Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

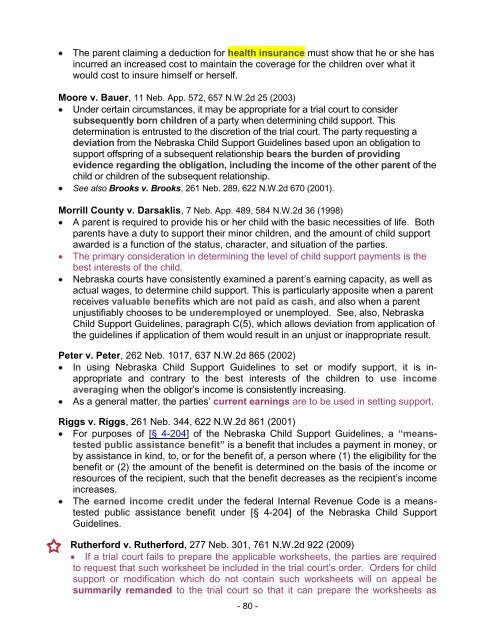

The parent claiming a deduction for health insurance must show that he or she has<br />

incurred an increased cost to maintain the coverage for the children over what it<br />

would cost to insure himself or herself.<br />

Moore v. Bauer, 11 Neb. App. 572, 657 N.W.2d 25 (2003)<br />

Under certain circumstances, it may be appropriate for a trial court to consider<br />

subsequently born children of a party when determining child support. This<br />

determination is entrusted to the discretion of the trial court. The party requesting a<br />

deviation from the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines based upon an obligation to<br />

support offspring of a subsequent relationship bears the burden of providing<br />

evidence regarding the obligation, including the income of the other parent of the<br />

child or children of the subsequent relationship.<br />

See also Brooks v. Brooks, 261 Neb. 289, 622 N.W.2d 670 (2001).<br />

Morrill <strong>County</strong> v. Darsaklis, 7 Neb. App. 489, 584 N.W.2d 36 (1998)<br />

A parent is required to provide his or her child with the basic necessities of life. Both<br />

parents have a duty to support their minor children, and the amount of child support<br />

awarded is a function of the status, character, and situation of the parties.<br />

The primary consideration in determining the level of child support payments is the<br />

best interests of the child.<br />

<strong>Nebraska</strong> courts have consistently examined a parent‘s earning capacity, as well as<br />

actual wages, to determine child support. This is particularly apposite when a parent<br />

receives valuable benefits which are not paid as cash, and also when a parent<br />

unjustifiably chooses to be underemployed or unemployed. See, also, <strong>Nebraska</strong><br />

<strong>Child</strong> <strong>Support</strong> Guidelines, paragraph C(5), which allows deviation from application of<br />

the guidelines if application of them would result in an unjust or inappropriate result.<br />

Peter v. Peter, 262 Neb. 1017, 637 N.W.2d 865 (2002)<br />

In using <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines to set or modify support, it is inappropriate<br />

and contrary to the best interests of the children to use income<br />

averaging when the obligor‘s income is consistently increasing.<br />

As a general matter, the parties‘ current earnings are to be used in setting support.<br />

Riggs v. Riggs, 261 Neb. 344, 622 N.W.2d 861 (2001)<br />

For purposes of [§ 4-204] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines, a “meanstested<br />

public assistance benefit” is a benefit that includes a payment in money, or<br />

by assistance in kind, to, or for the benefit of, a person where (1) the eligibility for the<br />

benefit or (2) the amount of the benefit is determined on the basis of the income or<br />

resources of the recipient, such that the benefit decreases as the recipient‘s income<br />

increases.<br />

The earned income credit under the federal Internal Revenue Code is a meanstested<br />

public assistance benefit under [§ 4-204] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong><br />

Guidelines.<br />

Rutherford v. Rutherford, 277 Neb. 301, 761 N.W.2d 922 (2009)<br />

If a trial court fails to prepare the applicable worksheets, the parties are required<br />

to request that such worksheet be included in the trial court‘s order. Orders for child<br />

support or modification which do not contain such worksheets will on appeal be<br />

summarily remanded to the trial court so that it can prepare the worksheets as<br />

- 80 -