Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

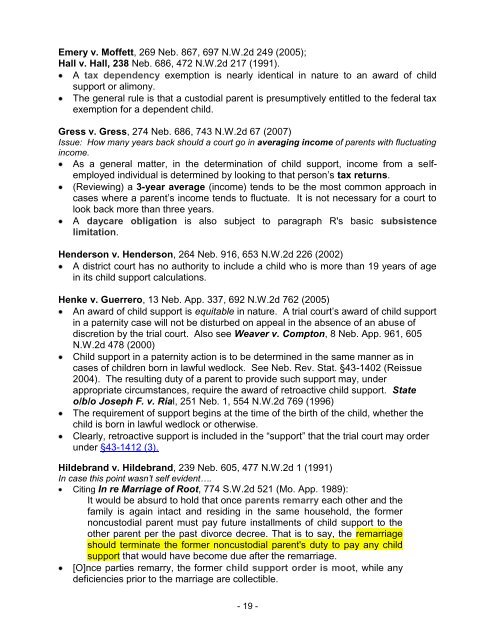

Emery v. Moffett, 269 Neb. 867, 697 N.W.2d 249 (2005);<br />

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991).<br />

A tax dependency exemption is nearly identical in nature to an award of child<br />

support or alimony.<br />

The general rule is that a custodial parent is presumptively entitled to the federal tax<br />

exemption for a dependent child.<br />

Gress v. Gress, 274 Neb. 686, 743 N.W.2d 67 (2007)<br />

Issue: How many years back should a court go in averaging income of parents with fluctuating<br />

income.<br />

As a general matter, in the determination of child support, income from a selfemployed<br />

individual is determined by looking to that person‘s tax returns.<br />

(Reviewing) a 3-year average (income) tends to be the most common approach in<br />

cases where a parent‘s income tends to fluctuate. It is not necessary for a court to<br />

look back more than three years.<br />

A daycare obligation is also subject to paragraph R's basic subsistence<br />

limitation.<br />

Henderson v. Henderson, 264 Neb. 916, 653 N.W.2d 226 (2002)<br />

A district court has no authority to include a child who is more than 19 years of age<br />

in its child support calculations.<br />

Henke v. Guerrero, 13 Neb. App. 337, 692 N.W.2d 762 (2005)<br />

An award of child support is equitable in nature. A trial court‘s award of child support<br />

in a paternity case will not be disturbed on appeal in the absence of an abuse of<br />

discretion by the trial court. Also see Weaver v. Compton, 8 Neb. App. 961, 605<br />

N.W.2d 478 (2000)<br />

<strong>Child</strong> support in a paternity action is to be determined in the same manner as in<br />

cases of children born in lawful wedlock. See Neb. Rev. Stat. §43-1402 (Reissue<br />

2004). The resulting duty of a parent to provide such support may, under<br />

appropriate circumstances, require the award of retroactive child support. State<br />

o/b/o Joseph F. v. Rial, 251 Neb. 1, 554 N.W.2d 769 (1996)<br />

The requirement of support begins at the time of the birth of the child, whether the<br />

child is born in lawful wedlock or otherwise.<br />

Clearly, retroactive support is included in the ―support‖ that the trial court may order<br />

under §43-1412 (3).<br />

Hildebrand v. Hildebrand, 239 Neb. 605, 477 N.W.2d 1 (1991)<br />

In case this point wasn’t self evident….<br />

Citing In re Marriage of Root, 774 S.W.2d 521 (Mo. App. 1989):<br />

It would be absurd to hold that once parents remarry each other and the<br />

family is again intact and residing in the same household, the former<br />

noncustodial parent must pay future installments of child support to the<br />

other parent per the past divorce decree. That is to say, the remarriage<br />

should terminate the former noncustodial parent's duty to pay any child<br />

support that would have become due after the remarriage.<br />

[O]nce parties remarry, the former child support order is moot, while any<br />

deficiencies prior to the marriage are collectible.<br />

- 19 -