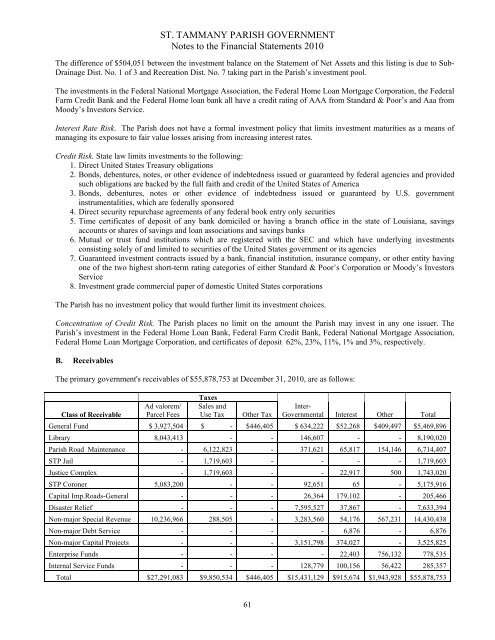

ST. TAMMANY PARISH GOVERNMENT Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010 The difference of $504,051 between the investment balance on the <strong>St</strong>atement of Net Assets and this listing is due to Sub- Drainage Dist. No. 1 of 3 and Recreation Dist. No. 7 taking part in the <strong>Parish</strong>’s investment pool. The investments in the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Federal Farm Credit Bank and the Federal Home loan bank all have a credit rating of AAA from <strong>St</strong>andard & Poor’s and Aaa from Moody’s Investors Service. Interest Rate Risk. The <strong>Parish</strong> does not have a formal investment policy that limits investment maturities as a means of managing its exposure to fair value losses arising from increasing interest rates. Credit Risk. <strong>St</strong>ate law limits investments to the following: 1. Direct United <strong>St</strong>ates Treasury obligations 2. Bonds, debentures, notes, or other evidence of indebtedness issued or guaranteed by federal agencies and provided such obligations are backed by the full faith and credit of the United <strong>St</strong>ates of America 3. Bonds, debentures, notes or other evidence of indebtedness issued or guaranteed by U.S. government instrumentalities, which are federally sponsored 4. Direct security repurchase agreements of any federal book entry only securities 5. Time certificates of deposit of any bank domiciled or having a branch office in the state of Louisiana, savings accounts or shares of savings and loan associations and savings banks 6. Mutual or trust fund institutions which are registered with the SEC and which have underlying investments consisting solely of and limited to securities of the United <strong>St</strong>ates government or its agencies 7. Guaranteed investment contracts issued by a bank, financial institution, insurance company, or other entity having one of the two highest short-term rating categories of either <strong>St</strong>andard & Poor’s Corporation or Moody’s Investors Service 8. Investment grade commercial paper of domestic United <strong>St</strong>ates corporations The <strong>Parish</strong> has no investment policy that would further limit its investment choices. Concentration of Credit Risk. The <strong>Parish</strong> places no limit on the amount the <strong>Parish</strong> may invest in any one issuer. The <strong>Parish</strong>’s investment in the Federal Home Loan Bank, Federal Farm Credit Bank, Federal National Mortgage Association, Federal Home Loan Mortgage Corporation, and certificates of deposit 62%, 23%, 11%, 1% and 3%, respectively. B. Receivables The primary government's receivables of $55,878,753 at December 31, 2010, are as follows: Class of Receivable Ad valorem/ Parcel Fees Taxes Sales and Use Tax Other Tax Inter- Governmental Interest Other Total General Fund $ 3,927,504 $ - $446,405 $ 634,222 $52,268 $409,497 $5,469,896 Library 8,043,413 - - 146,607 - - 8,190,020 <strong>Parish</strong> Road Maintenance - 6,122,823 - 371,621 65,817 154,146 6,714,407 STP Jail - 1,719,603 - - - - 1,719,603 Justice Complex - 1,719,603 - - 22,917 500 1,743,020 STP Coroner 5,083,200 - - 92,651 65 - 5,175,916 Capital Imp.Roads-General - - - 26,364 179,102 - 205,466 Disaster Relief - - - 7,595,527 37,867 - 7,633,394 Non-major Special Revenue 10,236,966 288,505 - 3,283,560 54,176 567,231 14,430,438 Non-major Debt Service - - - - 6,876 - 6,876 Non-major Capital Projects - - - 3,151,798 374,027 - 3,525,825 Enterprise Funds - - - - 22,403 756,132 778,535 Internal Service Funds - - - 128,779 100,156 56,422 285,357 Total $27,291,083 $9,850,534 $446,405 $15,431,129 $915,674 $1,943,928 $55,878,753 61

