Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

__________________________________________________ CENTRAL COALFIELDS LIMITED<br />

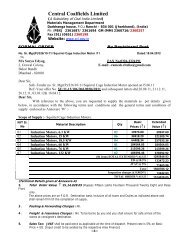

10.4 IICM charge amounting to 237.61 lakh (Previous <strong>Year</strong> 235.40 lakh) levied by the Holding<br />

Company @ 0.50 per tonne of coal produced, has been accounted for.<br />

10.5 In terms of CIL's letter No. CGM(F)/126/07 dtd. 08.04.2004 a charge of 2772.60 lakh (Previous<br />

year 2651.76 lakh) levied by the Holding Company @ 6.00 per tonne of coal released during<br />

<strong>2010</strong>-<strong>11</strong> towards Rehabilitation fund for dealing with fire, shifting and stabilization of unstable<br />

areas have been accounted for.<br />

<strong>11</strong>. GENERAL<br />

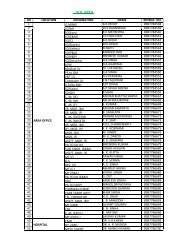

<strong>11</strong>.1 In terms of lease agreement with M/s. Imperial Fastners Pvt. Limited, the Company has granted<br />

a right to occupy and use the assets of the Company. The cost of gross carrying amount at the<br />

beginning of the year is 8019.06 lakh. The accumulated depreciation as at the end of the year<br />

7194.25 lakh. Depreciation for the year is 289.59 lakh. The future minimum lease payment<br />

receivable in the aggregate during the period of lease is 5810.00 lakh. The details of future<br />

lease payment receivables are as under :<br />

<strong>2010</strong>-<strong>11</strong><br />

( in lakh)<br />

(i) Not later than one year 384.00<br />

(ii) Later than one year and not later than five years <strong>11</strong>52.00<br />

(iii) Later than five years 4274.00<br />

—————<br />

Total 5810.00<br />

—————<br />

<strong>11</strong>.2 The Bonds received on securitization of dues from State Electricity Boards, from the State<br />

Government of Utter Pradesh and Haryana are treated as long time investment and is valued at<br />

cost. During the year under audit an amount of 942.30 lakh has been redeemed.<br />

<strong>11</strong>.3 In compliance with AS-22, Deferred Tax Assets has been derecognized for 1412.22 lakh for<br />

the year <strong>2010</strong>-<strong>11</strong> making a total net deferred tax asset for 49315.75 lakh as on 31.03.20<strong>11</strong>.<br />

The total deferred tax assets is 57900.10 lakh, liable to reversal in one or more subsequent<br />

period(s), consists of Doubtful debts, Gratuity and Leave encashment on actuarial basis, provision<br />

for Loans & Advances, Obsolescence of stores and carry forward of expenditures of VRS and<br />

P&B etc. Similarly, the deferred tax liability, being the difference of WDV of fixed assets as per<br />

books and as per I.T. Rules, is 8584.35 lakh.<br />

<strong>11</strong>.4 The Carpet coal at colliery as measured by CIL Measurement Team is 1.57 lakh tonne which<br />

has been included in adopted stock of 163.71 tonne as on 31.03.<strong>11</strong>. The quantity of carpet coal<br />

is only 0.96% of the total quantity of coal at collieries, as adopted in the accounts of <strong>2010</strong>-<strong>11</strong>.<br />

While valuing carpet coal, digging cost equivalent to loading cost is deducted from net realizable<br />

value of the coal in case the stock is valued at NRV.<br />

<strong>11</strong>.5 During the year the provision for mine closure has been made based on 6.00 lakh per Ha. for<br />

Open Cast Mines and 1.00 lakh per Ha. for Underground mines on leasehold area. Total cost<br />

so arrived at has been amortized over balance life of mine in years for operating and existing<br />

mine. Due to the above, charge to P&L Account during the year is 4739.30 lakh after adjusting<br />

opening balance of provision (based on earlier basis of providing 0.75 lakh per Ha. each for<br />

technical and biological reclamation) amounting to 4526.27 lakh. The total provision for mine<br />

closure as on 31.03.20<strong>11</strong> is 9265.57 lakh.<br />

<strong>11</strong>.6 Liabilities with regard to the Gratuity plan are determined by actuarial valuation at each Balance<br />

Sheet date using the projected unit credit method. The Company has contributed towards the<br />

105