Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Additional information on <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s capital assets can be found<br />

in Note IV.C on pages 62-64 of this report.<br />

The <strong>Parish</strong> receives a sales tax dedicated for road improvements. This revenue makes it<br />

possible for a variety of road improvement projects to be completed during a year. At the<br />

end of 2010, construction in progress for road improvement projects and other<br />

infrastructure totaled $7,284,534. Road improvement and other infrastructure projects<br />

completed during the current year totaled $10,251,431.<br />

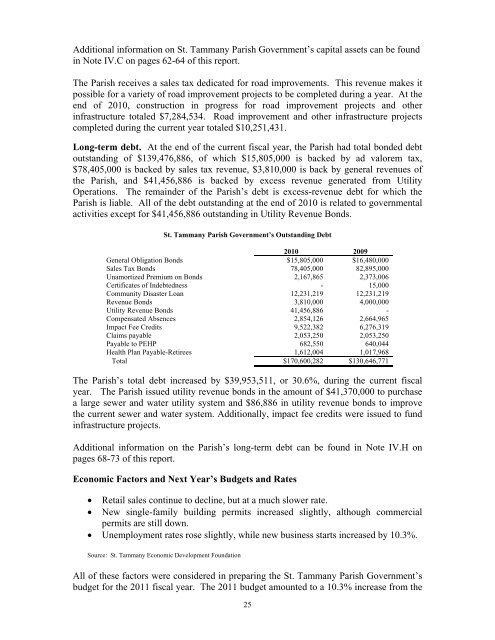

Long-term debt. At the end of the current fiscal year, the <strong>Parish</strong> had total bonded debt<br />

outstanding of $139,476,886, of which $15,805,000 is backed by ad valorem tax,<br />

$78,405,000 is backed by sales tax revenue, $3,810,000 is back by general revenues of<br />

the <strong>Parish</strong>, and $41,456,886 is backed by excess revenue generated from Utility<br />

Operations. The remainder of the <strong>Parish</strong>’s debt is excess-revenue debt for which the<br />

<strong>Parish</strong> is liable. All of the debt outstanding at the end of 2010 is related to governmental<br />

activities except for $41,456,886 outstanding in Utility Revenue Bonds.<br />

<strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s Outstanding Debt<br />

2010 2009<br />

General Obligation Bonds $15,805,000 $16,480,000<br />

Sales Tax Bonds 78,405,000 82,895,000<br />

Unamortized Premium on Bonds 2,167,865 2,373,006<br />

Certificates of Indebtedness - 15,000<br />

Community Disaster Loan 12,231,219 12,231,219<br />

Revenue Bonds 3,810,000 4,000,000<br />

Utility Revenue Bonds 41,456,886 -<br />

Compensated Absences 2,854,126 2,664,965<br />

Impact Fee Credits 9,522,382 6,276,319<br />

Claims payable 2,053,250 2,053,250<br />

Payable to PEHP 682,550 640,044<br />

Health Plan Payable-Retirees 1,612,004 1,017,968<br />

Total $170,600,282 $130,646,771<br />

The <strong>Parish</strong>’s total debt increased by $39,953,511, or 30.6%, during the current fiscal<br />

year. The <strong>Parish</strong> issued utility revenue bonds in the amount of $41,370,000 to purchase<br />

a large sewer and water utility system and $86,886 in utility revenue bonds to improve<br />

the current sewer and water system. Additionally, impact fee credits were issued to fund<br />

infrastructure projects.<br />

Additional information on the <strong>Parish</strong>’s long-term debt can be found in Note IV.H on<br />

pages 68-73 of this report.<br />

Economic Factors and Next Year’s Budgets and Rates<br />

• Retail sales continue to decline, but at a much slower rate.<br />

• New single-family building permits increased slightly, although commercial<br />

permits are still down.<br />

• Unemployment rates rose slightly, while new business starts increased by 10.3%.<br />

Source: <strong>St</strong>. <strong>Tammany</strong> Economic Development Foundation<br />

All of these factors were considered in preparing the <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s<br />

budget for the 2011 fiscal year. The 2011 budget amounted to a 10.3% increase from the<br />

25