ST. TAMMANY PARISH GOVERNMENT Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010 C. Capital Assets Depreciation expense of $12,651,036 for the year ended December 31, 2010, was charged to the following governmental functions: Governmental Activities: General government $1,453,349 Public safety 1,189,184 Highways and streets 9,596,263 Sanitation 26,314 Health and welfare 87,481 Cultural and recreation 295,437 Economic development 3,008 Total depreciation expense – governmental activities $12,651,036 Business-type activities: Property Management $146,858 Utility Operations 2,316,788 Total depreciation expense – business type activities $2,463,646 Capital assets and depreciation activity as of and for the year ended December 31, 2010, for the primary government are as follows: Primary Government Beginning Balance Increases Decreases Re-classes Ending Balance Governmental activities: Capital assets, not being depreciated: Land $37,646,837 $6,462,769 $ - $ - $44,109,606 Land Imp-non-exhaustible 107,122 - - - 107,122 Construction in progress 7,251,542 2,322,419 - (1,035,983) 8,537,978 Infrastructure: Land 8,131,125 802,021 - (461,777) 8,471,369 Land improvements-non-exhaustible 3,141,072 506,741 - 461,777 4,109,590 Construction in progress 2,986,488 14,549,477 - (10,251,431) 7,284,534 Total capital assets, not being depreciated 59,264,186 24,643,427 - (11,287,414) 72,620,199 Capital Assets being depreciated: Land Improvements 4,177,446 10,577 - 632,658 4,820,681 Buildings 81,177,634 - - 232,719 81,410,353 Building Improvements 3,036,650 - - 19,012 3,055,662 Water and Sewer Systems 156,279 25,198 - (25,198) 156,279 Vehicles 3,037,457 75,164 - 1,004,437 4,117,058 Machinery and equipment 18,474,220 245,243 - 3,335 18,722,798 Office/Other equipment 5,971,781 1,113,576 - 168,005 7,253,362 Infrastructure: Roads 223,817,326 3,948,527 (1,804,394) 7,950,577 233,912,036 Other 11,179,356 - - 2,300,854 13,480,210 Total capital assets being depreciated 351,028,149 5,418,285 (1,804,394) 12,286,399 366,928,439 Less accumulated depreciation for: Land Improvements (651,083) (225,101) - - (876,184) Buildings (17,642,392) (2,032,872) - - (19,675,264) Building Improvements (312,097) (143,196) - - (455,293) Water and Sewer Systems (90,642) (6,251) - - (96,893) Vehicles (2,455,675) (240,861) - (857,540) (3,554,076) Machinery and equipment (13,653,902) (1,268,705) - (3,335) (14,925,942) Office/Other equipment (3,833,151) (527,374) - (126,022) (4,486,547) Infrastructure: Roads (65,286,691) (7,797,777) 932,252 - (72,152,216) Other (2,271,968) (408,899) - - (2,680,867) Total accumulated depreciation (106,197,601) (12,651,036) 932,252 (986,897) (118,903,282) Total capital assets being depreciated, net 244,830,548 (7,232,751) (872,142) 11,299,502 248,025,157 62

- Page 1 and 2:

Comprehensive Annual Financial Repo

- Page 4 and 5:

ST. TAMMANY PARISH GOVERNMENT COMPR

- Page 6:

Schedule of Compensation Paid to Co

- Page 10 and 11:

St. Tammany Parish Department of Fi

- Page 12 and 13:

months of 2010. This increase was n

- Page 15 and 16:

