Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Country Assessment<br />

Regional Equity <strong>Strategy</strong> Q4 2007<br />

Meanwhile, we note that <strong>the</strong> government’s expansionary budget is targeted at quality<br />

development, with emphasis on infrastructure development <strong>and</strong> welfare programs. The<br />

government still has capacity to use its Rp101.5tr resources to finance infrastructure projects<br />

such as roads, railways, ports <strong>and</strong> bridges. These infrastructure projects are <strong>the</strong> basic<br />

requirements for Indonesia to build a foundation for sustainable economic growth <strong>and</strong><br />

efficiency. Sectors with exposure to infrastructure, such as cement <strong>and</strong> construction, are set to<br />

benefit from <strong>the</strong> country’s infrastructure development.<br />

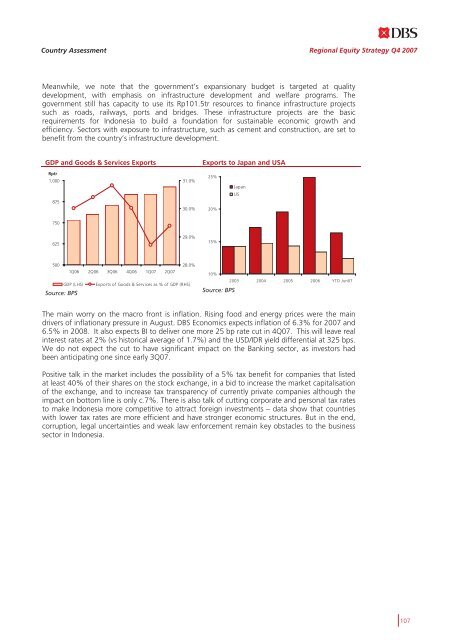

GDP <strong>and</strong> Goods & Services Exports<br />

Exports to Japan <strong>and</strong> USA<br />

Rptr<br />

1,000<br />

875<br />

31.0%<br />

30.0%<br />

25%<br />

20%<br />

Japan<br />

US<br />

750<br />

625<br />

29.0%<br />

15%<br />

500<br />

28.0%<br />

1Q06 2Q06 3Q06 4Q06 1Q07 2Q07<br />

GDP (LHS) Exports of Goods & Services as % of GDP (RHS)<br />

Source: BPS<br />

10%<br />

Source: BPS<br />

2003 2004 2005 2006 YTD Jun07<br />

The main worry on <strong>the</strong> macro front is inflation. Rising food <strong>and</strong> energy prices were <strong>the</strong> main<br />

drivers of inflationary pressure in August. <strong>DBS</strong> Economics expects inflation of 6.3% for 2007 <strong>and</strong><br />

6.5% in 2008. It also expects BI to deliver one more 25 bp rate cut in 4Q07. This will leave real<br />

interest rates at 2% (vs historical average of 1.7%) <strong>and</strong> <strong>the</strong> USD/IDR yield differential at 325 bps.<br />

We do not expect <strong>the</strong> cut to have significant impact on <strong>the</strong> Banking sector, as investors had<br />

been anticipating one since early 3Q07.<br />

Positive talk in <strong>the</strong> market includes <strong>the</strong> possibility of a 5% tax benefit for companies that listed<br />

at least 40% of <strong>the</strong>ir shares on <strong>the</strong> stock exchange, in a bid to increase <strong>the</strong> market capitalisation<br />

of <strong>the</strong> exchange, <strong>and</strong> to increase tax transparency of currently private companies although <strong>the</strong><br />

impact on bottom line is only c.7%. There is also talk of cutting corporate <strong>and</strong> personal tax rates<br />

to make Indonesia more competitive to attract foreign investments – data show that countries<br />

with lower tax rates are more efficient <strong>and</strong> have stronger economic structures. But in <strong>the</strong> end,<br />

corruption, legal uncertainties <strong>and</strong> weak law enforcement remain key obstacles to <strong>the</strong> business<br />

sector in Indonesia.<br />

107