Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

Country Assessment<br />

Reits are preferred over Property stocks, offering more upside at 21% compared to only 2%<br />

last quarter. The average forward DPU yield is now 4.9%, which compares favorably against low<br />

10 yr bond yield forecasts at 2.9%(+20bp). Meanwhile, <strong>the</strong> underlying asset upcycle remains<br />

intact, <strong>and</strong> <strong>the</strong> rental markets for most asset classes remain firm. Our preferred pick is CDL<br />

Hospitality Reit, which is <strong>the</strong> largest hotel owner in Singapore, which will benefit from <strong>the</strong><br />

tourism <strong>the</strong>me. It offers a decent yield of 3.8% <strong>and</strong> strong organic growth on <strong>the</strong> back of <strong>the</strong><br />

rise in hotel room rates.<br />

Singapore REITS<br />

Last Price<br />

<strong>DBS</strong>V<br />

Price<br />

Yield (%)<br />

17-Sep-07 Target FYE Current Forward Recom'd<br />

Singapore (S$)<br />

A-REIT 2.65 3.16 Mar 4.8% 5.5% B<br />

<strong>Cap</strong>itaCommercial Trust 2.61 2.97 Dec 3.2% 4.3% H<br />

<strong>Cap</strong>itaMall Trust 3.56 4.31 Dec 4.0% 4.3% B<br />

Fortune REIT (HK$) 5.80 6.75 Dec 6.1% 6.2% B<br />

Macquarie MEAG Prime REIT 1.21 1.48 Dec 5.0% 5.9% B<br />

Mapletree Logistics Trust 1.15 1.46 Dec 5.1% 5.4% B<br />

Suntec REIT 1.86 2.20 Sep 4.5% 5.4% B<br />

Allco Commercial Real Estate 1.04 1.45 Dec 6.2% 6.4% B<br />

Ascott Residence Trust 1.74 2.30 Dec 4.1% 4.4% B<br />

K-REIT 2.40 3.70 Dec 3.2% 4.0% B<br />

CDL Hospitality Trust 2.35 2.90 Dec 3.9% 5.5% B<br />

<strong>Cap</strong>itaRetail China Trust* 2.60 NR Dec 2.6% 3.4% NR<br />

Source: <strong>DBS</strong> <strong>Vickers</strong><br />

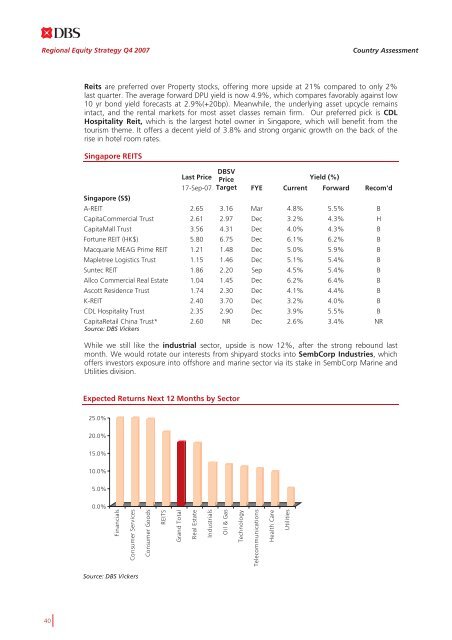

While we still like <strong>the</strong> industrial sector, upside is now 12%, after <strong>the</strong> strong rebound last<br />

month. We would rotate our interests from shipyard stocks into SembCorp Industries, which<br />

offers investors exposure into offshore <strong>and</strong> marine sector via its stake in SembCorp Marine <strong>and</strong><br />

Utilities division.<br />

Expected Returns Next 12 Months by Sector<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

Financials<br />

Consumer Services<br />

Consumer Goods<br />

REITS<br />

Gr<strong>and</strong> Total<br />

Real Estate<br />

Industrials<br />

Oil & Gas<br />

Technology<br />

Telecommunications<br />

Health Care<br />

Utilities<br />

Source: <strong>DBS</strong> <strong>Vickers</strong><br />

40