • be effectively subordinated to

- Page 27 and 28: Use of Proceeds ................ Tr

- Page 29 and 30: Unaudited Nine months ended and as

- Page 31 and 32: The reconciliation of operating pro

- Page 33 and 34: Our credit facilities contain finan

- Page 35 and 36: Facility, causing all the debt unde

- Page 37 and 38: An active trading market may not de

- Page 39 and 40: its hedging arrangements. As at Sep

- Page 41 and 42: • issued such Guarantee in a situ

- Page 43 and 44: will continue to be preferred by ou

- Page 45 and 46: We are subject to various environme

- Page 47 and 48: Changes in laws and regulations rel

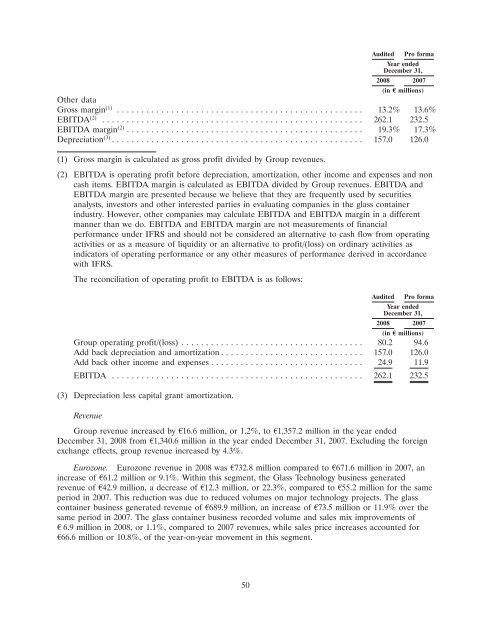

- Page 49 and 50: the twelve months ended September 3

- Page 51 and 52: Coulson is Chairman of the board of

- Page 53 and 54: CAPITALIZATION The following table

- Page 55 and 56: Unaudited Nine months ended and as

- Page 57 and 58: UNAUDITED SUPPLEMENTAL INFORMATION

- Page 59 and 60: OPERATING AND FINANCIAL REVIEW AND

- Page 61 and 62: Acquisition of Busch and Spreen. In

- Page 63 and 64: Goodwill Goodwill represents the ex

- Page 65: Operating Profit Excluding other in

- Page 69 and 70: major drivers of the rise in gross

- Page 71 and 72: Operating Results The significant i

- Page 73 and 74: Historical Development The followin

- Page 75 and 76: External Financings The following t

- Page 77 and 78: Derivative transactions are only un

- Page 79 and 80: Beverages, Diageo, and Nestlé. Ard

- Page 81 and 82: has consistently focused on decreas

- Page 83 and 84: The following table shows certain p

- Page 85 and 86: Ardagh Glass Engineering Ardagh’s

- Page 87 and 88: Key competitors by material type: P

- Page 89 and 90: period. This agreement supersedes a

- Page 91 and 92: Intellectual Property Glass Contain

- Page 93 and 94: Asbestos is present, or may be pres

- Page 95 and 96: facilities are well maintained and

- Page 97 and 98: glass container industry. Heye Inte

- Page 99 and 100: Board of Directors The following ta

- Page 101 and 102: Internal Control and Risk Managemen

- Page 103 and 104: DESCRIPTION OF OTHER INDEBTEDNESS T

- Page 105 and 106: Under the Intercreditor Agreement,

- Page 107 and 108: In addition, certain negative coven

- Page 109 and 110: DESCRIPTION OF THE NOTES The defini

- Page 111 and 112: (b) rank senior in right of payment

- Page 113 and 114: etain Permitted Junior Securities a

- Page 115 and 116: under the Guarantee would cause the

- Page 117 and 118:

of its Subsidiaries may act as payi

- Page 119 and 120:

to obtain such receipts, the same a

- Page 121 and 122:

the Issuer would be obligated to pa

- Page 123 and 124:

of Control could cause a default un

- Page 125 and 126:

or otherwise become responsible for

- Page 127 and 128:

principal amount that may be drawn

- Page 129 and 130:

Payment (or, if such aggregate cumu

- Page 131 and 132:

indirectly, to issue or sell, any s

- Page 133 and 134:

directly secured by a Lien on such

- Page 135 and 136:

Notwithstanding the foregoing, noth

- Page 137 and 138:

(e) encumbrances or restrictions co

- Page 139 and 140:

(ii) maintain or preserve such Pers

- Page 141 and 142:

Guarantor would dispose of, all or

- Page 143 and 144:

periods and other than by regularly

- Page 145 and 146:

(b) the Issuer’s obligations to i

- Page 147 and 148:

occurring after an Event of Default

- Page 149 and 150:

Indenture, the Notes or any Guarant

- Page 151 and 152:

‘‘Asset Sale’’ means any sa

- Page 153 and 154:

a share of the profits and losses,

- Page 155 and 156:

‘‘Consolidated Fixed Charge Cov

- Page 157 and 158:

Notwithstanding any of the foregoin

- Page 159 and 160:

otherwise require any cash payment

- Page 161 and 162:

or other property to others or any

- Page 163 and 164:

(f) Investments in the Notes and th

- Page 165 and 166:

