Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

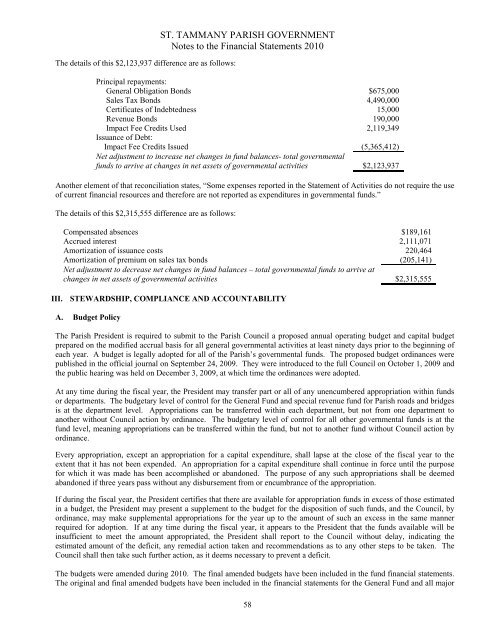

The details of this $2,123,937 difference are as follows:<br />

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

Principal repayments:<br />

General Obligation Bonds $675,000<br />

Sales Tax Bonds 4,490,000<br />

Certificates of Indebtedness 15,000<br />

Revenue Bonds 190,000<br />

Impact Fee Credits Used 2,119,349<br />

Issuance of Debt:<br />

Impact Fee Credits Issued (5,365,412)<br />

Net adjustment to increase net changes in fund balances- total governmental<br />

funds to arrive at changes in net assets of governmental activities $2,123,937<br />

Another element of that reconciliation states, “Some expenses reported in the <strong>St</strong>atement of Activities do not require the use<br />

of current financial resources and therefore are not reported as expenditures in governmental funds.”<br />

The details of this $2,315,555 difference are as follows:<br />

Compensated absences $189,161<br />

Accrued interest 2,111,071<br />

Amortization of issuance costs 220,464<br />

Amortization of premium on sales tax bonds (205,141)<br />

Net adjustment to decrease net changes in fund balances – total governmental funds to arrive at<br />

changes in net assets of governmental activities $2,315,555<br />

III. STEWARDSHIP, COMPLIANCE AND ACCOUNTABILITY<br />

A. Budget Policy<br />

The <strong>Parish</strong> President is required to submit to the <strong>Parish</strong> Council a proposed annual operating budget and capital budget<br />

prepared on the modified accrual basis for all general governmental activities at least ninety days prior to the beginning of<br />

each year. A budget is legally adopted for all of the <strong>Parish</strong>’s governmental funds. The proposed budget ordinances were<br />

published in the official journal on September 24, 2009. They were introduced to the full Council on October 1, 2009 and<br />

the public hearing was held on December 3, 2009, at which time the ordinances were adopted.<br />

At any time during the fiscal year, the President may transfer part or all of any unencumbered appropriation within funds<br />

or departments. The budgetary level of control for the General Fund and special revenue fund for <strong>Parish</strong> roads and bridges<br />

is at the department level. Appropriations can be transferred within each department, but not from one department to<br />

another without Council action by ordinance. The budgetary level of control for all other governmental funds is at the<br />

fund level, meaning appropriations can be transferred within the fund, but not to another fund without Council action by<br />

ordinance.<br />

Every appropriation, except an appropriation for a capital expenditure, shall lapse at the close of the fiscal year to the<br />

extent that it has not been expended. An appropriation for a capital expenditure shall continue in force until the purpose<br />

for which it was made has been accomplished or abandoned. The purpose of any such appropriations shall be deemed<br />

abandoned if three years pass without any disbursement from or encumbrance of the appropriation.<br />

If during the fiscal year, the President certifies that there are available for appropriation funds in excess of those estimated<br />

in a budget, the President may present a supplement to the budget for the disposition of such funds, and the Council, by<br />

ordinance, may make supplemental appropriations for the year up to the amount of such an excess in the same manner<br />

required for adoption. If at any time during the fiscal year, it appears to the President that the funds available will be<br />

insufficient to meet the amount appropriated, the President shall report to the Council without delay, indicating the<br />

estimated amount of the deficit, any remedial action taken and recommendations as to any other steps to be taken. The<br />

Council shall then take such further action, as it deems necessary to prevent a deficit.<br />

The budgets were amended during 2010. The final amended budgets have been included in the fund financial statements.<br />

The original and final amended budgets have been included in the financial statements for the General Fund and all major<br />

58