Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

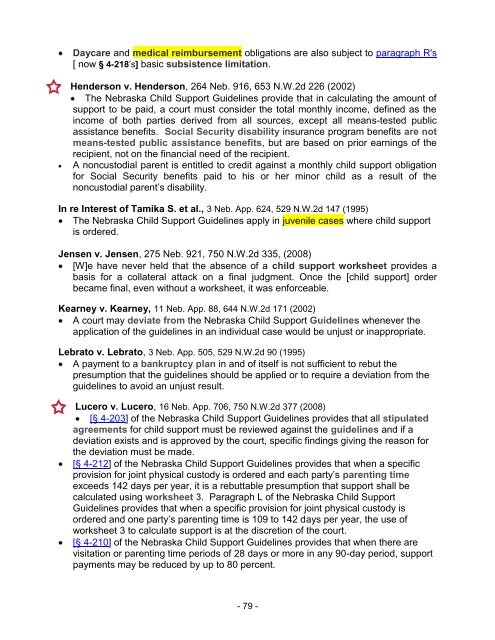

Daycare and medical reimbursement obligations are also subject to paragraph R's<br />

[ now § 4-218‘s] basic subsistence limitation.<br />

Henderson v. Henderson, 264 Neb. 916, 653 N.W.2d 226 (2002)<br />

The <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines provide that in calculating the amount of<br />

support to be paid, a court must consider the total monthly income, defined as the<br />

income of both parties derived from all sources, except all means-tested public<br />

assistance benefits. Social Security disability insurance program benefits are not<br />

means-tested public assistance benefits, but are based on prior earnings of the<br />

recipient, not on the financial need of the recipient.<br />

A noncustodial parent is entitled to credit against a monthly child support obligation<br />

for Social Security benefits paid to his or her minor child as a result of the<br />

noncustodial parent‘s disability.<br />

In re Interest of Tamika S. et al., 3 Neb. App. 624, 529 N.W.2d 147 (1995)<br />

The <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines apply in juvenile cases where child support<br />

is ordered.<br />

Jensen v. Jensen, 275 Neb. 921, 750 N.W.2d 335, (2008)<br />

[W]e have never held that the absence of a child support worksheet provides a<br />

basis for a collateral attack on a final judgment. Once the [child support] order<br />

became final, even without a worksheet, it was enforceable.<br />

Kearney v. Kearney, 11 Neb. App. 88, 644 N.W.2d 171 (2002)<br />

A court may deviate from the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines whenever the<br />

application of the guidelines in an individual case would be unjust or inappropriate.<br />

Lebrato v. Lebrato, 3 Neb. App. 505, 529 N.W.2d 90 (1995)<br />

A payment to a bankruptcy plan in and of itself is not sufficient to rebut the<br />

presumption that the guidelines should be applied or to require a deviation from the<br />

guidelines to avoid an unjust result.<br />

Lucero v. Lucero, 16 Neb. App. 706, 750 N.W.2d 377 (2008)<br />

[§ 4-203] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines provides that all stipulated<br />

agreements for child support must be reviewed against the guidelines and if a<br />

deviation exists and is approved by the court, specific findings giving the reason for<br />

the deviation must be made.<br />

[§ 4-212] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines provides that when a specific<br />

provision for joint physical custody is ordered and each party‘s parenting time<br />

exceeds 142 days per year, it is a rebuttable presumption that support shall be<br />

calculated using worksheet 3. Paragraph L of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong><br />

Guidelines provides that when a specific provision for joint physical custody is<br />

ordered and one party‘s parenting time is 109 to 142 days per year, the use of<br />

worksheet 3 to calculate support is at the discretion of the court.<br />

[§ 4-210] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines provides that when there are<br />

visitation or parenting time periods of 28 days or more in any 90-day period, support<br />

payments may be reduced by up to 80 percent.<br />

- 79 -