Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

been recorded. The <strong>Parish</strong> does appropriate funds yearly in the public health fund for any expenditure that may be needed.<br />

In 2010, the <strong>Parish</strong> budgeted $3,000 and no expenditures were incurred.<br />

E. Extraordinary Event<br />

Fire Protection District No. 1<br />

Fire Protection District No. 1 was forgiven of its entire Community Disaster Loan in the amount of $5,145,439.<br />

F. Post-employment Benefits<br />

Plan Description. <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s medical benefits are provided through an insured medical plan and<br />

are made available to employees upon actual retirement. The plan is a single-employer defined benefit plan.<br />

The employer pays only for the employee or retiree (not dependents) medical coverage. The employer pays 100% of the<br />

employee coverage before retirement and a percentage of the retiree coverage varying depending on years of service at<br />

retirement (25% for 10-15 years; 50% for 15-20 years; and, 75% for 20 years or more). The retirement eligibility<br />

(D.R.O.P. entry) provisions are as follows: the earliest of 30 years of service; age 55 and 25 years of service; age 60 and<br />

10 years of service; or, age 65 and 7 years of service. Complete plan provisions are contained in the official plan<br />

documents.<br />

Contribution Rates. Employees do not contribute to their post employment benefits costs until they become retirees and<br />

begin receiving those benefits. The plan provisions and contribution rates are contained in the official plan documents.<br />

Fund Policy. Until 2008, <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government recognized the cost of providing post-employment medical<br />

benefits (<strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s portion of the retiree medical benefit premiums) as an expense when the<br />

benefit premiums were due and thus financed the cost of the post-employment benefits on a pay-as-you-go basis. In 2008,<br />

2009 and 2010, respectively, <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s portion of health care funding cost for retired employees<br />

totaled $90,194, $85,361and $97,042.<br />

Effective with the Fiscal Year beginning January 1, 2008, <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government implemented Government<br />

Accounting <strong>St</strong>andards Board <strong>St</strong>atement Number 45, Accounting and <strong>Financial</strong> <strong>Report</strong>ing by Employers for Post<br />

employment Benefits Other than Pensions (GASB 45).<br />

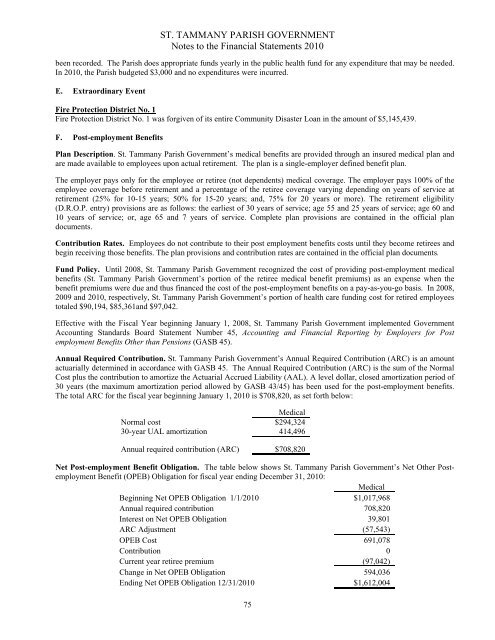

<strong>Annual</strong> Required Contribution. <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s <strong>Annual</strong> Required Contribution (ARC) is an amount<br />

actuarially determined in accordance with GASB 45. The <strong>Annual</strong> Required Contribution (ARC) is the sum of the Normal<br />

Cost plus the contribution to amortize the Actuarial Accrued Liability (AAL). A level dollar, closed amortization period of<br />

30 years (the maximum amortization period allowed by GASB 43/45) has been used for the post-employment benefits.<br />

The total ARC for the fiscal year beginning January 1, 2010 is $708,820, as set forth below:<br />

Medical<br />

Normal cost $294,324<br />

30-year UAL amortization 414,496<br />

<strong>Annual</strong> required contribution (ARC) $708,820<br />

Net Post-employment Benefit Obligation. The table below shows <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government’s Net Other Postemployment<br />

Benefit (OPEB) Obligation for fiscal year ending December 31, 2010:<br />

Medical<br />

Beginning Net OPEB Obligation 1/1/2010 $1,017,968<br />

<strong>Annual</strong> required contribution 708,820<br />

Interest on Net OPEB Obligation 39,801<br />

ARC Adjustment (57,543)<br />

OPEB Cost 691,078<br />

Contribution 0<br />

Current year retiree premium (97,042)<br />

Change in Net OPEB Obligation 594,036<br />

Ending Net OPEB Obligation 12/31/2010 $1,612,004<br />

75