Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Stock</strong> Profile: UOB<br />

BUY S$20.80 STI : 3,476.31<br />

Price Target : 12-month S$ 27.50<br />

Potential Catalyst: <strong>Cap</strong>ital management <strong>and</strong> regionalisation<br />

ANALYST<br />

Singapore Research Team<br />

research@dbsvickers.com<br />

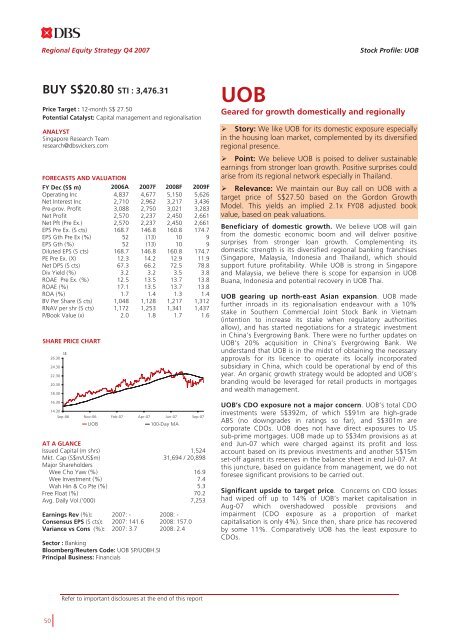

FORECASTS AND VALUATION<br />

FY Dec (S$ m) 2006A 2007F 2008F 2009F<br />

Operating Inc 4,837 4,677 5,150 5,626<br />

Net Interest Inc 2,710 2,962 3,217 3,436<br />

Pre-prov. Profit 3,088 2,750 3,021 3,283<br />

Net Profit 2,570 2,237 2,450 2,661<br />

Net Pft (Pre Ex.) 2,570 2,237 2,450 2,661<br />

EPS Pre Ex. (S cts) 168.7 146.8 160.8 174.7<br />

EPS Gth Pre Ex (%) 52 (13) 10 9<br />

EPS Gth (%) 52 (13) 10 9<br />

Diluted EPS (S cts) 168.7 146.8 160.8 174.7<br />

PE Pre Ex. (X) 12.3 14.2 12.9 11.9<br />

Net DPS (S cts) 67.3 66.2 72.5 78.8<br />

Div Yield (%) 3.2 3.2 3.5 3.8<br />

ROAE Pre Ex. (%) 12.5 13.5 13.7 13.8<br />

ROAE (%) 17.1 13.5 13.7 13.8<br />

ROA (%) 1.7 1.4 1.3 1.4<br />

BV Per Share (S cts) 1,048 1,128 1,217 1,312<br />

RNAV per shr (S cts) 1,172 1,253 1,341 1,437<br />

P/Book Value (x) 2.0 1.8 1.7 1.6<br />

SHARE PRICE CHART<br />

S$<br />

26.30<br />

24.30<br />

22.30<br />

20.30<br />

18.30<br />

16.30<br />

14.30<br />

Sep-06 Nov-06 Feb-07 Apr-07 Jun-07 Sep-07<br />

UOB<br />

100-Day MA<br />

AT A GLANCE<br />

Issued <strong>Cap</strong>ital (m shrs) 1,524<br />

Mkt. <strong>Cap</strong> (S$m/US$m) 31,694 / 20,898<br />

Major Shareholders<br />

Wee Cho Yaw (%) 16.9<br />

Wee Investment (%) 7.4<br />

Wah Hin & Co Pte (%) 5.3<br />

Free Float (%) 70.2<br />

Avg. Daily Vol.(‘000) 7,253<br />

Earnings Rev (%): 2007: - 2008: -<br />

Consensus EPS (S cts): 2007: 141.6 2008: 157.0<br />

Variance vs Cons (%): 2007: 3.7 2008: 2.4<br />

Sector : Banking<br />

Bloomberg/Reuters Code: UOB SP/UOBH.SI<br />

Principal Business: Financials<br />

UOB<br />

Geared for growth domestically <strong>and</strong> regionally<br />

Story: We like UOB for its domestic exposure especially<br />

in <strong>the</strong> housing loan market, complemented by its diversified<br />

regional presence.<br />

Point: We believe UOB is poised to deliver sustainable<br />

earnings from stronger loan growth. Positive surprises could<br />

arise from its regional network especially in Thail<strong>and</strong>.<br />

Relevance: We maintain our Buy call on UOB with a<br />

target price of S$27.50 based on <strong>the</strong> Gordon Growth<br />

Model. This yields an implied 2.1x FY08 adjusted book<br />

value, based on peak valuations.<br />

Beneficiary of domestic growth. We believe UOB will gain<br />

from <strong>the</strong> domestic economic boom <strong>and</strong> will deliver positive<br />

surprises from stronger loan growth. Complementing its<br />

domestic strength is its diversified regional banking franchises<br />

(Singapore, Malaysia, Indonesia <strong>and</strong> Thail<strong>and</strong>), which should<br />

support future profitability. While UOB is strong in Singapore<br />

<strong>and</strong> Malaysia, we believe <strong>the</strong>re is scope for expansion in UOB<br />

Buana, Indonesia <strong>and</strong> potential recovery in UOB Thai.<br />

UOB gearing up north-east Asian expansion. UOB made<br />

fur<strong>the</strong>r inroads in its regionalisation endeavour with a 10%<br />

stake in Sou<strong>the</strong>rn Commercial Joint <strong>Stock</strong> Bank in Vietnam<br />

(intention to increase its stake when regulatory authorities<br />

allow), <strong>and</strong> has started negotiations for a strategic investment<br />

in China’s Evergrowing Bank. There were no fur<strong>the</strong>r updates on<br />

UOB’s 20% acquisition in China’s Evergrowing Bank. We<br />

underst<strong>and</strong> that UOB is in <strong>the</strong> midst of obtaining <strong>the</strong> necessary<br />

approvals for its licence to operate its locally incorporated<br />

subsidiary in China, which could be operational by end of this<br />

year. An organic growth strategy would be adopted <strong>and</strong> UOB’s<br />

br<strong>and</strong>ing would be leveraged for retail products in mortgages<br />

<strong>and</strong> wealth management.<br />

UOB’s CDO exposure not a major concern. UOB’s total CDO<br />

investments were S$392m, of which S$91m are high-grade<br />

ABS (no downgrades in ratings so far), <strong>and</strong> S$301m are<br />

corporate CDOs. UOB does not have direct exposures to US<br />

sub-prime mortgages. UOB made up to S$34m provisions as at<br />

end Jun-07 which were charged against its profit <strong>and</strong> loss<br />

account based on its previous investments <strong>and</strong> ano<strong>the</strong>r S$15m<br />

set-off against its reserves in <strong>the</strong> balance sheet in end Jul-07. At<br />

this juncture, based on guidance from management, we do not<br />

foresee significant provisions to be carried out.<br />

Significant upside to target price. Concerns on CDO losses<br />

had wiped off up to 14% of UOB’s market capitalisation in<br />

Aug-07 which overshadowed possible provisions <strong>and</strong><br />

impairment (CDO exposure as a proportion of market<br />

capitalisation is only 4%). Since <strong>the</strong>n, share price has recovered<br />

by some 11%. Comparatively UOB has <strong>the</strong> least exposure to<br />

CDOs.<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

50