Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

estimated useful lives for concrete, asphalt, and gravel roads are 40, 30, and 50 years, respectively. The mid-year<br />

convention is used for infrastructure.<br />

All capital assets, other than land, are depreciated using the straight-line method. The costs of normal maintenance<br />

and repairs that do not add to the value of the asset or materially extend the asset’s life are not capitalized. Bridges<br />

were valued using estimated historical cost. The Louisiana Department of Transportation and Development<br />

maintains a listing of <strong>Parish</strong> Bridges that includes the construction date and estimated replacement cost. Using this<br />

list, along with the Consumer Price Index, historical cost was estimated.<br />

The <strong>Parish</strong> began the majority of the reconstruction of <strong>Parish</strong> roads after the voters of <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> passed a<br />

two percent (2%) sales tax used specifically for this purpose in 1986. The actual records of these capital projects<br />

were obtained for projects completed from 1988 to the present and were used to determine historical cost.<br />

Roads taken into inventory by donation from a developer of a new subdivision prior to 1988 were valued at estimated<br />

historical cost. The estimated historical cost was determined by using current construction costs, as determined by<br />

the <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Department of Engineering, and the Consumer Price Index.<br />

The value of the land underneath the roads was valued at estimated fair value at the time of donation. This estimate<br />

was determined by using the average assessed value of unimproved land in the <strong>Parish</strong>. The assessed value closely<br />

approximates 10% of the fair value, which was $11,410/acre for 2010. The actual length and width of the road was<br />

known, and the width of the land generally includes an additional 4 feet each side for shoulder and ditch. The square<br />

feet of the land, including shoulder and ditch, was used to determine value.<br />

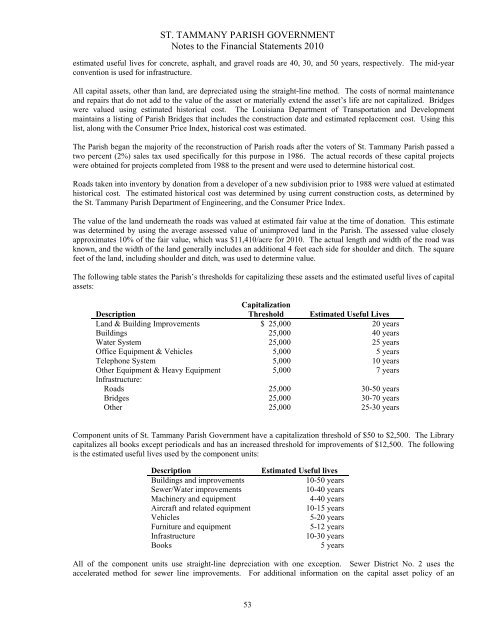

The following table states the <strong>Parish</strong>’s thresholds for capitalizing these assets and the estimated useful lives of capital<br />

assets:<br />

Description<br />

Capitalization<br />

Threshold Estimated Useful Lives<br />

Land & Building Improvements $ 25,000 20 years<br />

Buildings 25,000 40 years<br />

Water System 25,000 25 years<br />

Office Equipment & Vehicles 5,000 5 years<br />

Telephone System 5,000 10 years<br />

Other Equipment & Heavy Equipment 5,000 7 years<br />

Infrastructure:<br />

Roads 25,000 30-50 years<br />

Bridges 25,000 30-70 years<br />

Other 25,000 25-30 years<br />

Component units of <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Government have a capitalization threshold of $50 to $2,500. The Library<br />

capitalizes all books except periodicals and has an increased threshold for improvements of $12,500. The following<br />

is the estimated useful lives used by the component units:<br />

Description<br />

Buildings and improvements<br />

Sewer/Water improvements<br />

Machinery and equipment<br />

Aircraft and related equipment<br />

Vehicles<br />

Furniture and equipment<br />

Infrastructure<br />

Books<br />

Estimated Useful lives<br />

10-50 years<br />

10-40 years<br />

4-40 years<br />

10-15 years<br />

5-20 years<br />

5-12 years<br />

10-30 years<br />

5 years<br />

All of the component units use straight-line depreciation with one exception. Sewer District No. 2 uses the<br />

accelerated method for sewer line improvements. For additional information on the capital asset policy of an<br />

53