Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

Comprehensive Annual Financial Report - St. Tammany Parish ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

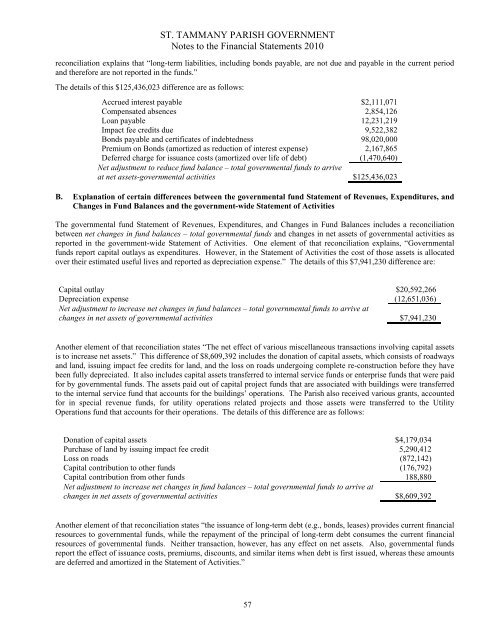

ST. TAMMANY PARISH GOVERNMENT<br />

Notes to the <strong>Financial</strong> <strong>St</strong>atements 2010<br />

reconciliation explains that “long-term liabilities, including bonds payable, are not due and payable in the current period<br />

and therefore are not reported in the funds.”<br />

The details of this $125,436,023 difference are as follows:<br />

Accrued interest payable $2,111,071<br />

Compensated absences 2,854,126<br />

Loan payable 12,231,219<br />

Impact fee credits due 9,522,382<br />

Bonds payable and certificates of indebtedness 98,020,000<br />

Premium on Bonds (amortized as reduction of interest expense) 2,167,865<br />

Deferred charge for issuance costs (amortized over life of debt) (1,470,640)<br />

Net adjustment to reduce fund balance – total governmental funds to arrive<br />

at net assets-governmental activities $125,436,023<br />

B. Explanation of certain differences between the governmental fund <strong>St</strong>atement of Revenues, Expenditures, and<br />

Changes in Fund Balances and the government-wide <strong>St</strong>atement of Activities<br />

The governmental fund <strong>St</strong>atement of Revenues, Expenditures, and Changes in Fund Balances includes a reconciliation<br />

between net changes in fund balances – total governmental funds and changes in net assets of governmental activities as<br />

reported in the government-wide <strong>St</strong>atement of Activities. One element of that reconciliation explains, “Governmental<br />

funds report capital outlays as expenditures. However, in the <strong>St</strong>atement of Activities the cost of those assets is allocated<br />

over their estimated useful lives and reported as depreciation expense.” The details of this $7,941,230 difference are:<br />

Capital outlay $20,592,266<br />

Depreciation expense (12,651,036)<br />

Net adjustment to increase net changes in fund balances – total governmental funds to arrive at<br />

changes in net assets of governmental activities $7,941,230<br />

Another element of that reconciliation states “The net effect of various miscellaneous transactions involving capital assets<br />

is to increase net assets.” This difference of $8,609,392 includes the donation of capital assets, which consists of roadways<br />

and land, issuing impact fee credits for land, and the loss on roads undergoing complete re-construction before they have<br />

been fully depreciated. It also includes capital assets transferred to internal service funds or enterprise funds that were paid<br />

for by governmental funds. The assets paid out of capital project funds that are associated with buildings were transferred<br />

to the internal service fund that accounts for the buildings’ operations. The <strong>Parish</strong> also received various grants, accounted<br />

for in special revenue funds, for utility operations related projects and those assets were transferred to the Utility<br />

Operations fund that accounts for their operations. The details of this difference are as follows:<br />

Donation of capital assets $4,179,034<br />

Purchase of land by issuing impact fee credit 5,290,412<br />

Loss on roads (872,142)<br />

Capital contribution to other funds (176,792)<br />

Capital contribution from other funds 188,880<br />

Net adjustment to increase net changes in fund balances – total governmental funds to arrive at<br />

changes in net assets of governmental activities $8,609,392<br />

Another element of that reconciliation states “the issuance of long-term debt (e.g., bonds, leases) provides current financial<br />

resources to governmental funds, while the repayment of the principal of long-term debt consumes the current financial<br />

resources of governmental funds. Neither transaction, however, has any effect on net assets. Also, governmental funds<br />

report the effect of issuance costs, premiums, discounts, and similar items when debt is first issued, whereas these amounts<br />

are deferred and amortized in the <strong>St</strong>atement of Activities.”<br />

57