ST. TAMMANY PARISH EXECUTIVE BRANCH

- Page 17 and 18: ST. TAMMANY PARISH GOVERNMENT PRINC

- Page 20 and 21: LAPORTE SEHRT ROMIG HAND CERTIfiED

- Page 22 and 23: Management’s Discussion and Analy

- Page 24 and 25: The Parish adopts annual appropriat

- Page 26 and 27: At the end of the current fiscal ye

- Page 28 and 29: Expenses and Program Revenues - Gov

- Page 30 and 31: sales tax revenue stabilizes so tha

- Page 32 and 33: Additional information on St. Tamma

- Page 34: BASIC FINANCIAL STATEMENTS 27

- Page 37 and 38: ST. TAMMANY PARISH, LOUISIANA State

- Page 39 and 40: ST. TAMMANY PARISH, LOUISIANA Balan

- Page 41 and 42: ST. TAMMANY PARISH, LOUISIANA State

- Page 43 and 44: ST. TAMMANY PARISH, LOUISIANA Recon

- Page 45: STATEMENT G ST. TAMMANY PARISH, LOU

- Page 48 and 49: SCHEDULE H (continued) ST. TAMMANY

- Page 50 and 51: STATEMENT I Recreation District No.

- Page 52: STATEMENT J Fire Protection Distric

- Page 55 and 56: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 57 and 58: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 59 and 60: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 61 and 62: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 63 and 64: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 65 and 66: The details of this $2,123,937 diff

- Page 67: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 71 and 72: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 73 and 74: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 75 and 76: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 77 and 78: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 79 and 80: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 81 and 82: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 83 and 84: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 85 and 86: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 87 and 88: ST. TAMMANY PARISH GOVERNMENT Notes

- Page 89 and 90: ST. TAMMANY PARISH, LOUISIANA Sched

- Page 91 and 92: ST. TAMMANY PARISH, LOUISIANA Sched

- Page 93 and 94: ST. TAMMANY PARISH, LOUISIANA Sched

- Page 96 and 97: NOTES TO REQUIRED SUPPLEMENTARY INF

- Page 98: SCHEDULE 7 Public Safety Health and

- Page 101 and 102: ST. TAMMANY PARISH, LOUISIANA Combi

- Page 104 and 105: NON-MAJOR SPECIAL REVENUE FUNDS Spe

- Page 106 and 107: NON-MAJOR SPECIAL REVENUE FUNDS (Co

- Page 108 and 109: SCHEDULE 10 continued 020 Environme

- Page 110 and 111: SCHEDULE 10 continued 164 Lighting

- Page 112 and 113: SCHEDULE 10 continued 401 Grants -

- Page 114 and 115: SCHEDULE 10 continued 440 Grants -

- Page 116 and 117: SCHEDULE 11 continued Final Budget

- Page 118 and 119:

SCHEDULE 11 continued Final Budget

- Page 120 and 121:

SCHEDULE 11 continued Final Budget

- Page 122 and 123:

SCHEDULE 11 continued 166 167 169 L

- Page 124 and 125:

SCHEDULE 11 continued 174 175 176 L

- Page 126 and 127:

SCHEDULE 11 continued 402 403 404 G

- Page 128 and 129:

SCHEDULE 11 continued 416 418 420 G

- Page 130 and 131:

SCHEDULE 11 continued Final Budget

- Page 132 and 133:

NON-MAJOR DEBT SERVICE FUNDS Debt S

- Page 134 and 135:

SCHEDULE 12 237 Justice Complex Deb

- Page 136 and 137:

SCHEDULE 13 continued 233 234 237 L

- Page 138 and 139:

SCHEDULE 13 continued 249 Total Non

- Page 140 and 141:

NON-MAJOR CAPITAL PROJECTS FUNDS Ca

- Page 142 and 143:

NON-MAJOR CAPITAL PROJECTS FUNDS (C

- Page 144 and 145:

SCHEDULE 14 continued 305 Capital S

- Page 146 and 147:

SCHEDULE 14 continued 320 GIS Capit

- Page 148 and 149:

SCHEDULE 14 continued 333 Parish Li

- Page 150 and 151:

SCHEDULE 15 continued ST. TAMMANY P

- Page 152 and 153:

SCHEDULE 15 continued 305 306 307 C

- Page 154 and 155:

SCHEDULE 15 continued 310 311 312 C

- Page 156 and 157:

SCHEDULE 15 continued 316 320 321 C

- Page 158 and 159:

SCHEDULE 15 continued 324 325 326 D

- Page 160 and 161:

SCHEDULE 15 continued Final Budget

- Page 162 and 163:

