Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

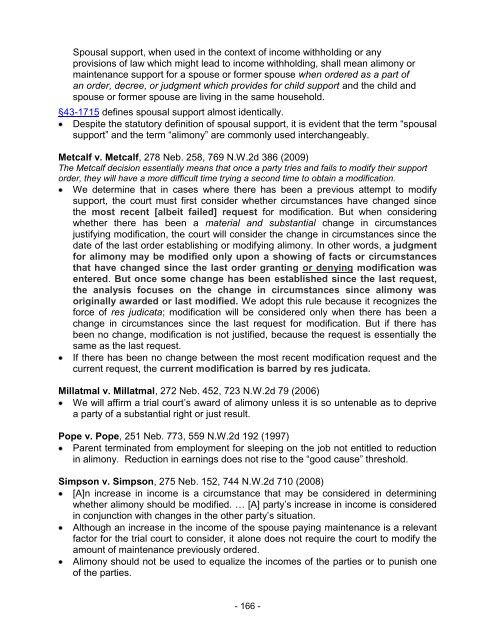

Spousal support, when used in the context of income withholding or any<br />

provisions of law which might lead to income withholding, shall mean alimony or<br />

maintenance support for a spouse or former spouse when ordered as a part of<br />

an order, decree, or judgment which provides for child support and the child and<br />

spouse or former spouse are living in the same household.<br />

§43-1715 defines spousal support almost identically.<br />

Despite the statutory definition of spousal support, it is evident that the term ―spousal<br />

support‖ and the term ―alimony‖ are commonly used interchangeably.<br />

Metcalf v. Metcalf, 278 Neb. 258, 769 N.W.2d 386 (2009)<br />

The Metcalf decision essentially means that once a party tries and fails to modify their support<br />

order, they will have a more difficult time trying a second time to obtain a modification.<br />

We determine that in cases where there has been a previous attempt to modify<br />

support, the court must first consider whether circumstances have changed since<br />

the most recent [albeit failed] request for modification. But when considering<br />

whether there has been a material and substantial change in circumstances<br />

justifying modification, the court will consider the change in circumstances since the<br />

date of the last order establishing or modifying alimony. In other words, a judgment<br />

for alimony may be modified only upon a showing of facts or circumstances<br />

that have changed since the last order granting or denying modification was<br />

entered. But once some change has been established since the last request,<br />

the analysis focuses on the change in circumstances since alimony was<br />

originally awarded or last modified. We adopt this rule because it recognizes the<br />

force of res judicata; modification will be considered only when there has been a<br />

change in circumstances since the last request for modification. But if there has<br />

been no change, modification is not justified, because the request is essentially the<br />

same as the last request.<br />

If there has been no change between the most recent modification request and the<br />

current request, the current modification is barred by res judicata.<br />

Millatmal v. Millatmal, 272 Neb. 452, 723 N.W.2d 79 (2006)<br />

We will affirm a trial court‘s award of alimony unless it is so untenable as to deprive<br />

a party of a substantial right or just result.<br />

Pope v. Pope, 251 Neb. 773, 559 N.W.2d 192 (1997)<br />

Parent terminated from employment for sleeping on the job not entitled to reduction<br />

in alimony. Reduction in earnings does not rise to the ―good cause‖ threshold.<br />

Simpson v. Simpson, 275 Neb. 152, 744 N.W.2d 710 (2008)<br />

[A]n increase in income is a circumstance that may be considered in determining<br />

whether alimony should be modified. … [A] party‘s increase in income is considered<br />

in conjunction with changes in the other party‘s situation.<br />

Although an increase in the income of the spouse paying maintenance is a relevant<br />

factor for the trial court to consider, it alone does not require the court to modify the<br />

amount of maintenance previously ordered.<br />

Alimony should not be used to equalize the incomes of the parties or to punish one<br />

of the parties.<br />

- 166 -