Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

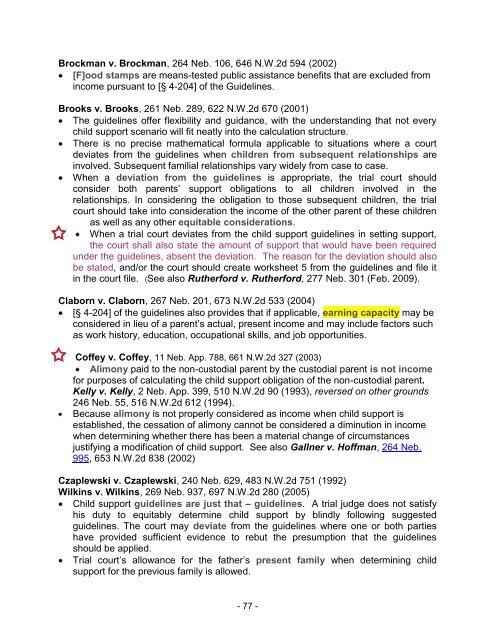

Brockman v. Brockman, 264 Neb. 106, 646 N.W.2d 594 (2002)<br />

[F]ood stamps are means-tested public assistance benefits that are excluded from<br />

income pursuant to [§ 4-204] of the Guidelines.<br />

Brooks v. Brooks, 261 Neb. 289, 622 N.W.2d 670 (2001)<br />

The guidelines offer flexibility and guidance, with the understanding that not every<br />

child support scenario will fit neatly into the calculation structure.<br />

There is no precise mathematical formula applicable to situations where a court<br />

deviates from the guidelines when children from subsequent relationships are<br />

involved. Subsequent familial relationships vary widely from case to case.<br />

When a deviation from the guidelines is appropriate, the trial court should<br />

consider both parents‘ support obligations to all children involved in the<br />

relationships. In considering the obligation to those subsequent children, the trial<br />

court should take into consideration the income of the other parent of these children<br />

as well as any other equitable considerations.<br />

When a trial court deviates from the child support guidelines in setting support,<br />

the court shall also state the amount of support that would have been required<br />

under the guidelines, absent the deviation. The reason for the deviation should also<br />

be stated, and/or the court should create worksheet 5 from the guidelines and file it<br />

in the court file. (See also Rutherford v. Rutherford, 277 Neb. 301 (Feb. 2009).<br />

Claborn v. Claborn, 267 Neb. 201, 673 N.W.2d 533 (2004)<br />

[§ 4-204] of the guidelines also provides that if applicable, earning capacity may be<br />

considered in lieu of a parent‘s actual, present income and may include factors such<br />

as work history, education, occupational skills, and job opportunities.<br />

Coffey v. Coffey, 11 Neb. App. 788, 661 N.W.2d 327 (2003)<br />

Alimony paid to the non-custodial parent by the custodial parent is not income<br />

for purposes of calculating the child support obligation of the non-custodial parent.<br />

Kelly v. Kelly, 2 Neb. App. 399, 510 N.W.2d 90 (1993), reversed on other grounds<br />

246 Neb. 55, 516 N.W.2d 612 (1994).<br />

Because alimony is not properly considered as income when child support is<br />

established, the cessation of alimony cannot be considered a diminution in income<br />

when determining whether there has been a material change of circumstances<br />

justifying a modification of child support. See also Gallner v. Hoffman, 264 Neb.<br />

995, 653 N.W.2d 838 (2002)<br />

Czaplewski v. Czaplewski, 240 Neb. 629, 483 N.W.2d 751 (1992)<br />

Wilkins v. Wilkins, 269 Neb. 937, 697 N.W.2d 280 (2005)<br />

<strong>Child</strong> support guidelines are just that – guidelines. A trial judge does not satisfy<br />

his duty to equitably determine child support by blindly following suggested<br />

guidelines. The court may deviate from the guidelines where one or both parties<br />

have provided sufficient evidence to rebut the presumption that the guidelines<br />

should be applied.<br />

Trial court‘s allowance for the father‘s present family when determining child<br />

support for the previous family is allowed.<br />

- 77 -