Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

service funds include the cost of sales and services, administrative expenses, and depreciation on capital assets. All<br />

revenues and expenses not meeting this definition are reported as non-operating revenues and expenses.<br />

When both restricted and unrestricted resources are available for use, it is the <strong>Parish</strong>’s policy to use restricted resources<br />

first, then unrestricted resources as they are needed.<br />

D. Assets, Liabilities, and Net Assets or Equity<br />

1. Deposits and Investments<br />

The <strong>Parish</strong>’s cash and cash equivalents include amounts in petty cash, demand deposits, and interest-bearing demand<br />

deposits.<br />

<strong>St</strong>ate law allows the <strong>Parish</strong> to invest in collateralized certificates of deposits, government backed securities,<br />

commercial paper, the state sponsored investment pool, and mutual funds consisting solely of government backed<br />

securities.<br />

The <strong>Parish</strong> maintains pooled cash and investment accounts that are available for use by all funds, except those<br />

restricted by statutes or other legal reasons.<br />

Investments for the reporting entity consist primarily of U.S. Treasury obligations and obligations of the U.S.<br />

agencies. Investments in obligations of the U.S. Treasury and agencies are reported at fair value.<br />

2. Receivables and Payables<br />

Activity between funds that are representative of lending/borrowing arrangements outstanding at the end of the fiscal<br />

year are referred to as either “due to/from other fund” (i.e., the current portion of inter-fund loans) or “advances<br />

to/from other funds” (i.e., the non-current portion of inter-fund loans).<br />

Receivables and payables between the primary government and discretely presented component units are disclosed<br />

separately from inter-fund balances as “due to/from primary government/component units.”<br />

All trade and property tax receivables are shown net of an allowance for uncollectibles. The <strong>Parish</strong> records 95% of<br />

property tax billed as collectible. Property taxes are levied on a calendar year basis. On July 1, 2010 the taxes were<br />

levied for the 2010 calendar year. They are due on December 31 st of each year, and are considered delinquent on<br />

January 1 st , which is the lien date. The millage rates for the various component units can be found in the <strong>St</strong>atistical<br />

section of this report.<br />

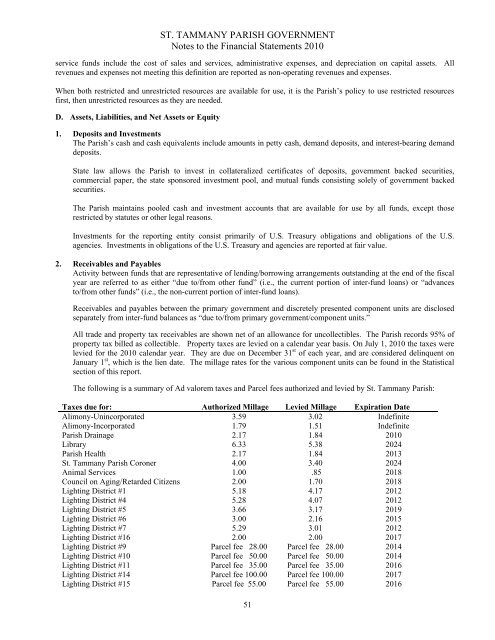

The following is a summary of Ad valorem taxes and Parcel fees authorized and levied by <strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong>:<br />

Taxes due for: Authorized Millage Levied Millage Expiration Date<br />

Alimony-Unincorporated 3.59 3.02 Indefinite<br />

Alimony-Incorporated 1.79 1.51 Indefinite<br />

<strong>Parish</strong> Drainage 2.17 1.84 2010<br />

Library 6.33 5.38 2024<br />

<strong>Parish</strong> Health 2.17 1.84 2013<br />

<strong>St</strong>. <strong>Tammany</strong> <strong>Parish</strong> Coroner 4.00 3.40 2024<br />

Animal Services 1.00 .85 2018<br />

Council on Aging/Retarded Citizens 2.00 1.70 2018<br />

Lighting District #1 5.18 4.17 2012<br />

Lighting District #4 5.28 4.07 2012<br />

Lighting District #5 3.66 3.17 2019<br />

Lighting District #6 3.00 2.16 2015<br />

Lighting District #7 5.29 3.01 2012<br />

Lighting District #16 2.00 2.00 2017<br />

Lighting District #9 Parcel fee 28.00 Parcel fee 28.00 2014<br />

Lighting District #10 Parcel fee 50.00 Parcel fee 50.00 2014<br />

Lighting District #11 Parcel fee 35.00 Parcel fee 35.00 2016<br />

Lighting District #14 Parcel fee 100.00 Parcel fee 100.00 2017<br />

Lighting District #15 Parcel fee 55.00 Parcel fee 55.00 2016<br />

51