Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> ________________________________________________________<br />

<strong>11</strong>. APEX OFFICE CHARGES AND INTEREST TO HOLDING COMPANY<br />

<strong>11</strong>.1 Apex office charges by Holding Company is allocated to revenue mines on the basis of coal<br />

production.<br />

<strong>11</strong>.2 Interest on loans from CIL is allocated to the units on the basis of Net Fixed Assets( excluding<br />

the Assets procured against specific loan) at the beginning of the year.<br />

<strong>11</strong>.3 In terms of CIL’s letter No. CGM(F)/126/07 dtd. 08.04.2004 an additional charge at the rate of<br />

6/- per tonne of coal released towards rehabilitation fund for dealing with fire, shifting and<br />

stabilization of unstable areas has been accounted for on the basis of debit advice received<br />

from CIL.<br />

12. OVERBURDEN REMOVAL(OBR) EXPENSES<br />

12.1 For Opencast mines which have been brought to revenue and have rated capacity of 1 million<br />

tones or above, the cost of OBR is charged on technically evaluated average ratio ( Coal : OB)<br />

at each mine with due adjustment for advance stripping and ratio variance account. The net<br />

balance of advance stripping and ratio variance at the end of the year is shown as cost of<br />

removal of Overburden.<br />

The reported quantity of overburden is considered in the Accounts where the variance between<br />

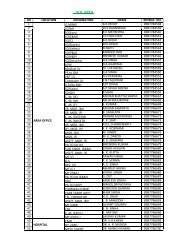

reported quantity and measured quantity is within the permissible limits detailed hereunder:<br />

Annual Quantum<br />

of OBR of the mine<br />

Permissible limits of variance<br />

(Whichever is less)<br />

——————————————————<br />

%age<br />

Quantum<br />

(In Mill. Cu. Mtr.)<br />

Less than 1 Mill. CUM ± 5% 0.03<br />

Between 1 and 5 Mill. CUM ± 3% 0.20<br />

More than 5 Mill. CUM ± 2% NIL<br />

If the variance between reported quantity and measured quantity is more than the above<br />

permissible limit, measured quantity will be considered in the Accounts.<br />

13. IMPAIRMENT OF ASSETS<br />

The Carrying amount of the assets, other than Inventories is reviewed at each Balance Sheet<br />

date to determine whether there is any indication of impairment. If any such indication exists,<br />

the recoverable amount of the assets is estimated.<br />

14. PRIOR PERIOD ADJUSTMENTS<br />

Income/expenditure items relating to prior period(s) which do not exceed<br />

case are treated as income/expenditure for the current year.<br />

5.00 lakh in each<br />

15. GENERAL:<br />

15.1 Retirement Benefits: Provisions for / contribution to retirement benefit schemes are made as<br />

follows:<br />

(a) Provident Fund on actual liability basis,<br />

100