Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

Fire Protection District No. 1 entered into a cooperative endeavor agreement with the City of Slidell on August 13, 2003<br />

whereby the District receives use of the City’s communication system and radios. Under the agreement, beginning July 1,<br />

2004, the District was obligated to make ten annual payments of $55,179 for a total of $551,791 for its share of the system<br />

and radios. Additionally, the District is required to make annual payments for maintenance beginning July 1, 2005. The<br />

first three payments were set at $14,208. Beginning July 1, 2008, the payment will be based on the City’s renegotiated<br />

maintenance contract. The financial statements include an asset and an obligation for the district’s share in the system.<br />

The asset will be amortized over 10 years. Amortization for the year ended December 31, 2010 is $55,179 and the balance<br />

due is $165,538. The maintenance contract expense will be expensed annually.<br />

Fire Protection District No. 13 borrowed $147,690 on August 27, 2004 at an interest rate of 5.00% from a bank secured<br />

by a fire truck with a carrying value of $115,572. The note requires annual payments of $24,891 beginning May 1, 2005<br />

and with the final payment on May 1, 2011. The balance due as of December 31, 2010 is $23,776, which is current.<br />

Community Disaster Loans<br />

Payments of principal and interest on the loans were deferred until the end of the original five-year term. Fire Protection<br />

District No. 1 has been forgiven of this loan, while all other agencies reported herein are awaiting a decision on their<br />

appeals of the denial of forgiveness. Payment terms included are those re-negotiated with FEMA prior to the end of the<br />

original five-year term.<br />

V. OTHER INFORMATION<br />

A. Risk Management<br />

The <strong>Parish</strong> is covered for its liability exposures by several policies of insurance with varying self-insured retentions (SIR)<br />

and/or deductibles. These policies provide the <strong>Parish</strong> with an excess layer of coverage in order to limit its potential<br />

exposure. Overall, the minimum limit per occurrence for any parish related liability exposure is $1,000,000, including<br />

those claims filed under worker’s compensation. The general and auto liability policies each have a $100,000 SIR, per<br />

occurrence; employee benefit plans administration liability has a $100,000 SIR each wrongful act. During 2010, the<br />

<strong>Parish</strong>’s maximum liability exposure within the self-insured retentions was $750,000 for general, auto and employee<br />

benefit plans administration. The worker’s compensation liability has a $300,000 SIR per accident; and a $25,000 SIR<br />

applies for each wrongful act to both the public entity employment practices liability and the public entity management<br />

liability.<br />

Risks of loss are accounted for and financed through internal service funds. The financial statements reflect an accrual for<br />

this maximum exposure, net of claims paid, of $2,553,250. Under the <strong>Parish</strong>’s worker’s compensation policy, the<br />

maximum exposure through the period ended December 31, 2010 was $1,129,307. The financial statements reflect an<br />

accrual of $84,153 for worker’s compensation claims, and management believes this amount is adequate to cover all open<br />

claims and known incidents at December 31, 2010. The liabilities for claims under the <strong>Parish</strong>’s self-insurance funds are<br />

based primarily on actual estimates of the amounts needed to pay prior and current year claims and to establish a reserve<br />

for incurred but not reported claims.<br />

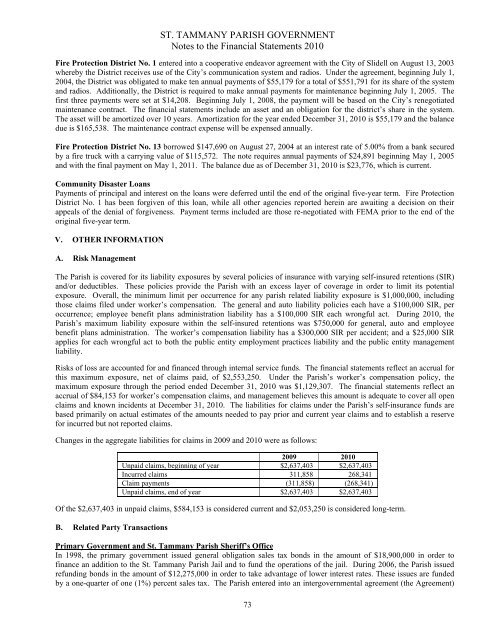

Changes in the aggregate liabilities for claims in 2009 and 2010 were as follows:<br />

2009 2010<br />

Unpaid claims, beginning of year $2,637,403 $2,637,403<br />

Incurred claims 311,858 268,341<br />

Claim payments (311,858) (268,341)<br />

Unpaid claims, end of year $2,637,403 $2,637,403<br />

Of the $2,637,403 in unpaid claims, $584,153 is considered current and $2,053,250 is considered long-term.<br />

B. Related Party Transactions<br />

Primary Government and <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Sheriff’s Office<br />

In 1998, the primary government issued general obligation sales tax bonds in the amount of $18,900,000 in order to<br />

finance an addition to the <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Jail and to fund the operations of the jail. During 2006, the <strong>Parish</strong> issued<br />

refunding bonds in the amount of $12,275,000 in order to take advantage of lower interest rates. These issues are funded<br />

by a one-quarter of one (1%) percent sales tax. The <strong>Parish</strong> entered into an intergovernmental agreement (the Agreement)<br />

73