(l) Liens arising by reason of any

- Page 167 and 168:

or associated with, any Asset Sale,

- Page 169 and 170:

elevant security agent in the enfor

- Page 171 and 172:

BOOK-ENTRY; DELIVERY AND FORM Gener

- Page 173 and 174:

The Global Note for Rule 144A Book-

- Page 175 and 176:

TAXATION Prospective purchasers of

- Page 177 and 178:

Encashment Tax If the Paying Agent

- Page 179 and 180:

Interest on the Senior Notes Paymen

- Page 181 and 182:

will hold Senior Notes as part of a

- Page 183 and 184:

amount of OID into U.S. dollars and

- Page 185 and 186:

LIMITATIONS ON VALIDITY AND ENFORCE

- Page 187 and 188:

Effect of Appointment of Examiner T

- Page 189 and 190:

Liability Company as General Partne

- Page 191 and 192:

of court by the company, its direct

- Page 193 and 194:

court). As a general rule, such leg

- Page 195 and 196:

which creditors have a right to be

- Page 197 and 198:

ascertain the center of main intere

- Page 199 and 200:

Italy Ardagh Glass S.r.l., one of t

- Page 201 and 202:

Fraudulent Transfer Provisions of G

- Page 203 and 204:

provided that no such offer of Seni

- Page 205 and 206:

NOTICE TO INVESTORS The Senior Note

- Page 207 and 208:

AND ANY APPLICABLE LOCAL LAWS AND R

- Page 209 and 210:

(ii) the process and decision of th

- Page 211 and 212:

In cases of non-compliance with or

- Page 213 and 214:

Recognition of Judgments in Civil a

- Page 215 and 216:

LISTING AND GENERAL INFORMATION 1.

- Page 217 and 218:

15. The consolidated non-statutory

- Page 219 and 220:

Place of Registration and Registrat

- Page 221 and 222:

Place of Registration and Registrat

- Page 223 and 224:

CONSOLIDATED NON-STATUTORY FINANCIA

- Page 225 and 226:

STATEMENT OF DIRECTORS’ RESPONSIB

- Page 227 and 228:

BASIS OF PREPARATION (Continued) su

- Page 229 and 230:

BASIS OF PREPARATION (Continued) In

- Page 231 and 232:

ACCOUNTING POLICIES (Continued) (v)

- Page 233 and 234:

ACCOUNTING POLICIES (Continued) INV

- Page 235 and 236:

ACCOUNTING POLICIES (Continued) to

- Page 237 and 238:

ACCOUNTING POLICIES (Continued) fin

- Page 239 and 240:

ACCOUNTING POLICIES (Continued) (ii

- Page 241 and 242:

CONSOLIDATED INCOME STATEMENT FOR T

- Page 243 and 244:

CONSOLIDATED BALANCE SHEET AS AT 31

- Page 245 and 246:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 247 and 248:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 249 and 250:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 251 and 252:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 253 and 254:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 255 and 256:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 257 and 258:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 259 and 260:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 261 and 262:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 263 and 264:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 265 and 266:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 267 and 268:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 269 and 270:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 271 and 272:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 273 and 274:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 275 and 276:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 277 and 278:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 279 and 280:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 281 and 282:

INDEPENDENT AUDITORS’ REPORT TO T

- Page 283 and 284:

BASIS OF PREPARATION These consolid

- Page 285 and 286:

BASIS OF PREPARATION (Continued) Ar

- Page 287 and 288:

ACCOUNTING POLICIES (Continued) (v)

- Page 289 and 290:

ACCOUNTING POLICIES (Continued) Sub

- Page 291 and 292:

ACCOUNTING POLICIES (Continued) car

- Page 293 and 294:

ACCOUNTING POLICIES (Continued) The

- Page 295 and 296:

ACCOUNTING POLICIES (Continued) bal

- Page 297 and 298:

CONSOLIDATED INCOME STATEMENT FOR T

- Page 299 and 300:

CONSOLIDATED BALANCE SHEET AS AT 31

- Page 301 and 302:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 303 and 304:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 305 and 306:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 307 and 308:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 309 and 310:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 311 and 312:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 313 and 314:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 315 and 316:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 317 and 318:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 319 and 320:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 321 and 322:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 323 and 324:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 325 and 326:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 327 and 328:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 329 and 330:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 331 and 332:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 333 and 334:

NOTES TO THE CONSOLIDATED FINANCIAL

- Page 335 and 336:

INTERIM UNAUDITED NON-STATUTORY GRO

- Page 337 and 338:

CONSOLIDATED INTERIM INCOME STATEME

- Page 339 and 340:

CONSOLIDATED INTERIM BALANCE SHEET

- Page 341 and 342:

NOTES TO THE UNAUDITED CONSOLIDATED

- Page 343 and 344:

NOTES TO THE UNAUDITED CONSOLIDATED

- Page 345 and 346:

NOTES TO THE UNAUDITED CONSOLIDATED

- Page 347 and 348:

NOTES TO THE UNAUDITED CONSOLIDATED

- Page 349 and 350:

ISSUER Ardagh Glass Finance plc 4 R

- Page 351:

F180,000,000 Ardagh Glass Finance p