Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

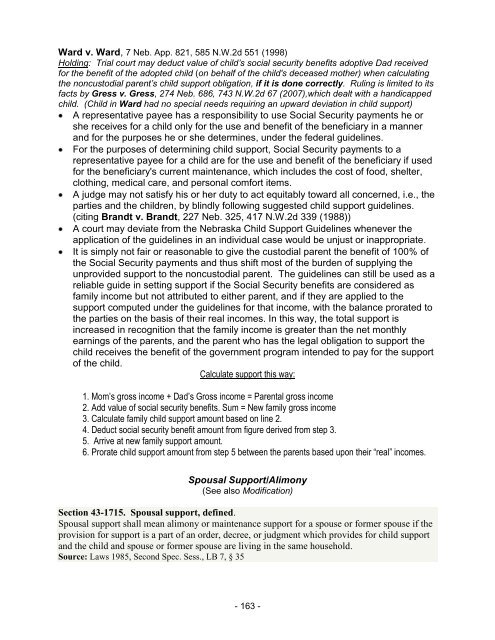

Ward v. Ward, 7 Neb. App. 821, 585 N.W.2d 551 (1998)<br />

Holding: Trial court may deduct value of child’s social security benefits adoptive Dad received<br />

for the benefit of the adopted child (on behalf of the child's deceased mother) when calculating<br />

the noncustodial parent’s child support obligation, if it is done correctly. Ruling is limited to its<br />

facts by Gress v. Gress, 274 Neb. 686, 743 N.W.2d 67 (2007),which dealt with a handicapped<br />

child. (<strong>Child</strong> in Ward had no special needs requiring an upward deviation in child support)<br />

A representative payee has a responsibility to use Social Security payments he or<br />

she receives for a child only for the use and benefit of the beneficiary in a manner<br />

and for the purposes he or she determines, under the federal guidelines.<br />

For the purposes of determining child support, Social Security payments to a<br />

representative payee for a child are for the use and benefit of the beneficiary if used<br />

for the beneficiary's current maintenance, which includes the cost of food, shelter,<br />

clothing, medical care, and personal comfort items.<br />

A judge may not satisfy his or her duty to act equitably toward all concerned, i.e., the<br />

parties and the children, by blindly following suggested child support guidelines.<br />

(citing Brandt v. Brandt, 227 Neb. 325, 417 N.W.2d 339 (1988))<br />

A court may deviate from the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines whenever the<br />

application of the guidelines in an individual case would be unjust or inappropriate.<br />

It is simply not fair or reasonable to give the custodial parent the benefit of 100% of<br />

the Social Security payments and thus shift most of the burden of supplying the<br />

unprovided support to the noncustodial parent. The guidelines can still be used as a<br />

reliable guide in setting support if the Social Security benefits are considered as<br />

family income but not attributed to either parent, and if they are applied to the<br />

support computed under the guidelines for that income, with the balance prorated to<br />

the parties on the basis of their real incomes. In this way, the total support is<br />

increased in recognition that the family income is greater than the net monthly<br />

earnings of the parents, and the parent who has the legal obligation to support the<br />

child receives the benefit of the government program intended to pay for the support<br />

of the child.<br />

Calculate support this way:<br />

1. Mom’s gross income + Dad’s Gross income = Parental gross income<br />

2. Add value of social security benefits. Sum = New family gross income<br />

3. Calculate family child support amount based on line 2.<br />

4. Deduct social security benefit amount from figure derived from step 3.<br />

5. Arrive at new family support amount.<br />

6. Prorate child support amount from step 5 between the parents based upon their “real” incomes.<br />

Spousal <strong>Support</strong>/Alimony<br />

(See also Modification)<br />

Section 43-1715. Spousal support, defined.<br />

Spousal support shall mean alimony or maintenance support for a spouse or former spouse if the<br />

provision for support is a part of an order, decree, or judgment which provides for child support<br />

and the child and spouse or former spouse are living in the same household.<br />

Source: Laws 1985, Second Spec. Sess., LB 7, § 35<br />

- 163 -