Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

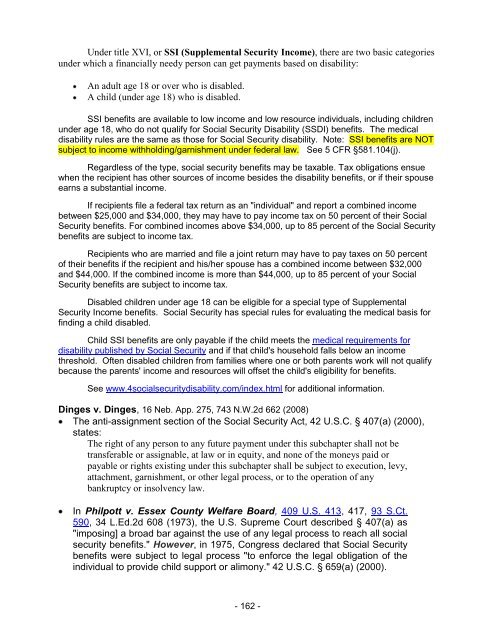

Under title XVI, or SSI (Supplemental Security Income), there are two basic categories<br />

under which a financially needy person can get payments based on disability:<br />

An adult age 18 or over who is disabled.<br />

A child (under age 18) who is disabled.<br />

SSI benefits are available to low income and low resource individuals, including children<br />

under age 18, who do not qualify for Social Security Disability (SSDI) benefits. The medical<br />

disability rules are the same as those for Social Security disability. Note: SSI benefits are NOT<br />

subject to income withholding/garnishment under federal law. See 5 CFR §581.104(j).<br />

Regardless of the type, social security benefits may be taxable. Tax obligations ensue<br />

when the recipient has other sources of income besides the disability benefits, or if their spouse<br />

earns a substantial income.<br />

If recipients file a federal tax return as an "individual" and report a combined income<br />

between $25,000 and $34,000, they may have to pay income tax on 50 percent of their Social<br />

Security benefits. For combined incomes above $34,000, up to 85 percent of the Social Security<br />

benefits are subject to income tax.<br />

Recipients who are married and file a joint return may have to pay taxes on 50 percent<br />

of their benefits if the recipient and his/her spouse has a combined income between $32,000<br />

and $44,000. If the combined income is more than $44,000, up to 85 percent of your Social<br />

Security benefits are subject to income tax.<br />

Disabled children under age 18 can be eligible for a special type of Supplemental<br />

Security Income benefits. Social Security has special rules for evaluating the medical basis for<br />

finding a child disabled.<br />

<strong>Child</strong> SSI benefits are only payable if the child meets the medical requirements for<br />

disability published by Social Security and if that child's household falls below an income<br />

threshold. Often disabled children from families where one or both parents work will not qualify<br />

because the parents' income and resources will offset the child's eligibility for benefits.<br />

See www.4socialsecuritydisability.com/index.html for additional information.<br />

Dinges v. Dinges, 16 Neb. App. 275, 743 N.W.2d 662 (2008)<br />

The anti-assignment section of the Social Security Act, 42 U.S.C. § 407(a) (2000),<br />

states:<br />

The right of any person to any future payment under this subchapter shall not be<br />

transferable or assignable, at law or in equity, and none of the moneys paid or<br />

payable or rights existing under this subchapter shall be subject to execution, levy,<br />

attachment, garnishment, or other legal process, or to the operation of any<br />

bankruptcy or insolvency law.<br />

In Philpott v. Essex <strong>County</strong> Welfare Board, 409 U.S. 413, 417, 93 S.Ct.<br />

590, 34 L.Ed.2d 608 (1973), the U.S. Supreme Court described § 407(a) as<br />

"imposing] a broad bar against the use of any legal process to reach all social<br />

security benefits." However, in 1975, Congress declared that Social Security<br />

benefits were subject to legal process "to enforce the legal obligation of the<br />

individual to provide child support or alimony." 42 U.S.C. § 659(a) (2000).<br />

- 162 -