Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Strategy</strong> Overview: Asian Equity<br />

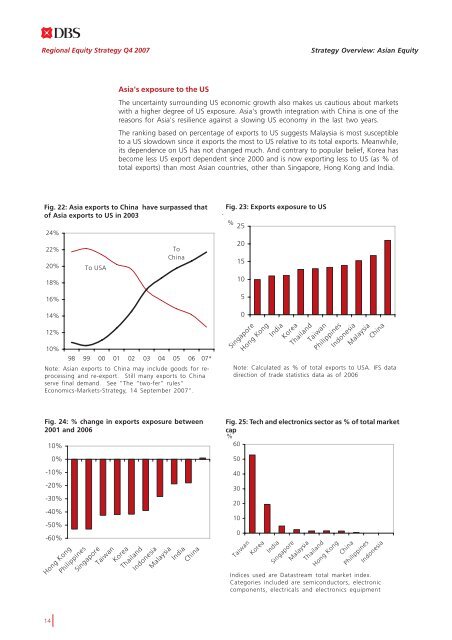

Asia's exposure to <strong>the</strong> US<br />

The uncertainty surrounding US economic growth also makes us cautious about markets<br />

with a higher degree of US exposure. Asia's growth integration with China is one of <strong>the</strong><br />

reasons for Asia's resilience against a slowing US economy in <strong>the</strong> last two years.<br />

The ranking based on percentage of exports to US suggests Malaysia is most susceptible<br />

to a US slowdown since it exports <strong>the</strong> most to US relative to its total exports. Meanwhile,<br />

its dependence on US has not changed much. And contrary to popular belief, Korea has<br />

become less US export dependent since 2000 <strong>and</strong> is now exporting less to US (as % of<br />

total exports) than most Asian countries, o<strong>the</strong>r than Singapore, Hong Kong <strong>and</strong> India.<br />

Fig. 22: Asia exports to China have surpassed that<br />

of Asia exports to US in 2003<br />

24%<br />

22%<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

To USA<br />

To<br />

China<br />

10%<br />

98 99 00 01 02 03 04 05 06 07*<br />

Note: Asian exports to China may include goods for reprocessing<br />

<strong>and</strong> re-export. Still many exports to China<br />

serve final dem<strong>and</strong>. See "The “two-fer” rules"<br />

Economics-Markets-<strong>Strategy</strong>, 14 September 2007".<br />

Fig. 23: Exports exposure to US<br />

%<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Singapore<br />

Hong Kong<br />

India<br />

Korea<br />

Thail<strong>and</strong><br />

Taiwan<br />

Philippines<br />

Indonesia<br />

Malaysia<br />

China<br />

Note: Calculated as % of total exports to USA. IFS data<br />

direction of trade statistics data as of 2006<br />

Fig. 24: % change in exports exposure between<br />

2001 <strong>and</strong> 2006<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

-60%<br />

14<br />

10%<br />

0%<br />

Hong Kong<br />

Philippines<br />

Singapore<br />

Taiwan<br />

Korea<br />

Thail<strong>and</strong><br />

Indonesia<br />

Malaysia<br />

India<br />

China<br />

Fig. 25: Tech <strong>and</strong> electronics sector as % of total market<br />

cap<br />

%<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Taiwan<br />

Korea<br />

India<br />

Singapore<br />

Malaysia<br />

Thail<strong>and</strong><br />

Hong Kong<br />

China<br />

Philippines<br />

Indonesia<br />

Indices used are Datastream total market index.<br />

Categories included are semiconductors, electronic<br />

components, electricals <strong>and</strong> electronics equipment