SCHEDULE 15 continued Final Budget

- Page 164 and 165:

SCHEDULE 15 continued Final Budget

- Page 166 and 167:

INTERNAL SERVICE FUNDS Internal Ser

- Page 168 and 169:

161

- Page 170 and 171:

SCHEDULE 16 continued 520 St. Tamma

- Page 172 and 173:

SCHEDULE 16 continued 587 Post Empl

- Page 174 and 175:

SCHEDULE 17 continued 520 St. Tamma

- Page 176 and 177:

SCHEDULE 17 continued 586 Post Empl

- Page 178 and 179:

SCHEDULE 18 continued 520 St. Tamma

- Page 180 and 181:

SCHEDULE 18 continued 587 Post Empl

- Page 182 and 183:

NON-MAJOR COMPONENT UNITS 175

- Page 184 and 185:

SCHEDULE 19 continued Fire Protecti

- Page 186 and 187:

SCHEDULE 19 continued Recreation Di

- Page 188 and 189:

SCHEDULE 19 continued Sub-Drainage

- Page 190 and 191:

SCHEDULE 20 continued Drainage Dist

- Page 192 and 193:

SCHEDULE 20 continued Net (Expenses

- Page 194 and 195:

SCHEDULE 20 continued Gravity Drain

- Page 196 and 197:

BUDGETARY COMPARISONS 189

- Page 198 and 199:

ST. TAMMANY PARISH, LOUISIANA Sched

- Page 200 and 201:

OTHER SUPPLEMENTARY INFORMATION 193

- Page 202 and 203:

SCHEDULE 24 ST. TAMMANY PARISH, LOU

- Page 204 and 205:

SCHEDULE 25 335 TOTAL Sub-Drainage

- Page 206 and 207:

ST. TAMMANY PARISH, LOUISIANA Sched

- Page 208 and 209:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 210 and 211:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 212 and 213:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 214 and 215:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 216 and 217:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 218 and 219:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 220 and 221:

ST. TAMMANY PARISH GOVERNMENT Capit

- Page 222 and 223:

ST. TAMMANY PARISH, LOUISIANA Detai

- Page 224 and 225:

ST. TAMMANY PARISH, LOUISIANA Debt

- Page 226 and 227:

ST. TAMMANY PARISH, LOUISIANA Debt

- Page 228 and 229:

ST. TAMMANY PARISH, LOUISIANA Sched

- Page 230 and 231:

STATISTICAL SECTION (UNAUDITED) Thi

- Page 232 and 233:

TABLE 1 2007 2006 2005 2004 2003 $

- Page 234 and 235:

General Revenues and Other Changes

- Page 236 and 237:

TABLE 3 Fiscal Year 2006 2005 2004

- Page 238 and 239:

TABLE 4 Fiscal Year 2007 2006 2005

- Page 240 and 241:

ST. TAMMANY PARISH, LOUISIANA TAX R

- Page 242 and 243:

ST. TAMMANY PARISH, LOUISIANA PRINC

- Page 244 and 245:

ST. TAMMANY PARISH, LOUISIANA DIREC

- Page 246 and 247:

ST. TAMMANY PARISH GOVERNMENT, LOUI

- Page 248 and 249:

ST. TAMMANY PARISH, LOUISIANA RATIO

- Page 250 and 251:

ST. TAMMANY PARISH GOVERNMENT TABLE

- Page 252 and 253:

ST. TAMMANY PARISH, GOVERNMENT DEMO

- Page 254 and 255:

TABLE 18 ST. TAMMANY PARISH, LOUISI

- Page 256 and 257:

TABLE 19 2006 2005 2004 2003 2002 2

- Page 258 and 259:

SINGLE AUDIT SECTION 251

- Page 260 and 261:

LAPORTE SEHRT ROMIG HAND CERTIFlED

- Page 262 and 263:

LAPORTE SEHRT ROMIG HAND CERTIFIED

- Page 264 and 265:

ST. TAMMANY PARISH, LOUISIANA SCHED

- Page 266 and 267:

ST. TAMMANY PARISH, LOUISIANA SCHED

- Page 268 and 269:

(Accrued) Unearned (Accrued) Unearn

- Page 270 and 271:

St. Tammany Parish Department of Fi