Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

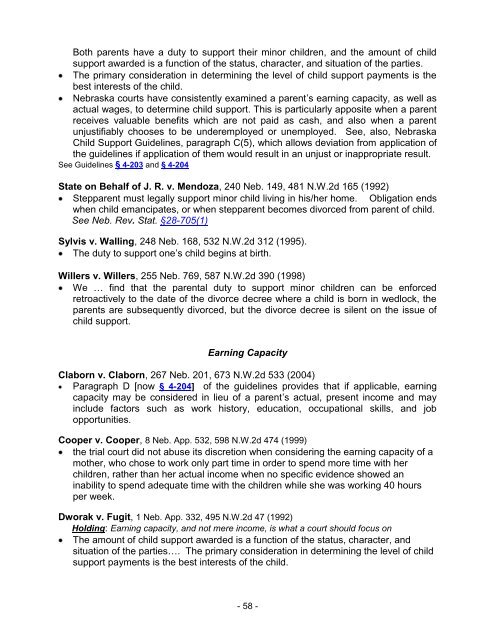

Both parents have a duty to support their minor children, and the amount of child<br />

support awarded is a function of the status, character, and situation of the parties.<br />

The primary consideration in determining the level of child support payments is the<br />

best interests of the child.<br />

<strong>Nebraska</strong> courts have consistently examined a parent‘s earning capacity, as well as<br />

actual wages, to determine child support. This is particularly apposite when a parent<br />

receives valuable benefits which are not paid as cash, and also when a parent<br />

unjustifiably chooses to be underemployed or unemployed. See, also, <strong>Nebraska</strong><br />

<strong>Child</strong> <strong>Support</strong> Guidelines, paragraph C(5), which allows deviation from application of<br />

the guidelines if application of them would result in an unjust or inappropriate result.<br />

See Guidelines § 4-203 and § 4-204<br />

State on Behalf of J. R. v. Mendoza, 240 Neb. 149, 481 N.W.2d 165 (1992)<br />

Stepparent must legally support minor child living in his/her home. Obligation ends<br />

when child emancipates, or when stepparent becomes divorced from parent of child.<br />

See Neb. Rev. Stat. §28-705(1)<br />

Sylvis v. Walling, 248 Neb. 168, 532 N.W.2d 312 (1995).<br />

The duty to support one‘s child begins at birth.<br />

Willers v. Willers, 255 Neb. 769, 587 N.W.2d 390 (1998)<br />

We … find that the parental duty to support minor children can be enforced<br />

retroactively to the date of the divorce decree where a child is born in wedlock, the<br />

parents are subsequently divorced, but the divorce decree is silent on the issue of<br />

child support.<br />

Earning Capacity<br />

Claborn v. Claborn, 267 Neb. 201, 673 N.W.2d 533 (2004)<br />

Paragraph D [now § 4-204] of the guidelines provides that if applicable, earning<br />

capacity may be considered in lieu of a parent‘s actual, present income and may<br />

include factors such as work history, education, occupational skills, and job<br />

opportunities.<br />

Cooper v. Cooper, 8 Neb. App. 532, 598 N.W.2d 474 (1999)<br />

the trial court did not abuse its discretion when considering the earning capacity of a<br />

mother, who chose to work only part time in order to spend more time with her<br />

children, rather than her actual income when no specific evidence showed an<br />

inability to spend adequate time with the children while she was working 40 hours<br />

per week.<br />

Dworak v. Fugit, 1 Neb. App. 332, 495 N.W.2d 47 (1992)<br />

Holding: Earning capacity, and not mere income, is what a court should focus on<br />

The amount of child support awarded is a function of the status, character, and<br />

situation of the parties…. The primary consideration in determining the level of child<br />

support payments is the best interests of the child.<br />

- 58 -