Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

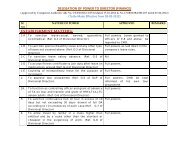

ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> ________________________________________________________<br />

SCHEDULE - S<br />

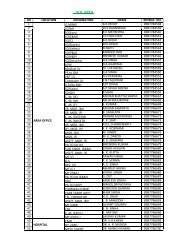

CASH FLOW STATEMENT (INDIRECT METHOD) FOR THE YEAR <strong>2010</strong>-<strong>11</strong><br />

( in Lakh)<br />

Current <strong>Year</strong><br />

Previous <strong>Year</strong><br />

A. CASH FLOW FROM OPERATING ACTIVITIES<br />

Net Profit before Tax and extra-ordinary items 187029.65 153198.59<br />

Adjustment for :<br />

Depreciation 6123.62 10480.51<br />

Deferred Tax 1412.22 5771.56<br />

O.B.R. Adjustment 10062.66 18502.34<br />

Interest on Investment (Tax Free Bonds) –460.55 –541.59<br />

Interest on Short Term Deposit –13965.76 –12776.54<br />

Interest on Surplus Fund Parked with CIL –949.61 –1402.73<br />

Interest & Finance Charges 1052.89 1924.64<br />

—————— 3275.47 ————— 21958.19<br />

—————— ——————<br />

Operating Profit before working Capital Changes 190305.12 175156.78<br />

Adjustment for :<br />

Increase (–)/Decrease (+) in Loans & Advances –18681.70 141372.16<br />

Increase (–)/Decrease (+) in Debtors –42919.19 23281.65<br />

Increase (–)/Decrease (+) in Inventories –26981.91 –209<strong>11</strong>.21<br />

Increase (–)/Decrease (+) in Other Current Asset –<strong>11</strong>166.86 –4260.54<br />

Decrease (–)/Increase (+) in Current Liabilities –45541.61 –147308.77<br />

––——— –145291.27 ————— –7826.71<br />

—————— ——————<br />

Cash Flow before Extra Ordinary items 45013.85 167330.07<br />

Prior Period Adjustment –1007.97 106.42<br />

Cash Flow from Operating Activities 44005.88 167436.49<br />

Tax Provision –61338.81 –63291.65<br />

—————— ——————<br />

Net Cash Flow from Operating Activities –17332.93 104144.84<br />

<strong>11</strong>4