Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

__________________________________________________ CENTRAL COALFIELDS LIMITED<br />

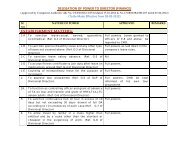

AUDITORS’ REPORT<br />

MANAGEMENT’S REPLY<br />

our opinion, leaves scope for improvement<br />

in widening scope and coverage of audit<br />

specially transaction audit to make it<br />

commensurate with the size and operations<br />

of the company, regular follow up actions<br />

and disposal of internal audit comments by<br />

the management.<br />

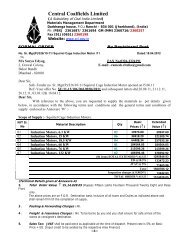

8. As explained to us by the Management, the<br />

Central Government has not prescribed<br />

maintenance of Cost records under section<br />

209(1)(d) of the Companies Act, 1956 for<br />

the products of the Company.<br />

all the subsidiary Companies.<br />

No comments.<br />

9(a)<br />

9(b)<br />

According to the information and<br />

explanations given by the Company,<br />

undisputed statutory dues including<br />

Provident Fund, Income Tax, Sales Tax,<br />

Wealth Tax, Service Tax, Customs Duty,<br />

Excise Duty, Cess and other statutory dues<br />

are generally deposited regularly and no<br />

undisputed dues were outstanding as at<br />

31st March, 20<strong>11</strong> for a period of more than<br />

six months from the date of becoming<br />

payable, except service tax amounting to<br />

3920.24 lacs in respect of different areas<br />

for the period from 01.01.2005 to<br />

31.12.2007. As informed to us Investor<br />

Education and Protection Fund and<br />

Employees’ State Insurance Act are not<br />

applicable to the Company.<br />

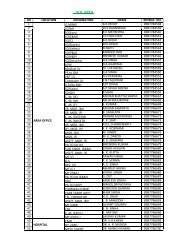

According to the information and<br />

explanations given by the Company, there<br />

is no disputed dues of Income Tax, Sales<br />

Tax, Wealth Tax, Service Tax, Custom Duty,<br />

Excise, Cess that have not been deposited<br />

on account of matters pending before<br />

appropriate authorities except the cases<br />

which are stated in Appendix –1 to the<br />

report.<br />

No comments.<br />

In the case of disputed dues of sales tax, royalty,<br />

cess etc. advance payment is to be made to the<br />

authority as a pre-requisite for appeal. The same<br />

amount has been shown as Loans & Advances.<br />

Contingent Liabilities for the total amount disputed<br />

has been shown in the Notes on Accounts.<br />

10. There is no accumulated loss of the<br />

Company at the end of the financial year<br />

and has not incurred any cash losses during<br />

No comments.<br />

125