Ardagh Glass Finance plc - Irish Stock Exchange

Ardagh Glass Finance plc - Irish Stock Exchange

Ardagh Glass Finance plc - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Unaudited<br />

Nine months ended and as at<br />

Audited Consolidated Before other Twelve months<br />

Year ended and as at<br />

income and Other income ended and as<br />

December 31,<br />

expense and expense at<br />

September 30, September 30, September 30, September 30, September 30,<br />

2008 2007* 2006 2009 2009 2009 2008 2009**<br />

(in E millions, except ratios and where indicated)<br />

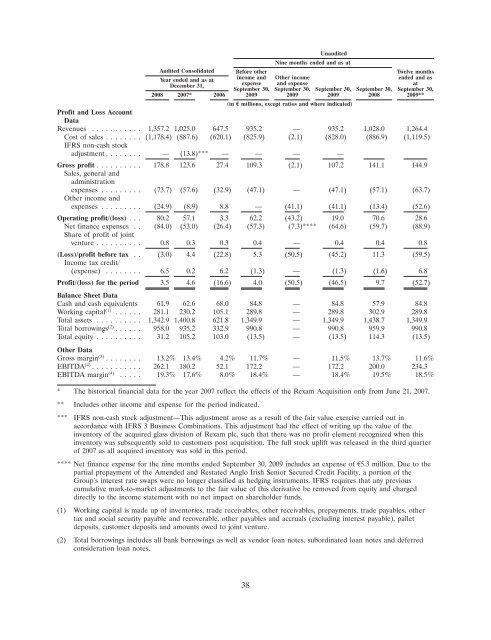

Profit and Loss Account<br />

Data<br />

Revenues ........... 1,357.2 1,025.0 647.5 935.2 — 935.2 1,028.0 1,264.4<br />

Cost of sales ........ (1,178.4) (887.6) (620.1) (825.9) (2.1) (828.0) (886.9) (1,119.5)<br />

IFRS non-cash stock<br />

adjustment ........ — (13.8)*** — — — —<br />

Gross profit .......... 178.8 123.6 27.4 109.3 (2.1) 107.2 141.1 144.9<br />

Sales, general and<br />

administration<br />

expenses ......... (73.7) (57.6) (32.9) (47.1) — (47.1) (57.1) (63.7)<br />

Other income and<br />

expenses ......... (24.9) (8.9) 8.8 — (41.1) (41.1) (13.4) (52.6)<br />

Operating profit/(loss) . . . 80.2 57.1 3.3 62.2 (43.2) 19.0 70.6 28.6<br />

Net finance expenses . . (84.0) (53.0) (26.4) (57.3) (7.3)**** (64.6) (59.7) (88.9)<br />

Share of profit of joint<br />

venture .......... 0.8 0.3 0.3 0.4 — 0.4 0.4 0.8<br />

(Loss)/profit before tax . . (3.0) 4.4 (22.8) 5.3 (50.5) (45.2) 11.3 (59.5)<br />

Income tax credit/<br />

(expense) ........ 6.5 0.2 6.2 (1.3) — (1.3) (1.6) 6.8<br />

Profit/(loss) for the period 3.5 4.6 (16.6) 4.0 (50.5) (46.5) 9.7 (52.7)<br />

Balance Sheet Data<br />

Cash and cash equivalents 61.9 62.6 68.0 84.8 — 84.8 57.9 84.8<br />

Working capital (1) ...... 281.1 230.2 105.1 289.8 — 289.8 302.9 289.8<br />

Total assets .......... 1,342.9 1,400.8 621.8 1,349.9 — 1,349.9 1,438.7 1,349.9<br />

Total borrowings (2) ...... 958.0 935.2 332.9 990.8 — 990.8 959.9 990.8<br />

Total equity .......... 31.2 105.2 103.0 (13.5) — (13.5) 114.3 (13.5)<br />

Other Data<br />

Gross margin (3) ........ 13.2% 13.4% 4.2% 11.7% — 11.5% 13.7% 11.6%<br />

EBITDA (4) ........... 262.1 180.2 52.1 172.2 — 172.2 200.0 234.3<br />

EBITDA margin (4) ..... 19.3% 17.6% 8.0% 18.4% — 18.4% 19.5% 18.5%<br />

* The historical financial data for the year 2007 reflect the effects of the Rexam Acquisition only from June 21, 2007.<br />

** Includes other income and expense for the period indicated.<br />

*** IFRS non-cash stock adjustment—This adjustment arose as a result of the fair value exercise carried out in<br />

accordance with IFRS 3 Business Combinations. This adjustment had the effect of writing up the value of the<br />

inventory of the acquired glass division of Rexam <strong>plc</strong>, such that there was no profit element recognized when this<br />

inventory was subsequently sold to customers post acquisition. The full stock uplift was released in the third quarter<br />

of 2007 as all acquired inventory was sold in this period.<br />

**** Net finance expense for the nine months ended September 30, 2009 includes an expense of A5.3 million. Due to the<br />

partial prepayment of the Amended and Restated Anglo <strong>Irish</strong> Senior Secured Credit Facility, a portion of the<br />

Group’s interest rate swaps were no longer classified as hedging instruments. IFRS requires that any previous<br />

cumulative mark-to-market adjustments to the fair value of this derivative be removed from equity and charged<br />

directly to the income statement with no net impact on shareholder funds.<br />

(1) Working capital is made up of inventories, trade receivables, other receivables, prepayments, trade payables, other<br />

tax and social security payable and recoverable, other payables and accruals (excluding interest payable), pallet<br />

deposits, customer deposits and amounts owed to joint venture.<br />

(2) Total borrowings includes all bank borrowings as well as vendor loan notes, subordinated loan notes and deferred<br />

consideration loan notes.<br />

38